Regina’s executive committee is recommending reducing the amount of tax customers pay on movie tickets in the Queen City.

Regina’s executive committee voted 6-2 Wednesday in approval of a plan which will reduce “the amusement tax levied on admission fees to commercial cinemas to a rate of five per cent from the current rate of 10 per cent, effective October 1, 2022″.

The change will now be up for final consideration at next Wednesday’s city council meeting.

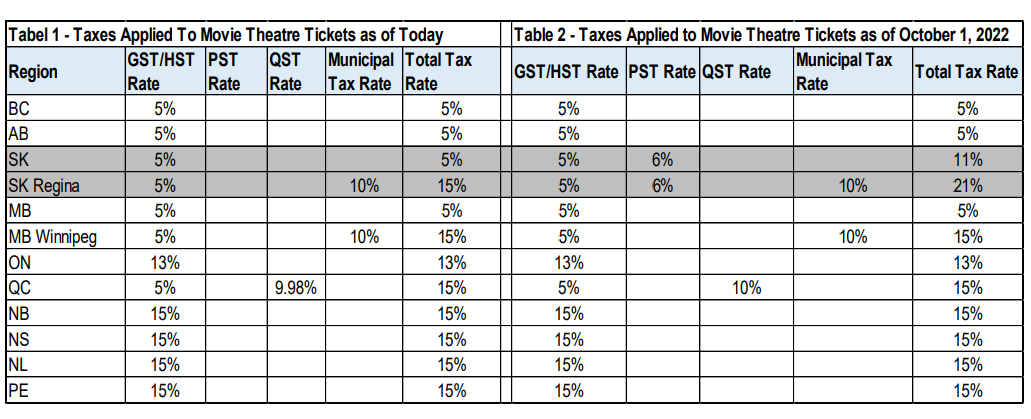

If approved there, the change would take effect the same day as the provincial government’s coming expansion of its six per cent provincial sales tax, leaving the total tax rate paid on movie tickets at 16 per cent (including GST) — still higher than in any other city in Canada.

If the item is not approved, taxes paid on movie tickets in Regina would total 21 per cent (including GST) — significantly higher than in any other city in Canada and, according to delegates to the meeting, higher than any other city in North America.

In its 2022-23 budget released in March, the province announced a PST expansion it projected would generate an additional $21 million a year in provincial tax revenue.

The budget announcement said, come Oct. 1, the six per cent tax would begin to be applied to things like gym and fitness memberships, sporting events, concerts and movie theatre tickets.

In August, as resource revenues soared above budget projections, the province announced it would remove gym and fitness memberships from the PST expansion, but when the expansion takes effect next Saturday, moviegoers will still begin to pay provincial sales tax on their ticket purchases.

Still, though, even with the PST expansion now projected to raise $18 million per year, city administration projects increased funding through the Municipal Revenue Sharing (MRS) Grant program will total approximately $350,000 — potentially offsetting revenue lost by reducing the amusement tax.

Get daily National news

In an average non-pandemic year, the amusement tax raises around $700,000 per year according to city administration.

While amusement tax revenue fell to $169,000 in 2020 and $219,000 in 2021, administration is still projecting potential revenue loss at $350,000 per year should council approve the reduction.

MRS grants are allocated based on fiscal year revenue two years prior which meaning the city would likely still see a net revenue loss until 2025.

Michael Paris, a board member with Movie Theatre Association of Canada, was a delegate at the meeting.

He said that without action Regina will actually become the highest taxed jurisdiction in North America and called for Regina’s entire Amusement Tax to be scrapped . He pointed out that with Rainbow Cinemas set to close this week, the tax will apply to just three separate businesses.

“Our position is this tax is unfair, it’s discriminatory and it’s regressive,” he told councillors Wednesday, adding the pandemic had a disproportionate impact on his industry.

“Not only were cinemas the first to close, the last to reopen, but we’re likely the only sector that had 100 per cent of its customers ushered into the captive arms of our competitors in streaming video. Those include Amazon, Apple, Disney and others who pay no taxes in Regina, employ nobody in Regina and contribute nothing to your local economy.”

He added Cineplex paid $168,000 in property taxes in Regina in 2021 and that Cineplex and Landmark employ 98 people in Regina.

“It’s time for this tax to go,” Paris said.

Landmark Cinemas Canada Chief Financial Officer Dave Cohen also spoke at the meeting.

He said in August 2022, Canadian box office revenue was still down one third over pre-pandemic levels. He added that with movie studios now releasing more titles directly to streaming services, cinemas now have access to “less than half” the number of studio titles than they used to.

“The customer will pay a lower amount at the box office,” Cohen said in response to councillor questions about whether or not a reduced tax rate would actually show up on customers’ bills.

“The after tax price will be lower.”

Paris added to Global News that it’s difficult to directly compare pre-tax ticket prices between cities in part because prices reflect the services and experience offered in a specific theatre.

Following the meeting, Regina Mayor Sandra Masters suggested the city is open to altering the amusement tax in the future.

“I think what you saw from council was to take the recommendation of administration with some view, perhaps over the next year…to look at either eliminating it or adding it to other venues,” she said.

Councillor Lori Bresciani voted against forwarding the item to council as recommended, saying she sees value in removing the tax completely.

She added she believes the change will result in lower ticket prices for consumers and help Regina’s movie theatres operate successfully into the future.

“We’ve already seen a theatre closing in the next four days. I don’t want to see another theatre closing,” she said.

“As a business owner you’ve got a bottom line, and they can only charge so much because people will only pay so much. If it’s layered with multiple taxes, something has to give and it gets very thin, and it becomes unaffordable to run a business. So that’s my concern.”

Comments

Want to discuss? Please read our Commenting Policy first.