A pair of polls out Wednesday suggest many Canadians are planning to do something in 2016 plenty of us haven’t in years. Reduce the amount of money we owe.

A poll released by CIBC says 26 per cent of respondents listed debt reduction as their top financial priority for the next year, a figure that balloons to 61 per cent of respondents in a similar poll released by the Chartered Professional Accountants, a trade group.

“Canadians across the country are telling us that reducing the burden of debt, along with keeping up with their bills, is what they are focused on,” CIBC executive vice-president Christina Kramer said.

Household debt levels have continued to spiral higher throughout 2015, aided by rock-bottom interest rates. Consumers now owe $1.64 in debt for every $1 in income – a record. See the chart below.

READ MORE: Canadians rack up record amount of debt (again) ahead of holidays

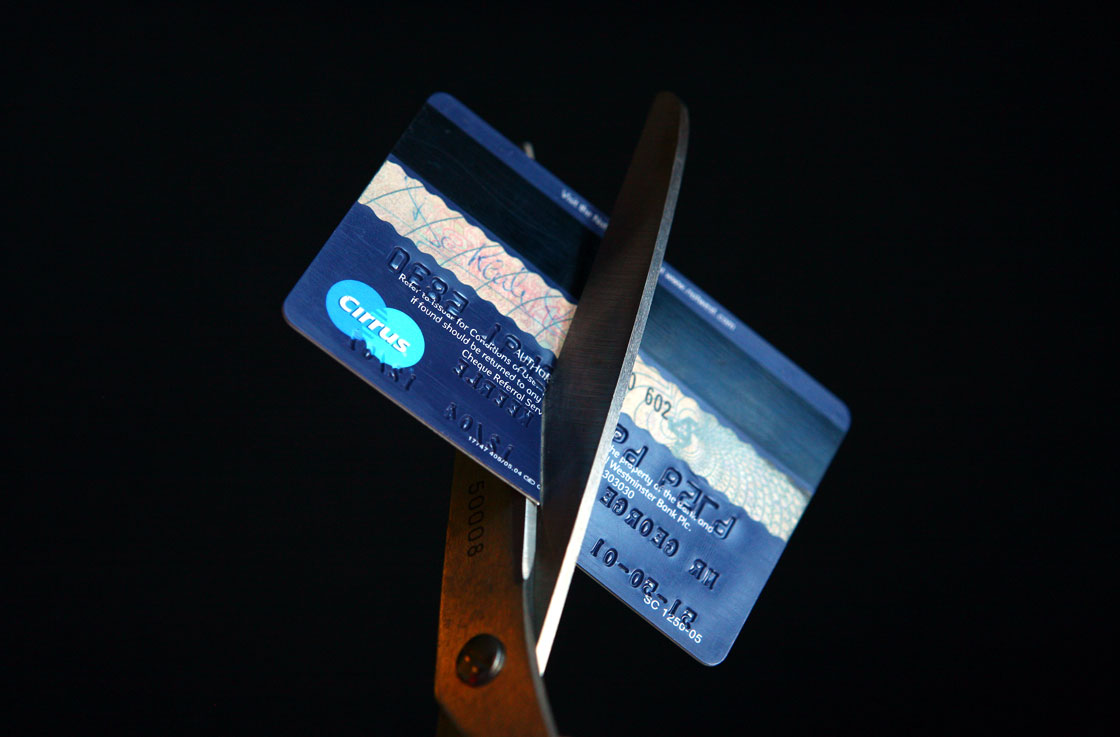

Most of the new debt has funneled into real estate, with home prices continuing to soar in major markets like Toronto and Vancouver. Aside from mortgages, consumer debt — credit cards, auto loans, etc. — has also trended higher however.

Jeff Schwartz, executive director at Consolidated Credit Counseling Services of Canada, said the CPA poll results were “encouraging” but worried expressions of interest among respondents won’t amount to action.

“Just like any other New Year’s resolution, if you don’t make a concrete plan and stick to it, it’s not going to happen,” Schwartz said. “You need to think about real dates and real dollars.”

Annual pledge

It was the sixth straight year debt repayment has topped the list on CIBC’s year-end poll. Kramer says the fact debt reduction has remained atop the list for so long, coupled with record high debt levels, indicates many Canadians are not making the headway they desire.

READ MORE: Here’s what your chequebook will look like next year

But with a sputtering economy in some regions such as Alberta and lacklustre job growth expected, 2016 could be the year that forces many to not push off a financial reconciliation to a later time.

WATCH: How to put a realistic financial plan in place to pay down holiday debt early in the new year.

— With files from The Canadian Press

Comments