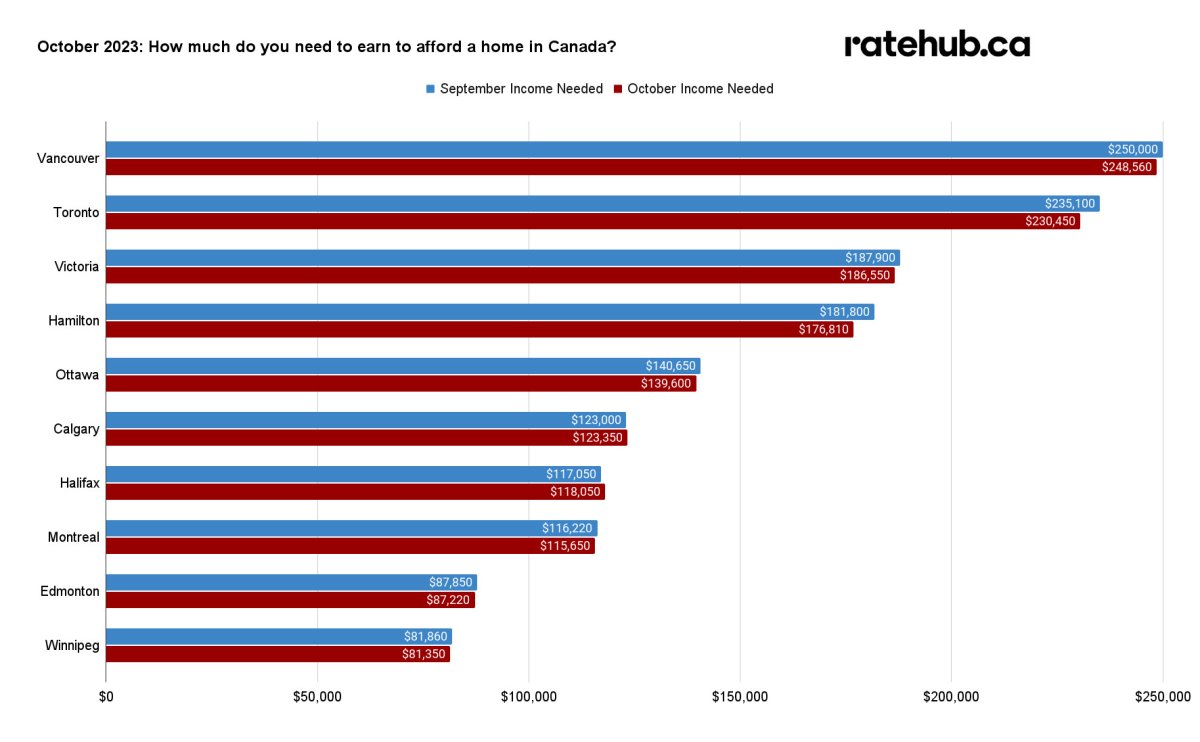

The co-founder of an online mortgage broker says it actually got a little bit easier to afford a home in Hamilton in October, but a household still needs to make about $177,000 a year to get into the game.

Rate Hub CEO James Laird says the average price of a home in the city actually came down by about $25,000 between September and October, however, a homeowner will still likely have to allocate up to 40 per cent of their income to qualify for the average local house.

“And remember, that is a pre-tax figure, so post-tax it’s much closer to two-thirds of your take-home pay,” Laird said.

Affordability data compiled by Ratehub.ca for a November analysis revealed that home prices decreased across Canada by a “large enough margin” to improve qualifications in eight of the 10 markets studied.

However, mortgage rates did rise slightly month over month, with the stress test hitting a new average high of 8.47 per cent amid the Canadian Real Estate Association reporting that average home prices flattened in October from September.

Hamilton homebuyers required roughly $5,000 less to qualify for a mortgage at a 6.47 per cent rate last month for a home at the average price of $829,100.

Laird says the numbers refer to the average price of all dwelling types, meaning a detached house would likely cost more and a condo less.

“How we got in here and a key reason is because of … supply and demand, where we’ve been under building across Canada … for decades,” Laird said.

“Combine that now with record levels of newcomers to the country and we’ve got almost $200,000 required to qualify for that average home.”

Toronto buyers also saw some relief in October, gaining some $4,650 in affordability for homes costing an average of $1.1 million.

Halifax and Calgary were the only two of 10 municipalities tracked that saw affordability slip, suggesting a household would need a $1,000 and $350 in income more to buy in October.

Comments