With the Feb. 29 deadline for registered retirement savings plan contributions looming, many Canadians are wondering whether it is better to pay off debt or add to their RRSP.

Financial advisers say that while making any contribution to an RRSP or a tax-free savings account (TSFA) is always a good thing, clearing up consumer debt should be the first priority.

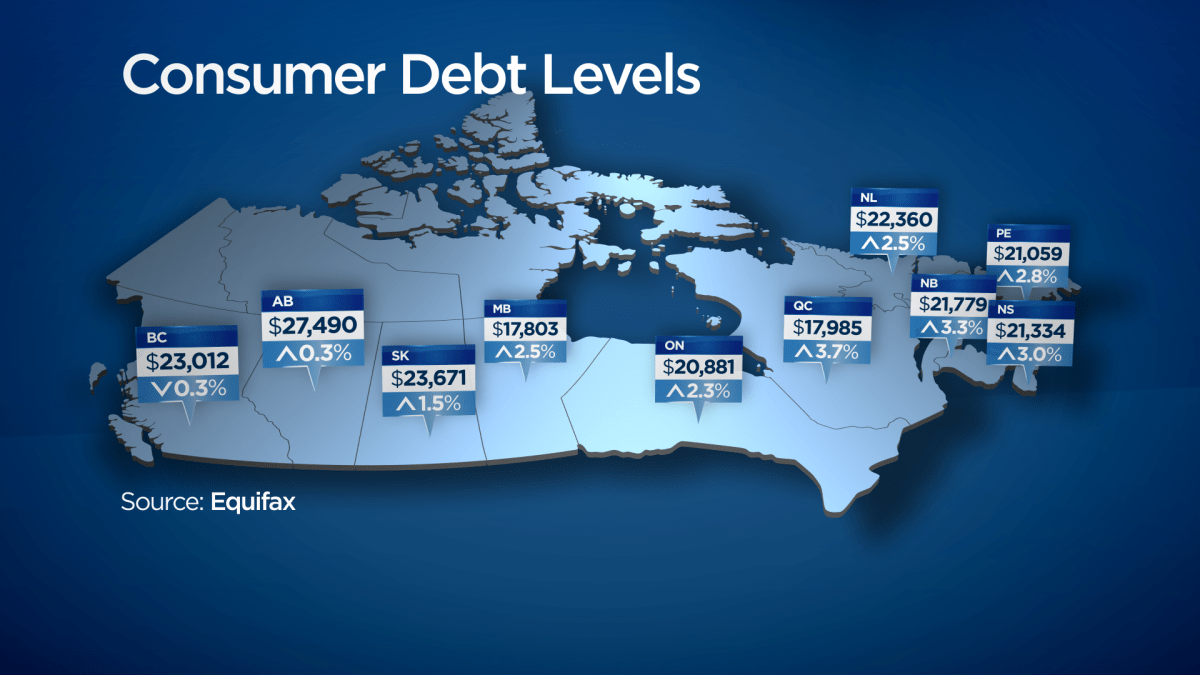

“If they’re in credit card debt then forget it, all they should be focused on is paying off that debt,” said David Trahair, a chartered professional accountant in Toronto. “Forget buying a house, forget RRSPs and focus on making money and spending less so you can pay off first the credit card debt and then the student loan debt.”

READ MORE: Five things you need to know about your RRSP

Canadians with taxable earnings can contribute up to 18 per cent of their previous year’s income to their RRSP. For the 2015 tax year, that works out to a maximum of $24,930. The contribution limit is also affected by how much you contribute to a company pension plan.

Unused contribution limits can be carried over from year to year. Your allowable limit will be on the notice of assessment you received last year from the Canada Revenue Agency.

WATCH: Finance minister announces tax cut for middle class, reduction to TFSA limit

Any money you contribute to an RRSP will count as a deduction from your taxable income, meaning your tax bill for 2015 will be lower and you could get a refund.

For Canadian homeowners choosing between contributing to an RRSP and a mortgage prepayment can be a difficult decision.

“The big decision really comes down to how well your RRSP is going to do, how well the investments are going to do versus the interest rate on the mortgage,” Trahair said. “But with interest rates being so low the RRSP is often the better answer.”

Peter Bowen, vice-president of tax and retirement research and solutions at Fidelity Investments, says looking at long-term financial planning is important.

“There is the emotional side of things. Does debt cause you to stay up at night?” said Bowen. “If so that leans one towards paying down the debt.”

- Life in the forest: How Stanley Park’s longest resident survived a changing landscape

- Bird flu risk to humans an ‘enormous concern,’ WHO says. Here’s what to know

- Roll Up To Win? Tim Hortons says $55K boat win email was ‘human error’

- Election interference worse than government admits, rights coalition says

Bowen says the next thing to consider is the marginal tax rate versus your income after retirement.

READ MORE: 6 overlooked tax deductions and credits that could score you a big return

Canadians should also be aware of the new tax changes coming into effect in 2016.

“Especially people making between $45,000 and $90,000, the tax rates that apply to them are dropping between 2015 and 2016,” said Bowen. “If they can stretch it a little bit this month and make a larger contribution to their RRSP that is 2015 income at 2016 tax rates and is worth a little bit more.”

RRSP vs. TFSA

When it comes to the question of a TFSA or RRSP, financial advisers say while both have their advantages they are designed to help save in different ways.

RRSPs are primarily used to help save for retirement. Money can be withdrawn under certain circumstances without penalty – to help buy a home or pay for education later in life – but they are primarily for retirement.

TFSAs, on the other hand, can be used for nearly anything, whether it’s saving for retirement, an emergency fund or money for a new car. Money put into a TFSA is not deductible from your income tax return.

READ MORE: RRSPs 101: Everything you need to know about filing your taxes

The annual contribution limit for a TFSA is $5,500. The previous Conservative government had increased the limit to $10,000 for 2015, but the decision was reversed by the Liberals.

Bowen says Canadians should choose a TFSA or an RRSP based on their long-term financial outlook.

“If you expect your tax rate to be lower in the future, then an RRSP is the vehicle you should be using,” he said. “If you expect that your tax rate will higher down the road when you need the cash flow, then using a TFSA is more valuable.”

For those in lower tax brackets a TFSA is usually more beneficial than a RRSP.

Bowen also says there is a misconception when it comes to TSFAs.

“They shouldn’t be thought of as a savings account when we are looking at a saving vehicle for retirement,” he said. “Just putting that money into a bank account isn’t very helpful … People should be thinking about what assets they are investing in that TFSA.”

Comments