Insurance rates for some cars are increasing in Canada due to a growing auto theft crisis.

Rates.ca, an insurance price aggregate site, reports that insurance premiums for car models most often stolen have increased between 25 to 50 per cent over the last two years.

“To our knowledge, some insurers are applying this ‘high auto theft risk surcharge’ only in certain high-risk regions and/or to certain high-risk vehicles,” the Insurance Bureau of Canada told Global News Wednesday, the day after the Rates.ca report was released.

“Many insurers are also waiving this surcharge if the policyholder opts to take proactive steps, outlined by the insurer, to better protect their vehicle.”

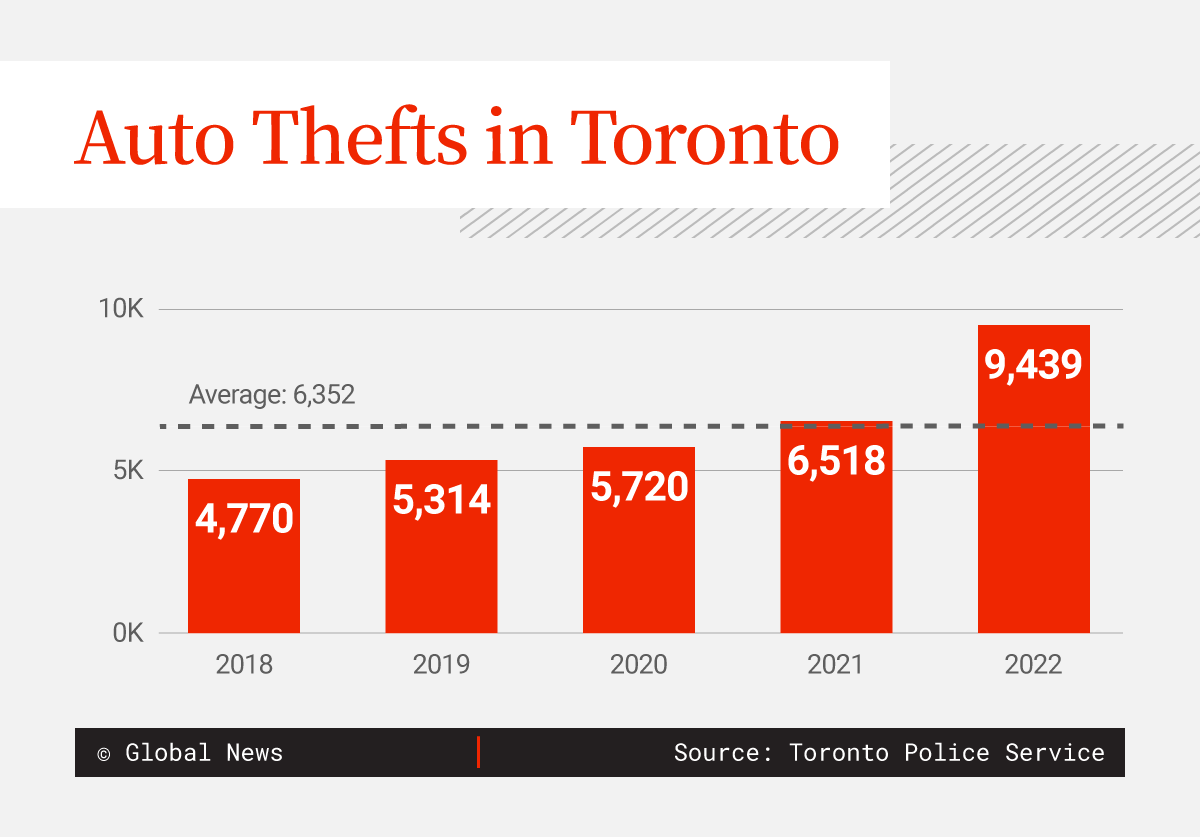

“It’s a national crisis,” Bryan Gastl, vice-president of Investigative Services at Équité, told Global News. “In 2023, the first six months are proving to be worse than 2022.”

Gast previously told Global News that Canada has become a “source country” for stolen vehicles and international thieves are targeting here due to the ease of theft. Stolen vehicles are shipped off to places such as Africa to net a profit for the thieves.

Get daily National news

Insurance companies have taken a hit due to the higher thefts. In 2022, the insurance industry lost $1 billion due to theft claims, according to Rates.ca, a significant increase from 2021.

Thefts in Ontario rose nearly 50 per cent between 2021 and 2022, while Quebec was over 50 per cent, Alberta was nearly 20 per cent and Atlantic Canada was up nearly 35 per cent, according to Équité.

Insurance companies now seem to be responding to the cost of auto theft.

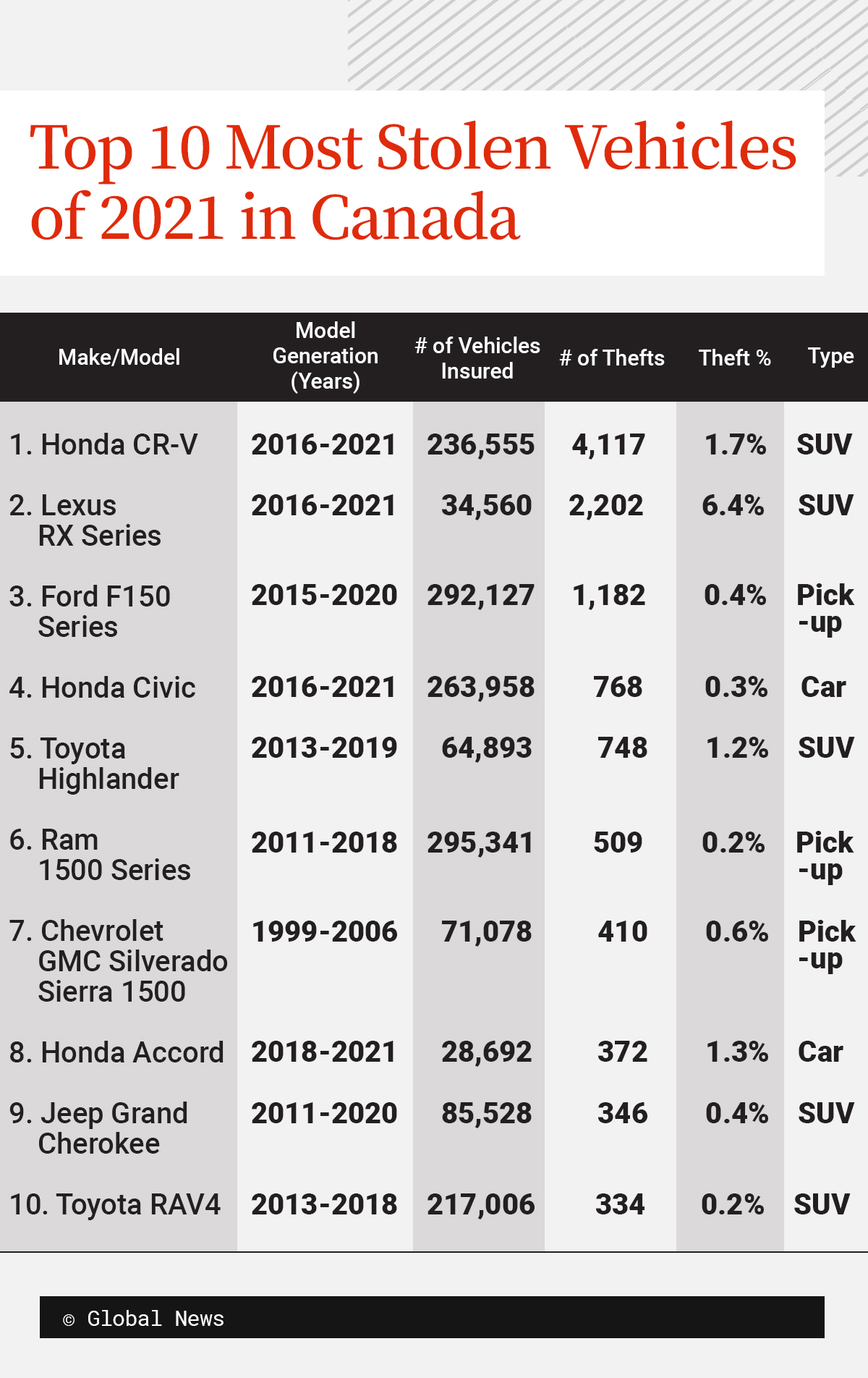

According to Rates.ca’s report, a 35-year-old male driver with no prior convictions saw a 26 per cent increase in portions of their auto insurance between 2022 and 2023 for a Honda CR-V.

In addition to higher premiums, some insurance companies, such as CAA, are also charging an extra $500 for vehicles with high rates of theft, but the surcharge will be removed once drivers prove they have purchased an anti-theft device, such as a wheel lock.

Other companies, such as Aviva, Gore Mutual and TD Insurance, are requiring customers to install a tracking system from Canadian company Tag to avoid a “High Theft Vehicle” surcharge, according to Rates.ca.

The installation costs around $400 and places individual trackers on commonly sold parts of the car to make resale more difficult and recovery more likely. Some companies offer reimbursement for the Tag installation while others just remove the surcharge, the report said.

Daniel Ivans, sales team lead with Rates.ca, told Global News that the extra surcharge is a fairly new approach by insurance companies taken up in the last couple of months. Only a few are doing so currently but that may change in the future, he said.

Ivans said customers will likely receive a notice in the mail about their premiums increasing and then may be given the option to get it removed if certain anti-theft measures are taken.

“A lot of markets are giving options (to reduce the surcharge),” Ivans said.

To help prevent auto theft, Équité recommends a “layered” approach that includes taking multiple measures to deter thieves. Those include keeping your car doors locked at all times, parking your car in well-lit areas and a secure garage if possible, turning off your key FOB when at home or placing it in an RFID-blocking pouch to avoid access by thieves, and using a wheel lock.

When asked how the federal government is responding to the rise in thefts, the Canada Border Services Agency (CBSA) said in an email Wednesday that its resources are “strategically allocated to remain operationally flexible to respond to threats or service demands at our ports of entry.”

“The CBSA assesses the risk of all marine containers to identify potentially high-risk shipments. All containers and the goods inside must be declared and each declaration is subject to a risk assessment.”

The agency said it may also use detection technology such as X-ray or gamma-ray machines on containers to detect the presence of vehicles.

— with files from Global News’ Anne Gaviola

Comments

Want to discuss? Please read our Commenting Policy first.