The rising cost of living has been top of mind for many in Nova Scotia as the price of basic needs like housing, groceries and gas continue to increase while wages fail to keep up.

The economic crunch is being especially felt by youth and young adults, who have had less time to settle into their careers and accumulate wealth before inflation began spiraling out of control.

While college or university is thought to be a way for people to improve their abilities to get a better-paying job, the situation is forcing some to reconsider their education.

“We’ve heard a lot of stories from folks, especially through the pandemic and now moving forward, who have had to make some tough decisions around being able to access education,” said Lydia Houck, the executive director of Students Nova Scotia.

“Whether it be choosing to go to another province to study, choosing to take some time off to go to work, or, in the case of some international students, actually going home just because the costs are untenable here.”

Mahmoud Sayed, a 19-year-old student at Dalhousie University, told Global News that if prices keep rising, he won’t be able to continue his post-secondary studies.

Full-time studies and part-time work is a lot to have on his plate, but recently he had to pick up a second part-time job just to keep up.

“I think I’m living the worst life of a student right now,” he said with a laugh. “I don’t have a lot of free time … and I’m working another job (in) security to afford myself more money.”

The high cost of living means he has to live with his parents, said Sayed.

“As a student and as a part-time (worker), I don’t have that income to make me live, which made me live with my parents,” he said.

Get daily National news

“Of course, I take student loans, but that’s not enough. Gas prices are really high, insurance is really high, and also the expenses we need as a student for books … tuition.

“Nowadays, I have to think twice before I spend any dollar.”

‘Lose-lose scenario’

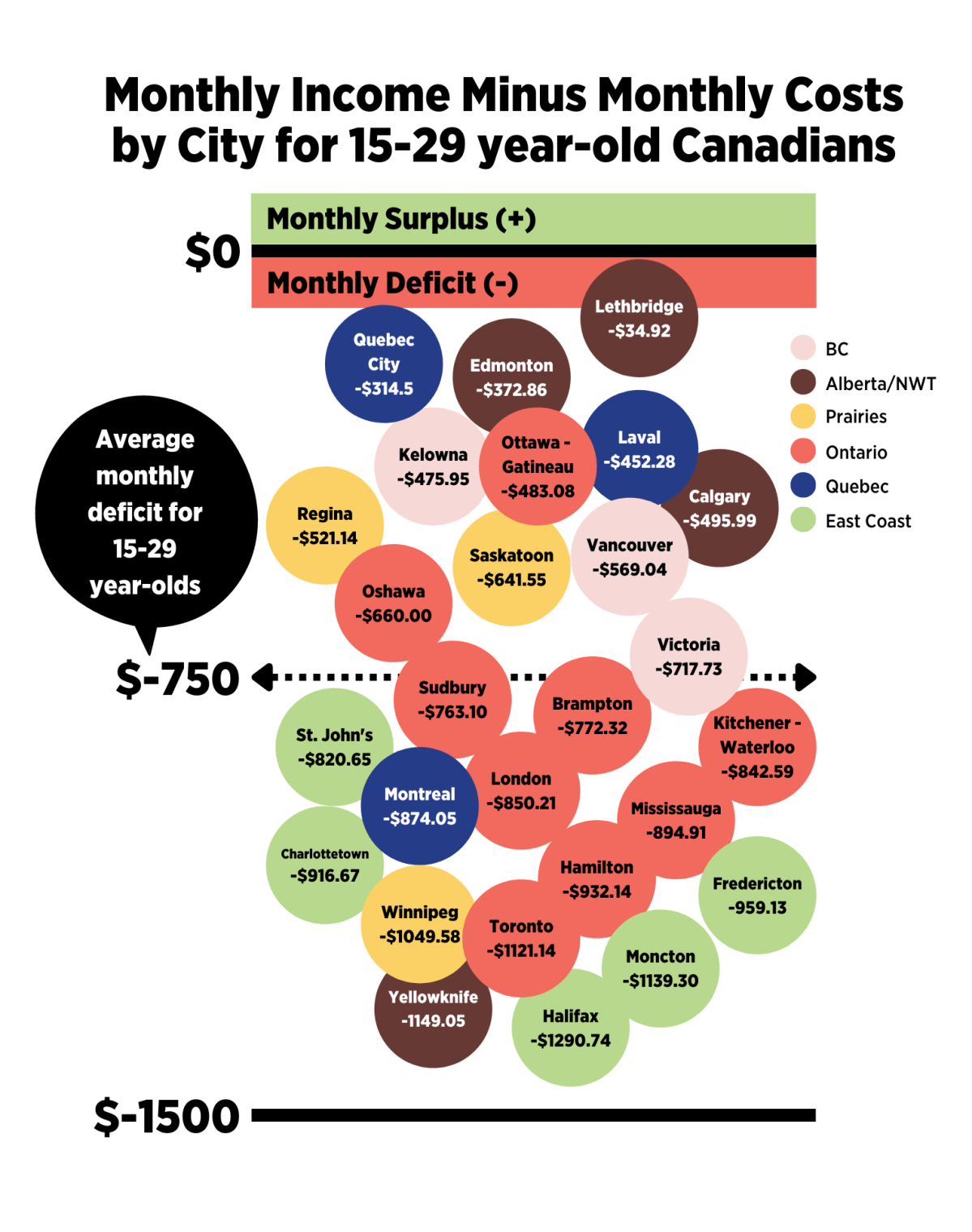

According to RBC’s Youthful Cities Real Affordability Index, which measures income in comparison to cost of living for 27 cities across the country, Halifax is Canada’s least affordable city for people aged 15 to 29.

“Regionally, Canadian cities in the East are the least affordable overall, primarily due to the east coast salary discount, while cities in Alberta and Quebec offer more opportunities for young people to save money,” said a release from RBC.

One big factor driving affordability is the rising cost of housing.

According to rentals.ca’s May 2022 rent report, the average monthly cost to rent in Halifax last month was $1,621 for a one-bedroom and $1,962 for a two-bedroom. In February 2020, those numbers were $1,286 and $1,614, respectively.

Nova Scotia’s hot housing market, with bidding wars and houses often selling for hundreds of thousands of dollars above asking, is also making it increasingly difficult for people to save for a down payment.

There is currently a two per cent rent cap in place, but that is set to lift at the end of 2023. That loss of rent control is a source of anxiety for 24-year-old Douglas Wetmore.

Wetmore rents a two-bedroom apartment in Halifax with his partner. He said they’re in a “fortunate position” where they’re able to stay afloat with the help of family, but their monthly rent of about $1,800 – below average for a two-bedroom apartment – is making things tough.

“Not only is that absurd in its own right, but it puts stress on us because if the two per cent rent cap were to lift at any moment, there’s no telling how much our rent would go up, and if it would immediately displace us,” he said.

The cost of living, especially in peninsular Halifax, has forced some of his friends to move out of the city.

But since many jobs and services remain in Halifax, moving away isn’t necessarily a solution – especially while gas prices continue to rise and public transportation is unreliable outside of the urban core.

“Many of my friends who have moved outside of the peninsula are now struggling to pay for gas just to get to town,” said Wetmore.

“If you want that reliable public transit alternative, your only option is to live downtown where you’re dealing with another cost. So, it’s a lose-lose scenario.

“The problems are coming at us from so many angles.”

Wetmore said the government should keep the rent cap in place longer to provide stability and keep people from being displaced once it lifts.

“It’s not the long-term solution that we need for affordability, but it does alleviate a lot of the stress in the short term,” he said.

“That’s what people need right now to keep comfortable.”

In terms of long-term affordability, Wetmore said further measures are needed to prevent so-called “renovictions” and improve affordability in the downtown core.

Earlier in the week, Nova Scotia Finance Minister Allan MacMaster said the province is working on a targeted package of relief for those with lower incomes.

MacMaster said following a cabinet meeting Thursday that relief will be coming “soon” for people on income assistance and those with lower incomes, building on a package that was announced in March.

That $13.2-million package included a one-time payment of $150 to people on income assistance, and to those eligible to receive the province’s heating assistance rebate among other measures.

However, MacMaster ruled out a cut in gas taxes, saying they provide needed revenue that goes to improve the province’s roads and highways.

Gas prices in the province are well over $2 a litre while the inflation rate as of last month sits at 7.1 per cent, according to Statistics Canada.

– with files from Amber Fryday, Graeme Benjamin and The Canadian Press

Comments