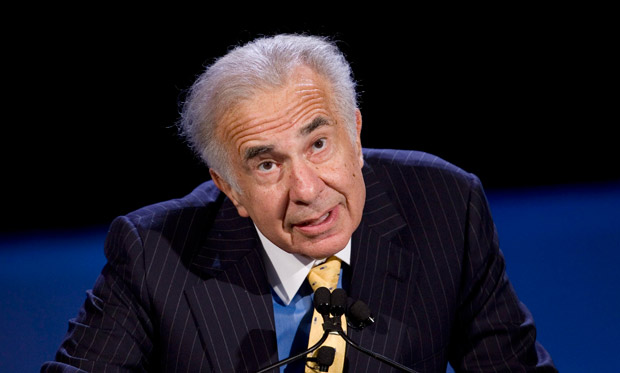

MONTREAL – One of Research In Motion’s Canadian shareholders says it would support activist investor Carl Icahn buying into the struggling BlackBerry maker to make changes or put the company up for sale.

“It’s been poor execution and poor innovation and Apple has galloped ahead,” said Vic Alboini, chairman and CEO of Toronto-based Jaguar Financial, which has pressed for changes at RIM.

He made the comments after RIM shares rose Tuesday in the wake of reports in the investment community that Icahn is buying into the Waterloo, Ont. smartphone maker.

If it’s disclosed that Icahn is a shareholder, Research In Motion must reach out to him and say “What should we do that would satisfy you,” Alboini said from Toronto.

“Strictly from the point of view of RIM, you do not want to ignore Mr. Icahn,” said the Jaguar executive, whose company owns just under five per cent of RIM stock.

“He will not stop. He will move forward and cause the change I think that shareholders want.”

Shares in Research In Motion (TSX:RIM) shot up initially more than five per cent Tuesday on speculation that Icahn has bought into the Waterloo, Ont., smartphone maker.

The stock later closed up 81 cents, or 3.6 per cent, to $23.15 on the Toronto Stock Exchange.

The shares began to rise after a report from the Reuters news agency about analyst speculation on an Icahn investment, which was not confirmed by his investment company or RIM.

Icahn has taken stakes in many big American companies – from Motorola and Lions Gate Entertainment to bleach maker Clorox – and usually forced them to restructure and become more profitable. Those shares then generally rise in value and Icahn cashes in on his investment.

Get daily National news

Alboini said that as a shareholder Icahn could pressure RIM to appoint new board members, ask for a shareholders’ meeting to put his associates on the board or pass a resolution to put the company up for sale.

Icahn could also make a bid for RIM himself, Alboini added.

The consumer technology maker, once Canada’s most valuable company with a worth approaching $70 billion, now has a stock market value of about $12 billion.

“It’s very positive for the shareholders. It’s not positive at all for the entrepreneurs, the builders, who are the co-CEOs,” he said of Jim Balsillie and Mike Lazaridis, who together own 11 per cent of the company.

“The bottom line is that it is a massively, widely held company with the exception of their stake. You can acquire, control and take a company private without their consent. If there’s a high premium takeover bid, everyone would see the writing on the wall, including the two CEOs.”

Edward Jones technology analyst Bill Kreher said the upward movement in RIM’s share price reflects the belief that an activist shareholder could prove to be an “agent of change, which would ultimately be applauded by the market.”

But Kreher said he isn’t certain what Icahn would be able to achieve right away.

“We appreciate the enthusiasm around the potential for change, but we’re uncertain whether Icahn’s involvement can do much in the near term,” Kreher said from St. Louis, Mo.

“I think on a stand-alone basis the company will continue to struggle and potentially the angle for Icahn is to extract some value from the patent portfolio,” he said. “We think it will be a more difficult proposition relative to his actions at Motorola.”

At Motorola, Icahn pressed the company to split its patents from its cellphone business and cashed in when Internet search giant Google paid US$12.5 billion to buy the business.

Earlier this month, Jaguar Financial also pressed for changes at RIM and said it should consider putting itself up for sale or spinning off its patent portfolio into a separate company.

Once a market leader, RIM has lost ground to Apple’s iPhone and to smartphones with Google’s Android operating system. RIM’s new PlayBook tablet appears to have made small headway against Apple’s iPad.

Alboini said RIM has to decide whether it just competes in the business sector.

“It has to decide whether it wants to compete for a consumer toy. Mr. Icahn, if he is a shareholder, may have something to say about that as well.”

Two of Canada’s biggest electronics retailers, Best Buy and Future Shop, as well as the Staples office supply chain have cut the price of RIM’s PlayBook tablet by $100 ahead of a software update planned for the tablet.

The tablet started selling at Canadian retailers in April with list prices at $499, $599 and $699 depending on the model, each of which have between 16 gigabytes and 64 gigabytes of memory.

But the PlayBook has struggled, with RIM shipping only about 200,000 PlayBooks in its most recent quarter, about half of what analysts had been expecting and below RIM’s own expectations.

In late July, RIM announced it was cutting 2,000 jobs to streamline its business and lower costs.

At the time, some analysts speculated the company should abandon the consumer market and focus on its bread-and-butter corporate and government business.

Earlier this month, Jaguar proposed that RIM benefit from the “surge” of mergers and acquisitions among technology companies that hold patents with Alboini noting the “enormous” value of patents.

It’s estimated that RIM has 10,000 to 15,000 patents and was part of a consortium that acquired the 6,000 patents of bankrupt equipment maker Nortel Networks.

Comments