Mortgage

-

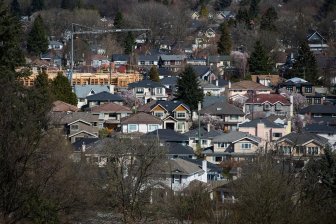

Canada’s housing affordability sees significant ‘deterioration,’ report saysThe banking institution pointed to rising interest rates as part of the cause, and combined with a surge in home prices, the ability to afford a home is a difficult prospect.EconomyNov 1, 2023

-

Stress test: 4 in 5 Canadian mortgage holders worried about payment hikesWith the current rates, four-in-five homeowners with a mortgage said they are either worried, or very worried they will face higher payments upon renewal of their mortgage.EconomyOct 23, 2023

-

-

Advertisement

-

‘Gutted’: Amid rising mortgage rates, B.C. couple sells home to go back to renting"With one in four mortgage renewals upcoming in the next two years, there's a modified strategy at renewal time that Canadians are going to be faced with."EconomyOct 2, 2023

![]()

-

-

Advertisement

-

Interest rates expected to stay higher for longer. What that means for your mortgageBorrowers with fixed rates are expected to see an average payment increase of between 14% and 25% next year compared with early 2022 costs, according to the Bank of CanadaConsumerOct 2, 2023

![]()

-

B.C. mortgage calculator: A simple way to examine interest rate changesGlobal News has put together a mortgage calculator and some information and tips from Vancity so British Columbians can plan ahead and get the most out of their mortgage.MoneyJul 12, 2023

![]()

-

-

Man renting home impersonates owner, applies for mortgage, takes funds: Toronto policeA man renting a home impersonated the owner, applied for a mortgage and then took the funds, Toronto police allege, and officers say the suspect may have committed similar crimes.CrimeJun 1, 2023

![]()

-

-

‘Very scary time’: Poll finds 76% of B.C. mortgage holders worried about next renewalThree-quarters of B.C. mortgage holders said they worried their next renewal could cost them more, with 35 per cent saying they were worried it would cost "significantly more."MoneyMay 2, 2023

![]()

-

Mortgages 101: What you need to know before looking for a homeGlobal News's Home School series is back with an explainer on mortgages: what kinds there are, what goes into qualifying and the costs you might not know about.MoneyApr 15, 2023

![]()

-

-

Advertisement

-

Rising Bank of Canada interest rates force difficult mortgage payments on Saskatchewan homesThe central bank raised its policy rate to 4.5 per cent on Jan. 25, 2023, an increase of 25 basis points and the highest the Bank of Canada’s key rate has been since 2007.CanadaJan 25, 2023

![]()

-

-

Advertisement

-

Mortgage stress test remains unchanged. What that means amid higher interest ratesThe regulator in charge of Canada's mortgage stress test announced Thursday it will leave the qualifying standard where it is amid current high rates and economic uncertainty.EconomyDec 15, 2022

![]()

Trending

-

![]() What is a halal mortgage? How interest-free home financing works in Canada28,173 Read

What is a halal mortgage? How interest-free home financing works in Canada28,173 Read -

![]() Ex-cop accused of slaying 2 women, abducting child, kills himself in police chase21,205 Read

Ex-cop accused of slaying 2 women, abducting child, kills himself in police chase21,205 Read -

![]() Train goes up in flames while rolling through London, Ont. Here’s what we know13,491 Read

Train goes up in flames while rolling through London, Ont. Here’s what we know13,491 Read -

![]() Ontario doctors offer solutions to help address shortage of family physicians12,573 Read

Ontario doctors offer solutions to help address shortage of family physicians12,573 Read -

![]() Canada’s most wanted list: Toronto suspect in fatal shooting at No. 111,932 Read

Canada’s most wanted list: Toronto suspect in fatal shooting at No. 111,932 Read -

![]() Belgian man whose body brews alcohol acquitted of drunk driving charge9,378 Read

Belgian man whose body brews alcohol acquitted of drunk driving charge9,378 Read -

Top Videos

-

![]() Business News: Impact of capital gains tax changes

Business News: Impact of capital gains tax changes -

![]() Ex-cop accused of murdering 2 and kidnapping baby kills self after police chase

Ex-cop accused of murdering 2 and kidnapping baby kills self after police chase -

![]() Train ride to hell? CPKC’s rail cars catch fire, blazing trail to London, Ont.

Train ride to hell? CPKC’s rail cars catch fire, blazing trail to London, Ont. -

![]() Doctors warn Ontario health-care crisis will worsen if family doctor shortage isn’t addressed

Doctors warn Ontario health-care crisis will worsen if family doctor shortage isn’t addressed -

![]() Canada’s top 25 most wanted list unveiled

Canada’s top 25 most wanted list unveiled -