Property tax assessments were mailed out to owners on Monday, and in a news conference, a city official explained how the overall city budget and assessment process are separate.

The city shared a video that explains that council determines how much it needs in the city budget to cover things like roads, parks, police, fire and snow removal. About half of these costs are covered by what Edmontonians pay in property taxes.

So, as the video explains, council determines how big the (budget) pie is and the property assessors determine how big a slice each property owner will pay for, based on things like lot size, location, home’s age and size, and they compare that value to changes in the overall market.

In December, after two weeks approving and rejecting hundreds of items, councillors approved a budget that comes with tax increases of nearly five per cent each year for four years.

“The assessment process is independent of council budget process,” said Cate Watt, branch manager of Assessment and Taxation.

“The assessment process shows how we will distribute the tax levy. The pie — the tax levy — that’s the thing that’s increased by just under five per cent, which is fairly reasonable given what’s happening in the world and in the economy, and in relation to other municipalities in and around the province.”

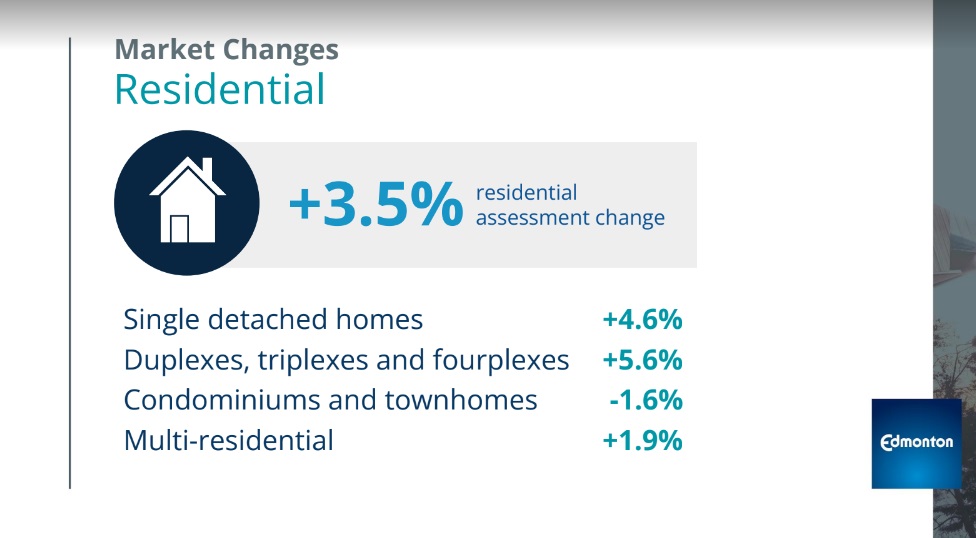

The city said Monday that overall, residential assessment values increased 3.5 per cent (residential change) and 6.1 per cent (non-residential change).

But not all properties increased in assessed value.

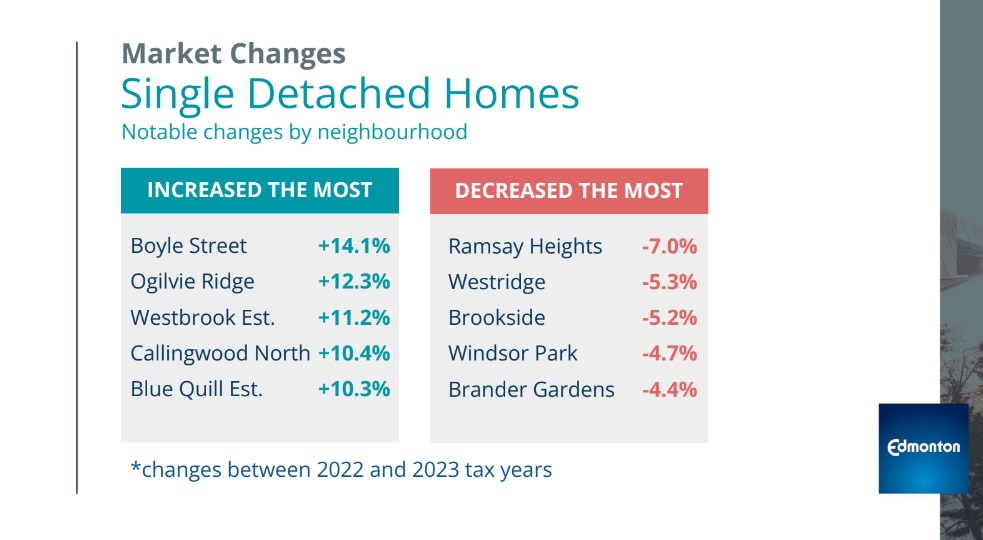

Single detached homes in Boyle Street (+14.1%) and Ogilvie Ridge (+12.3%) increased in assessed market value the most and Ramsay Heights (-7.0%) and Westridge (-5.3%) decreased the most between 2022 and 2023.

“The 3.5 per cent increase is the average increase in the residential homes assessment. If that homeowner sees an increase in their assessment of 3.5 per cent, they will see an increase in their taxes of 4.95 per cent on the municipal side,” Watt explained. “We still don’t know what’s happening on the provincial side.

Get weekly money news

“There will be other homeowners that will see less than that increase, and also a number of homeowners that will see more than that increase,” she added.

“It’s the pie that has increased. The individual slices are relative to how much more or less that property has increased or decreased compared to the rest of the market.”

It is council’s job to determine the size of the pie, Watt said. Assessors don’t have a say in that. Assessors simply determine the size of each slice of the pie.

“The pie size is the important thing in terms of what the tax levy is: the total amount of money that council is collecting from Edmontonain property owners as a whole, that’s the pie, that’s the 4.96 per cent budget increase,” Watt said.

“Then there’s another piece, which is what the province decides to take from Alberta property owners as a whole for their education property tax. And then the assessment is within that pie: how big is the slice? And that’s completely relative to the amount that the property is worth compared to all the other properties in the tax class.”

For 2023, a total of 423,857 properties were assessed.

The total assessed values were $188.1 billion (including $131.1 billion in residential assessed value and $57 billion in non-residential and apartment buildings assessed value).

The median assessed value of single detached homes in Edmonton went up from $402,000 in 2022 to $425,500 in 2023. Condos and townhomes went down the last two years, from $176,500 in 2022 to $174,500 in 2023.

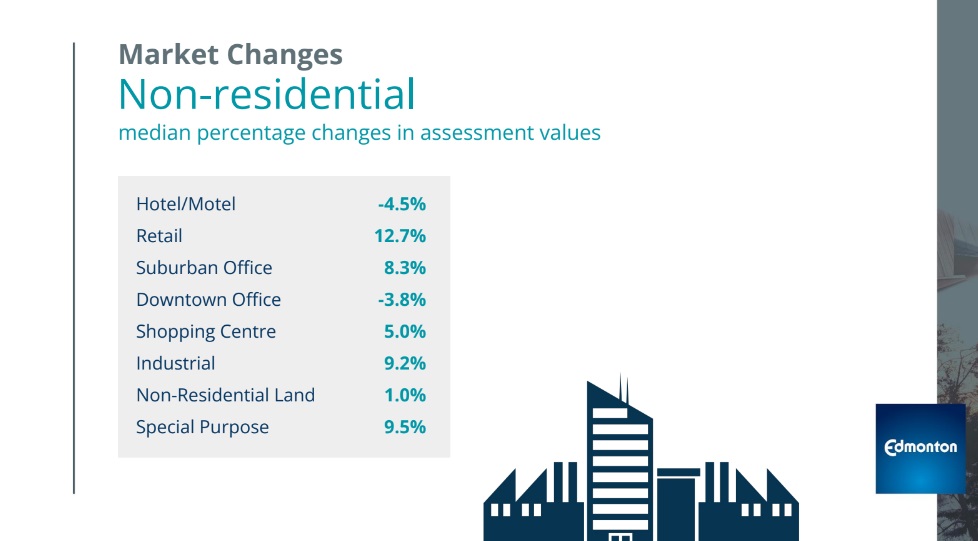

And, in terms of median percentage changes in assessment to non-residential properties, hotels/motels went down 4.5 per cent, retail went up 12.7 per cent, suburban office went up 8.3 per cent and downtown office went down 3.8 per cent.

“There is more than likely a good number of folks who won’t see an increase, may even see a decrease. So those folks who have properties that increased 3.5 per cent, they’re the ones that will see the 4.96 per cent change/increase in their taxes.

“Anyone who changes more than that — which is about half the city — will see a greater increase.

“And anyone who changes less than that — which is also about half the city — will see less than that 4.96 per cent increase.”

Property assessments are done using the value of the property on July 1 and the condition of the property on Dec. 31, 2022.

Owners are asked to review the assessment, check the details are correct and call 311 with any questions.

The city said Alberta Land Titles is about four months behind processing titles, so if someone bought a property after August 2022, they may not receive their notice. They should call 311, the city said.

Owners have until March 24 to appeal the assessment.

Anyone who’s signed up for electronic assessments is asked to check their spam folders, especially if they’re using a Hotmail email account.

For more information on the property assessment process or to view value estimates, visit the city’s MyProperty website.

Comments