Canadians are still expected to face a “pinch” at the dinner table this holiday, according to one food economist, despite signs of slowing in food inflation.

Canada saw a “broad-based” easing in grocery price hikes in November, according to Statistics Canada, while overall annual inflation rate held steady at 3.1 per cent last month.

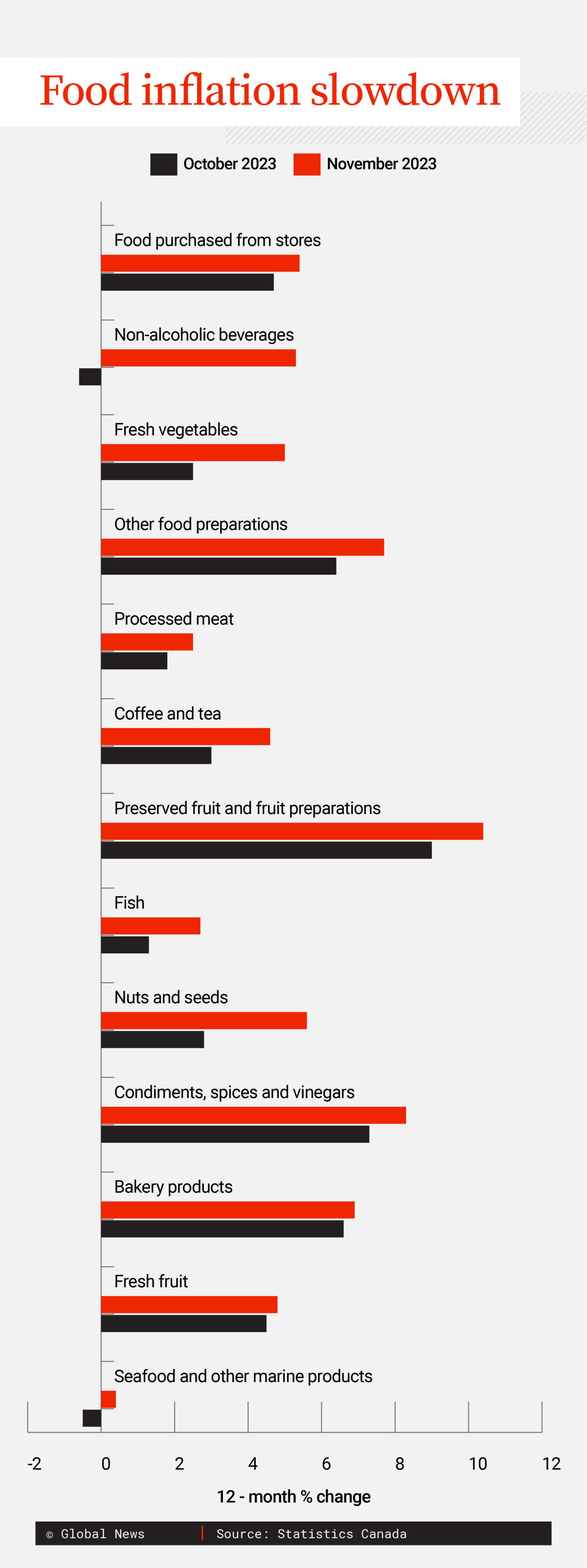

November was the fifth straight month that food inflation slowed, the agency noted Tuesday, with grocery prices rising 4.7 per cent annually in the month.

StatCan reported price hikes on every component in the grocery basket cooled in comparison to October’s increases. Fresh vegetables (up 2.5 per cent), processed meat (up 1.8 per cent) and fish (up 1.3 per cent) in particular saw substantial easing, with overall prices declining on non-alcoholic beverages.

But while the annual comparisons might give the impression of relief, many of the actual monthly changes are keeping the heat on consumers heading into the holiday season, says University of Guelph food economist Mike von Massow.

“It’s good news that that number is coming down but it doesn’t always reflect exactly what we’re experiencing at the grocery store,” he tells Global News.

Fresh vegetables, for example, might’ve only been a touch more expensive over November 2022, but von Massow notes prices here were up 7.4 per cent from October’s inflation report.

He says that the price Canadians pay for produce is always expected to rise this time of year because it needs to be shipped from outside the country and paid for in U.S. dollars.

For households gearing up for holiday dinners this time of year, von Massow says they might be able to avoid sticker shock on domestically produced staples like turkey and potatoes, but consumers should expect to pay more for any fresh greens on the side.

“The reality of what I am noticing in the grocery store is I’m paying more for my broccoli, or more for my brussels sprouts, than I was in October,” von Massow says.

“While they’re not up as much as they were last year or seasonally, they’re still up. So we will feel a pinch at Christmas like we have the last couple of years.”

Global supply chains are also facing a new risk heading into the holidays amid ongoing attacks from Yemen Houthi rebels on ships in the Red Sea, a critical shipping route that facilitates roughly 10 per cent of the world’s trade. Two of the world’s largest shipping companies, Maersk and Hapag-Lloyd, said last week they were pausing operations in the area.

Grocery shoppers in Canada likely won’t feel a direct impact from the disruption, von Massow says, because the Red Sea isn’t a major part of the country’s food supply chain. But he notes the domino effect from the disruption pushing up global oil prices comes at a critical time for food shipping costs in Canada that could eventually see costs passed on to consumers.

Get weekly money news

“That means that eventually we might see some of that impact on food prices because we’re transporting food this time of year,” he says.

The 2024 Food Price Report from von Massow and other Canadian researchers published earlier this month projects that costs will rise an average of 2.5 to 4.5 per cent in the new year, below the five to seven per cent expectations for 2023.

A new report released Tuesday from Dalhousie University’s Agri-Food Analytics Lab shows that Canadians are planning to shift their habits in 2024 to cope with higher costs. Some 43.3 per cent of respondents to a Caddie poll conducted for the report said they would focus more on sales and promotions in their grocery shopping, and 48 per cent said they’d plan meals more carefully to avoid food waste.

While von Massow says 2024 isn’t expected to be as bad as recent years when it comes to grocery price hikes, the cumulative impact of two years of elevated food inflation and rising costs elsewhere in the household budget means the affordability picture isn’t likely to improve for most Canadians until they get wage increases to relieve the pressure.

“This economic pressure that we felt from the price increases for food and everything else for the last couple of years, we will continue to feel. But it won’t get much worse,” he says. “Maybe it’ll give us an opportunity to catch up on this cost of living crisis.”

How does this affect the Bank of Canada's decisions?

Tuesday’s inflation report showed gas prices were down last month but to a lesser extent than October, which StatCan said put upward pressure on the monthly inflation figure. A drop in the price of fuel oil helped to reduce price pressures in the month, with the agency noting the Liberal government’s temporary suspension of the federal carbon levy on home heating oil “contributed to the decline.”

Some economists had expected a decline in the headline inflation figure, but StatCan said higher prices on travel tours and elevated housing costs kept the annual rate steady.

Rents were up 7.4 per cent year-over-year — down from the previous month — and mortgage interest costs rose nearly 30 per cent annually, the agency noted.

A 26.1 per cent jump in the prices for travel tours last month was offset by drops in the cost of cellular services, which StatCan said related to Black Friday deals in November.

The Bank of Canada has been encouraged by the recent slowdown in inflation and the economy overall, opting to hold its key interest rate steady at five per cent over the last few months.

RBC economist Claire Fan said in a note that while the November inflation print might mark an “upside surprise” compared to the cooling seen in recent months, there were still signs of progress under the hood.

Fan said Tuesday that the latest consumer price index report should “serve as a reminder that inflation readings can be ‘sticky.'”

CIBC senior economist Andrew Grantham said in a note to clients on Tuesday morning that inflation may well accelerate again come December, given less favourable comparisons to gas prices in the same month last year. But he expects that inflation will continue to ease over the spring and summer.

The Bank of Canada’s preferred measures of core inflations continued to ease, economists noted, with the three-month annualized rates for these metrics averaging to 2.5 per cent in the month.

Forecasters expect the central bank’s next move will be to cut interest rates once it feels more confident that inflation is heading back to its two per cent target.

Money markets trimmed their expectations for monetary policy easing after Tuesday’s inflation report, with Reuters putting the chances of a cut next month dipping to 16.0 per cent from 21.4 per cent. Markets still expect the central bank to begin easing as soon as April.

Grantham said that with signs the drivers of inflation are less widespread and expected cooling in the economy next year, rates could come down starting in June of 2024.

“Our expectation is for the first rate cut to come around mid-year 2024, contingent on further (but widely expected) softening in CPI readings in the months ahead,” Fan wrote.

— with files from Global News’s Sean Boynton, The Canadian Press, Reuters

Comments

Want to discuss? Please read our Commenting Policy first.