Prices for condominiums are heating up in Vancouver and Toronto, and that’s apparently a “concerning” development.

The story of Canada’s sustained housing boom this year has been driven largely by one thing: soaring values for single-detached homes in those two scorching markets, according to experts.

“Indeed, that is the key driver of national home price gains,” Benjamin Reitzes, senior economist at BMO, said in a new note Friday.

Strong demand and lack of supply of those property types in each city has led to searing gains – in the neighbourhood of 20 per cent in some months (year over year). The exuberance though is now “spreading” to the condo market, according to Reitzes.

MORE: The Great Canadian Housing Boom

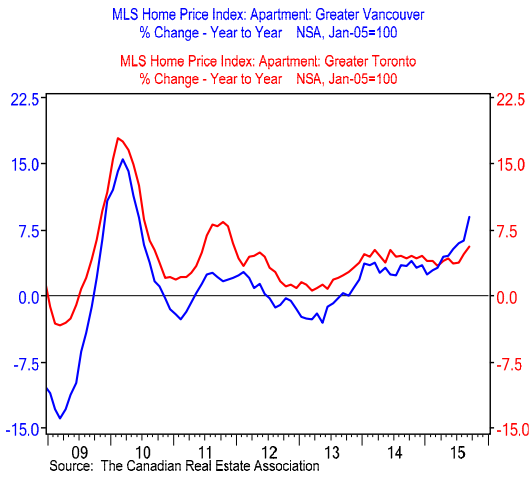

Benchmark index prices for condos in Vancouver jumped more than 9 per cent last month, while in Toronto – which continues to churn out record numbers of new units – benchmark prices are up 5.7 per cent. In Vancouver, that’s the fastest pace of price growth since mid-2010, and for Toronto, December 2011 (as the multi-unit construction boom was just getting off the ground).

Supply and demand

An estimated 80,000 condo units are in development in Toronto, an unprecedented number that has grown by 50 per cent in four years, ratings agency Fitch said earlier this year.

In August, the country’s federal housing agency, the Canada Mortgage and Housing Corp., said Toronto was a “high risk” for a market correction amid overbuilding. Developers could be forced to cut prices if demand falters.

MORE: Toronto faces ‘high risk’ of housing downturn, agency warns

But it hasn’t. Developers in Toronto and Vancouver say low mortgage rates and strong interest from foreign investors because of the falling loonie have helped stoke demand and pricing higher this year. And borrowing rates as well as the dollar aren’t likely to reverse course soon, experts say.

Not warranted

Still, BMO’s Reitzes said the price growth seen in the last few months was “concerning” given the ample amount of supply of new condos coming onto the market. Recent price gains may be creating the potential for a bigger eventual drop should a correction come.

“Accelerating price gains may not be warranted by fundamentals,” the BMO economist said. “Amid persistent worries about overheating, this report won’t help. Indeed, we’ll be closely watching these figures in the coming months.”

Here’s a look at benchmark price growth for condos in Toronto and Vancouver as a percentage, year-on-year. The chart, courtesy of Reitzes, shows gains accelerating in recent months:

Comments