WATCH ABOVE: The ins and outs of tax credit claims.

When filing your tax return, you want to make sure you take advantage of every credit and deduction available to you. But if you find the Canadian tax system confusing, you wouldn’t be alone and you wouldn’t be faulted.

We asked experts about some commonly overlooked tax credits and deductions.

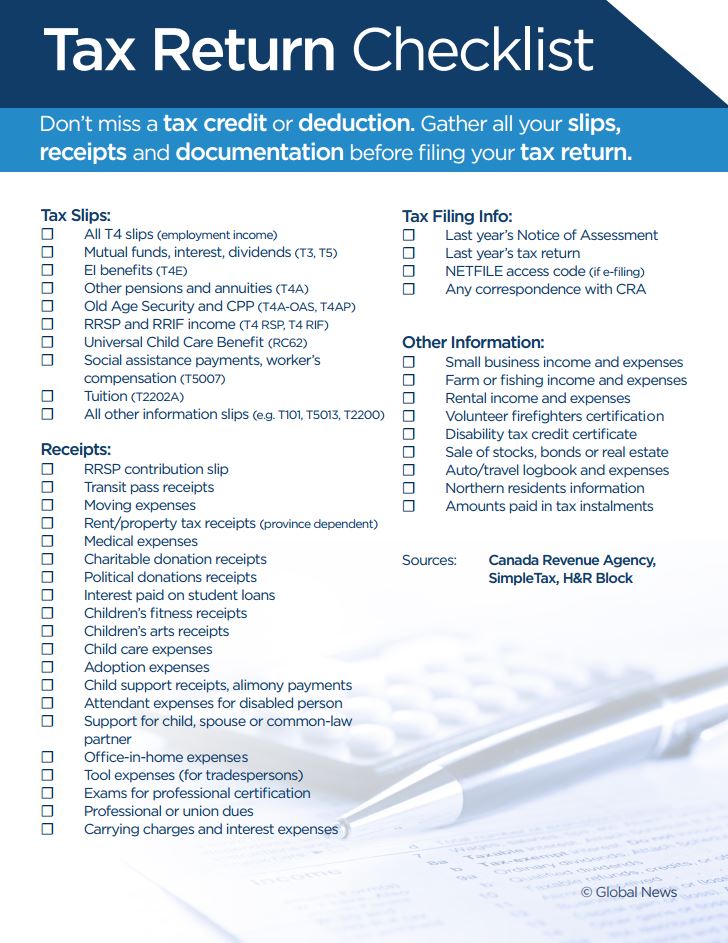

Print off this handy tax checklist, so you won’t forget a slip or receipt when filing your taxes.

“The tax system is so incredibly complex that it overwhelms people,” said Preet Banerjee, personal finance expert.

“There’s the fitness credit, there’s the arts and crafts credit, there are a thousand different credits out there, and people just aren’t going to know this stuff,” said Banerjee.

One area of confusion for tax-filers is the Children’s Arts Tax Credit (CATC). Parents can claim up to $500 per child for fees paid in 2014 for artistic, cultural, recreational or developmental activities or programs.

READ MORE: 5 things you need to know about your 2014 tax return

Many parents hear “children’s arts credit” and immediately think of painting or drawing, when in fact the credit covers a wide range of activities.

“The children’s art credit — that’s one that I find people don’t know what’s under there – they think, ‘well my child doesn’t do painting,’ but things like Girl Guides would count for that,” said Caroline Battista, senior tax analyst at H&R Block Canada.

Other prescribed programs that fall under the CATC include music classes, language classes, wilderness training and tutoring.

Also, medical expenses are often overlooked, said Battista.

Get weekly money news

“Travel medical insurance is one that surprises people,” she said. Also, “If you’re caring for someone in your home who has a disability, you could claim some home renovations, for example.” And, if you have to travel more than 40 km to receive health care treatment, you can claim transportation expenses on your tax return.

Beyond the tax credits granted for tuition fees, post-secondary and graduate students can get credit for textbooks and transit passes. Even if they aren’t making an income, students turning 19 before April 1, 2016 should file a tax return in order to take advantage of the GST/HST credit. You no longer have to apply separately to get the GST/HST credit, but you do need to file a tax return.

You can also claim many employment expenses, including professional or union dues, in-home office expenses, exams for professional certification, health care premiums paid by you (not your employer), even tool expenses for tradespeople.

Keep those receipts!

Before doing your taxes, gather all your tax slips, receipts and documentation. You may be surprised what expenses you can submit on your tax return.

“So many people are not claiming where they should, and it happens year over year,” said Laurie Campbell, CEO of Credit Canada Debt Solutions.

Transit passes, charitable donations, political donations, union dues, rent or property taxes, moving expenses — all can be claimed on your federal tax return.

WATCH: Tony Tighe explains new tax credits and deductions, as well as those that are commonly overlooked.

Print off this handy tax checklist, so you won’t forget a slip or receipt when filing your taxes.

Do your research, keep up to date on changes

The 2014 tax year saw some significant changes.

“There’s always changes, some years the changes are bigger than others, but there’s always changes,” said Battista.

New this year is the much-debated Family Tax Cut, enhancements to the Children’s Fitness Tax Credit and Universal Child Care Benefit, and more.

The deadline for Canadians to file their 2014 personal income tax return is April 30, 2015.

Comments