Flooding is becoming a greater hazard across Canada, according to experts, and poses a threat to more and more homeowners.

Now, with temperatures rising and snowpacks melting, the risk of flooding can be high in certain areas.

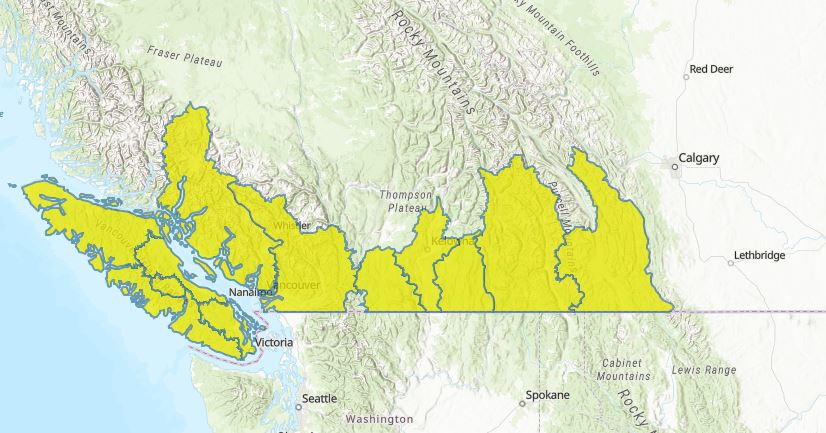

Most of southern B.C. is currently under high stream flow advisories amid wet weather that Global News chief meteorologist Anthony Farnell said could last the next couple of weeks, posing a potential flood risk.

Farnell said there are also flooding concerns for the Prairies, which still has extensive snow that will likely melt all at once as temperatures quickly rise. Southern Alberta municipalities have warned residents of flooding risks.

While major rivers will be close to the flood stage just with the snowmelt, rainfall would make that risk even higher, he said. Luckily, rain isn’t in the forecast yet.

Farnell expects some flooding in the Winnipeg area as the Red River flows south to north, bringing extra water from the U.S., with areas there bracing for a top-10 all-time flood event. Northern Ontario near the Muskoka region could see flooding too as snow will melt there.

Jim Mandeville, a senior vice-president at First Onsite Property Restoration, told Global News he is seeing more flooding than he has in the past and in areas that don’t historically experience it, such as in the outer suburbs of Toronto. That can create a problem if people aren’t prepared.

Global News spoke to experts to find out how you can best prepare and protect your home against flooding.

Inspect your home

Mandeville said the first thing to do to prepare is to take a walk around your house and look for signs of water damage.

“Look for things out of place,” he said. “If it looks wrong, it probably is.”

Get breaking National news

Possible signs include water pooling in certain areas, dampness, staining along the base of a wall, near windows or on the ceiling, cracked walls or a funny smell that could indicate mould.

If you do see any concerning signs, Mandeville said it is time to call a contractor to have them take a look. The problem may have a simple solution, he said, but if it is more serious damage, such as a lot of staining or a floor buckling, then he recommends reaching out to a restoration contractor.

Mandeville recommends checking that your gutters are clear — if they are blocked, water will spill over onto the perimeter of the building. He also says to make sure there are no large snow piles near your home.

Investing in a sump pump and a backflow preventer can help with any water overflow, he added.

Public Safety Canada recommends weather protection sealant around basement windows and the base of ground-level doors, and to not store important documents in the basement.

If a flood is forecasted or imminent, the government says to turn off basement furnaces and the outside gas valve, move furniture and electrical appliances to floors above ground level, remove toxic substances such as pesticides and insecticides from the flood area to prevent pollution, disconnect eavestroughs if they are connected to the house sewer, and not attempt to shut off the electricity if any water is present.

“Water and live electrical wires can be lethal,” the federal agency says. “Leave your home immediately and do not return until authorities indicate it is safe to do so.”

Read more: ‘Dark and cold’ — Residents of flooded Kelowna, B.C., apartment building still without power

With insurance, details matter

With flooding becoming more prevalent across Canada, insurance is one way to mitigate any financial loss from damages.

Anne Marie Thomas, a spokesperson for the Insurance Bureau of Canada, recommends homeowners shop around for the best policy that suits their needs. She warns, though, that most flood insurance covers overland flooding, meaning water that comes from a lake or stream, and not sewer backup that can happen when sewers get blocked and the water has no place to go but through the pipes that lead into homes.

“Not all policies are created equal,” she said. “It’s really important that people shop around and understand what it is that they need and what it is that they’re buying so that …. they have the coverage that they think that they have.”

Where you live will also be a factor in how much you have to pay for insurance, with homes that are near rivers or lakes, or in a flood plain, paying more, she said.

Flooding has become so persistent that the federal government has stepped in with financial aid to create a national flood insurance program.

In the recently revealed 2023 budget, the government set aside $31.7 million to get started on building a program that will subsidize flood insurance to make it more affordable for Canadians and to ease the financial burden on insurance companies after years of industry lobbying.

Severe weather in 2022 cost $3.1 billion in insured damage, the Insurance Bureau of Canada has said.

Flood and storm surge damage is not covered under most standard insurance plans in Canada, and adding it to existing plans can be expensive for individuals who are at the highest risk.

If the worst does happen and you experience significant flooding, Mandeville recommends contacting restoration professionals as soon as possible.

“Hours matter, days matter when it comes to flooding,” he said.

Comments

Want to discuss? Please read our Commenting Policy first.