A network of proponents seeking to eliminate working poverty across Ontario is suggesting the recent October minimum wage increase is not the kind of pay that will bring a decent lifestyle for a person making it.

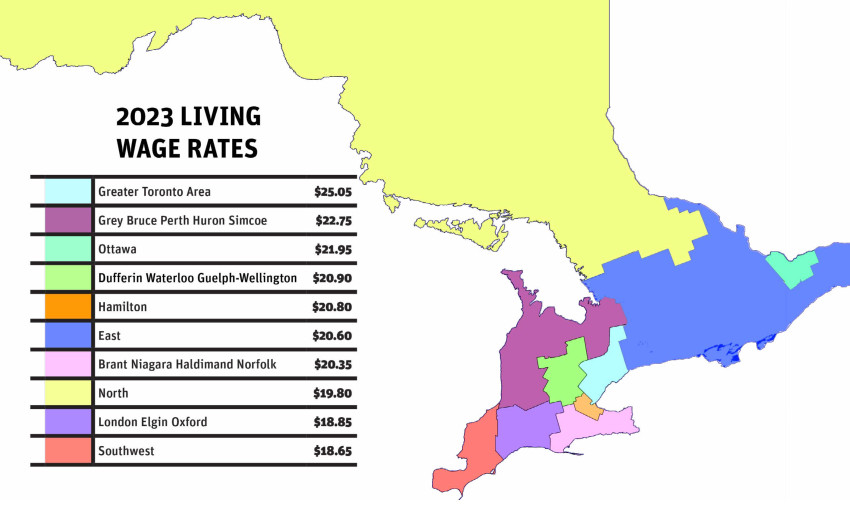

The latest Ontario Living Wage Networks (OLWN) annual study says $18.65 an hour is actually the bare minimum someone would need to live in Ontraio’s southwest, while trying to make it in the Greater Toronto Area would require $25.05 an hour.

The latest OLWN report illustrates the growing gap between monthly expenses and the incomes of those earning a minimum wage.

“While the minimum wage increased on October 1 of this year by 6.8 per cent to $16.55, there is still no place in the province where someone could make ends meet working full-time at this wage,” the report’s author Anne Coleman said.

Ottawa had the highest year-over-year increase in the living wage, moving up 12 per cent to $21.95 from $19.60, with rent and food the biggest factors driving the growth.

The city now ranks in the top three of the 10 regions tracked, up from eighth place in 2022 report.

Citing Canada’s Food Price Report, the price of eating went up an average of 1o per cent across the country in 2022 while renting was 9.6 per cent higher year over year, according to Rentals.ca data.

Using data from Statistics Canada, Canada Mortgage and Housing Corporation and others, the living wage weighs the average cost of basic goods and services for three different types of households, a family of four, a single parent with one child, and a single adult. It’s a before-tax income an adult needs to cover overall expenses and takes into account government aid families may receive, like the Canada Child Benefit and the Ontario CARE benefit.

Payroll and income taxes for a household are also considered, as well as what a typical person might need for clothing, transportation, internet, education, childcare and other amenities.

The OLWN says the rate is based on more than just survival, but allowance of some modest perks like vacations and opportunities to engage in local culture and the community.

“This is really about a rate that allows someone to participate in our community and not just to get by,” explained Ted Hildebrandt of Hamilton’s Social Planning and Research Council.

- Loblaw boycott: CEO responds to plans from ‘deeply unhappy’ customers

- Capital gains changes spur cottage market ‘anxiety.’ Will owners rush to sell?

- Why aren’t more foreign grocers in Canada? Lack of space a hurdle: minister

- As Canada’s tax deadline nears, what happens if you don’t file your return?

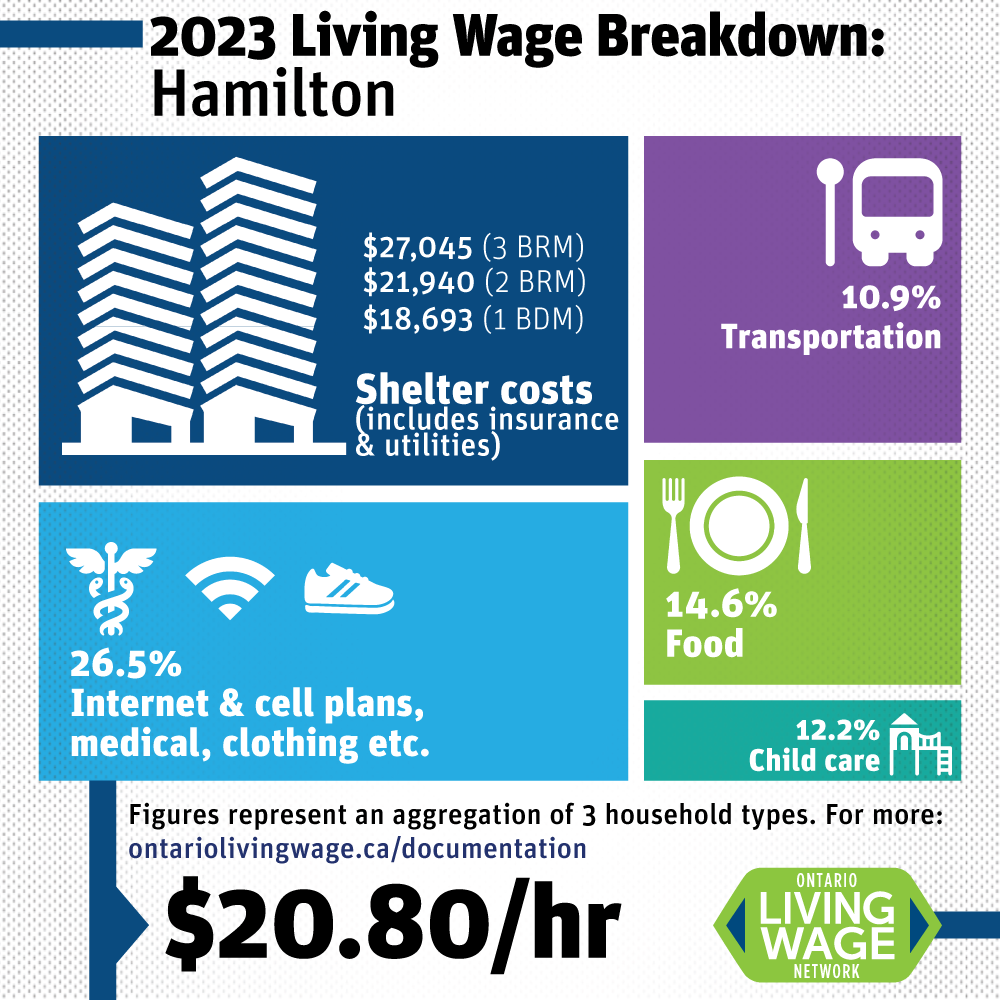

Hamilton, Ont., is an example of another city that made a big jump up among the 10 regions, moving to fifth from 10th place, year over year. The average adult now needs about $20.80 an hour to live sufficiently in the municipality.

An agency that monitors levels of poverty in the city is once again insisting the Ford government do a review of income security programs by upping the minimum wage to contribute to the well-being of the workforce in general.

“When employees can afford a decent standard of living, they experience reduced financial stress, improved mental and physical health, and increased job satisfaction,” said Tom Cooper, director of Hamilton Roundtable for Poverty Reduction.

“This can lead to higher employee morale and lower turnover rates, resulting in cost savings for employers.”

Data shows the biggest cost for a Hamilton household is shelter with a three-bedroom home in the city taking about $27,000 of a resident’s cash on average annually.

Food accounts for some 14.6 per cent of income while child care is 12.2 per cent.

In October, the Canadian Federation of Independent Business (CFIB) suggested the province faces pressures from both sides of the wage argument with businesses, particularly smaller ones, pushing back amid supply chain issues and inflation pressuring their bottom line.

“Costs throughout their entire supply chain have gone up,” said Ryan Mallough the CFIB’s vice-president of legislative affairs.

“We’ve seen property taxes go up, payroll taxes go up and the carbon tax go up on April 1.”

Deena Ladd of the Workers’ Action Centre, who’s pushing for a minimum wage of $20 an hour, submits that the more money in people’s pockets, the more cash that will go back into the economy.

“If the only money people have in their hands is just to pay basic rent and they do not have enough money to go to local restaurants or to buy many products, then everyone is affected, businesses included,” Ladd said.

Comments