EDMONTON – Despite a shaky Alberta economy, property value assessments in Edmonton have increased in all property types.

“The assessors look at every single sale that occurs within the city. We’ve got a direct link to land titles,” said assessment and taxation branch manager Rod Risling.

“We’re just reflecting what the market was telling us.”

Scroll down to view more details from the city.

Homeowners may want to keep an eye on their mailboxes over the next few days, especially if you own an apartment, condo, or live in the Homesteader neighbourhood.

Compared to last year, the assessed value of Edmonton apartment buildings went up nine per cent. Condos and townhouses saw an assessment increase of 4.8 per cent, while, on average, the value of single-family homes went up 1.7 per cent. A typical single-family, detached home is now valued at $408,000.

“On average, residential properties increased slightly in values,” said Risling. “These increases reflect the condition of the local real estate market we experienced this summer.”

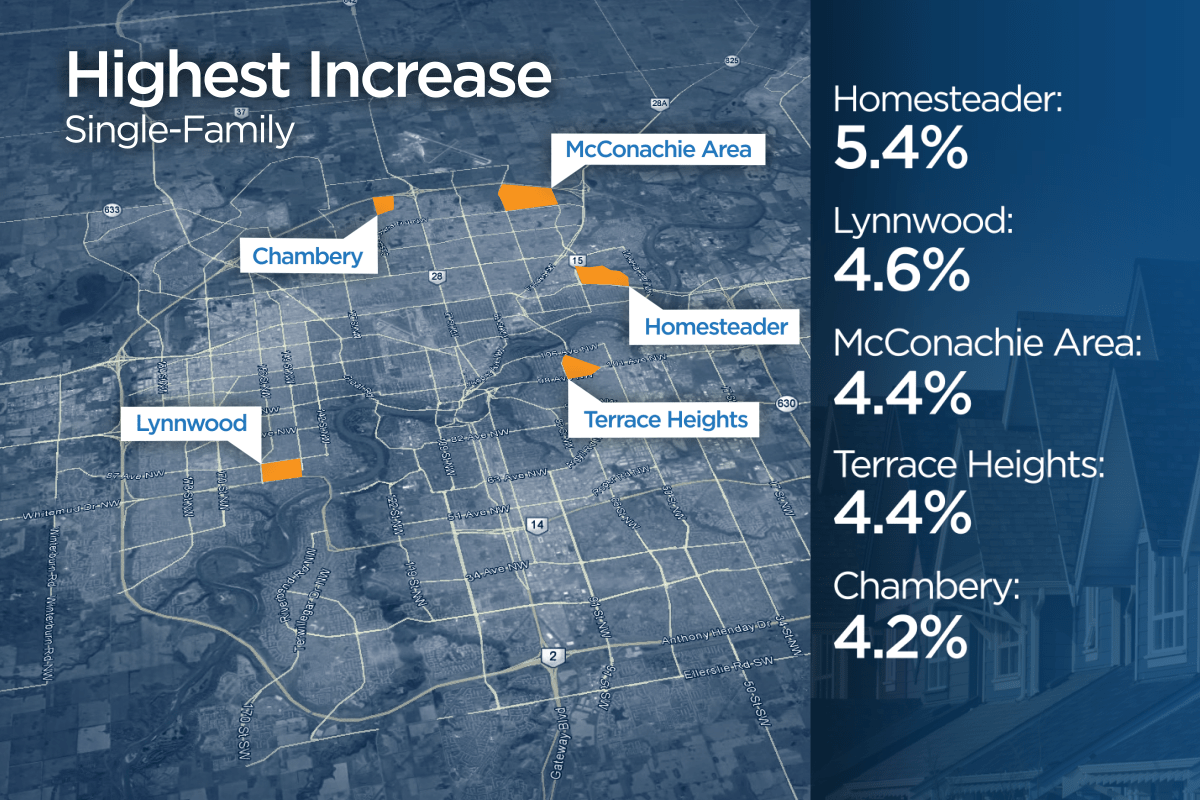

The five communities that saw the highest increase in assessed value are:

- Homesteader (up 5.4 per cent)

- Lynnwood (up 4.6 per cent)

- McConachie area (up 4.4 per cent)

- Terrace Heights (up 4.4 per cent)

- Chambery (up 4.2 per cent)

- Your holiday shopping may face a ‘triple threat’ if Canada Post strikes

- Canada approves Moderna’s RSV vaccine, first of its kind for older adults

- ‘More than just a fad’: Federal petition seeks tax relief for those with celiac disease

- ‘Huge surge’ in U.S. abortion pill demand after Trump’s election win

(Graphic: Tonia Huynh, Global News)

Get weekly money news

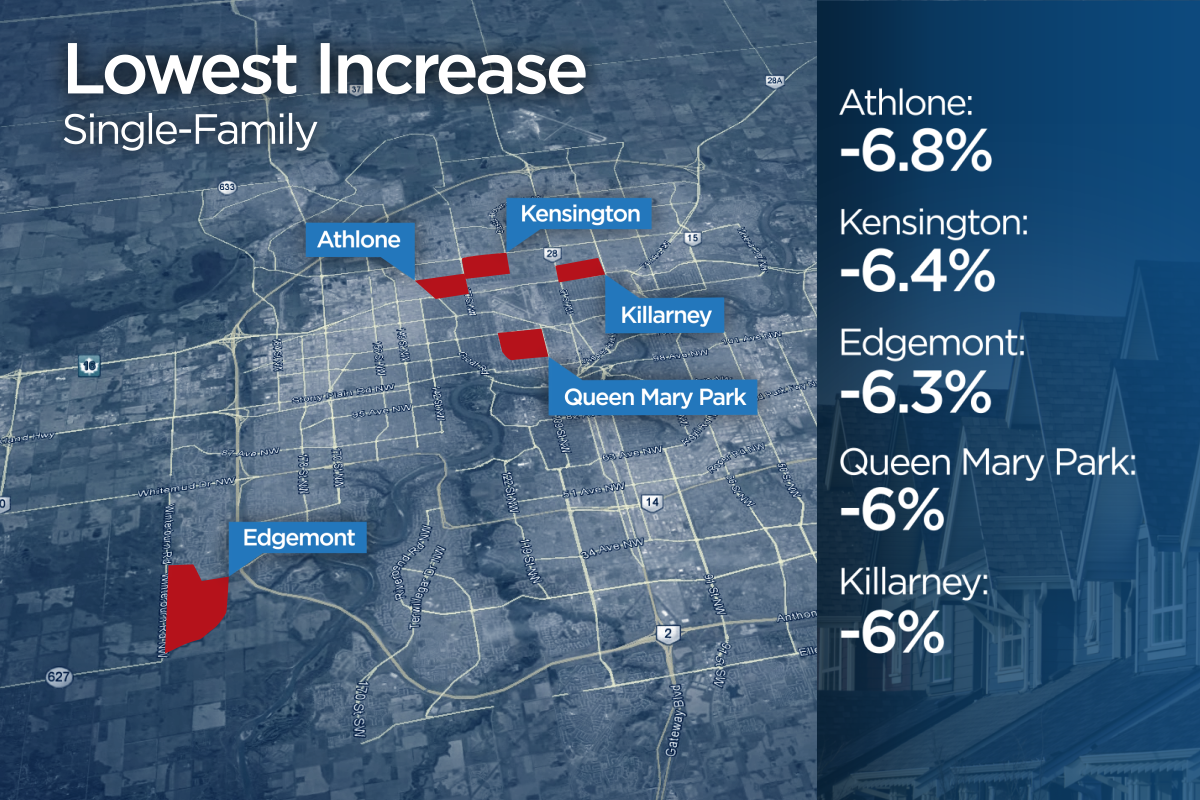

The five communities that saw the biggest decreases in assessed value are:

- Athlone (down 6.8 per cent)

- Kensington (down 6.4 per cent)

- Edgemont (down 6.3 per cent)

- Queen Mary Park (down six per cent)

- Killarney (down six per cent)

(Graphic: Tonia Huynh, Global News)

In 2014, the median property assessment for single-family, detached homes went up by 2.5 per cent, 7.1 per cent in 2015 and 1.7 per cent in 2016.

The value of commercial and industrial properties increased by 0.7 per cent in 2016.

The assessment is not the official property tax bill. The assessment notice provides a snapshot of what your property is worth – what it would have sold for on the open market – as of July 1, 2015.

“We must, legislatively, by the provincial government, reflect July 1… It’s based on what occurred six months ago,” said Risling.

Last year, 2,400 people filed for reassessment. The city said it’s expecting more this year, but hopes the explanation keeps complaints relatively stable.

“If you go back a decade ago, we were close to 10,000,” said Risling. “Last year was a little higher than the previous two or three years, but certainly 2,300-2,400 is a pretty respectable, reasonable number.”

Risling recommended citizens call a city assessor first before filing an official complaint. Residents have until March 11 to question their assessment.

The total combined value of all the properties in Edmonton equals $172.3 billion.

Comments