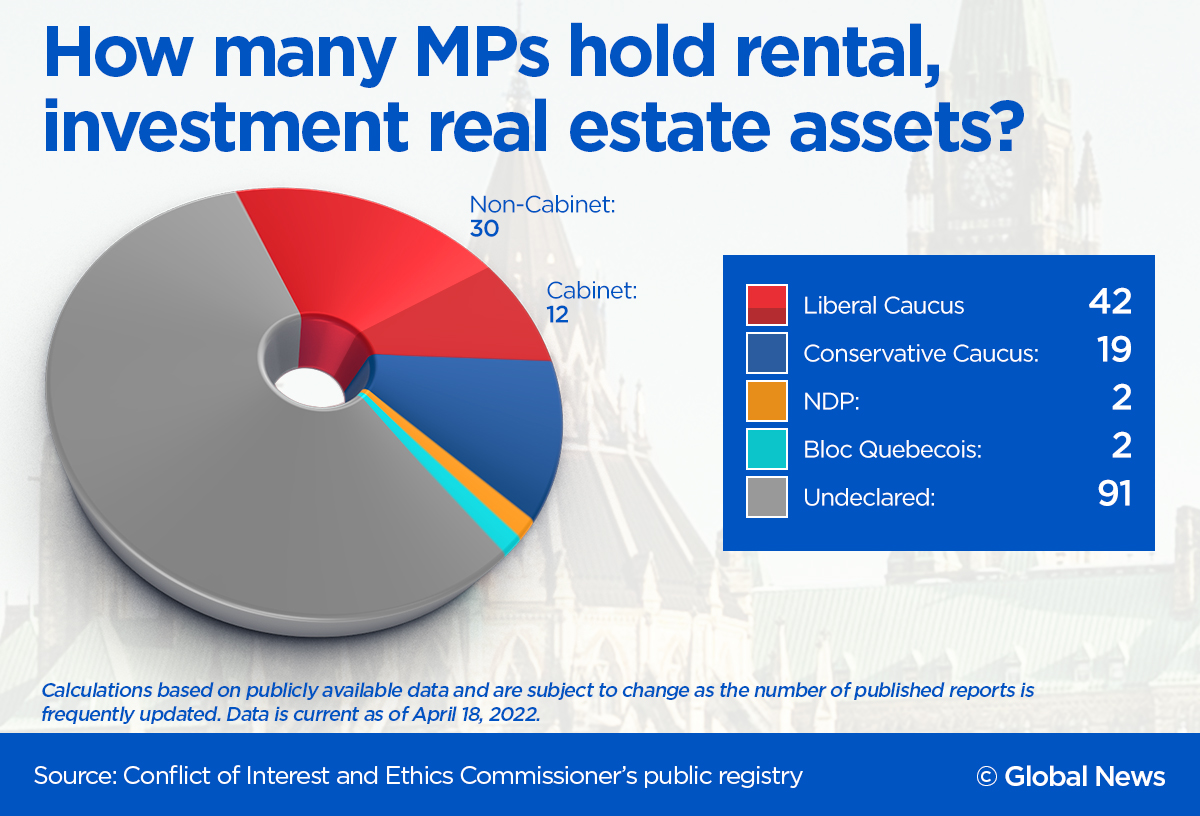

At least 65 Canadian members of Parliament hold rental or investment real estate assets, according to their filings with the federal conflict of interest commissioner.

However, that number may actually be much higher because 91 MPs either have not yet completed their disclosure process or the conflict of interest commissioner’s office hasn’t yet published their filings.

All of that is legal and all of the MPs disclosing the assets have fulfilled their duties under Canadian conflict of interest laws to report their assets to the federal conflict of interest commissioner.

Yet their disclosures come at a time of growing scrutiny and frustration about the role of real estate investors in fuelling the country’s housing unaffordability crunch.

Among the 91 MPs whose disclosures are not yet public are Liberal MP Taleeb Noormohamed, who faced criticism in the last election for flipping dozens of properties, and Conservative leadership candidate Pierre Poilievre.

According to the available filings, at least 42 Liberal MPs own rental or investment real estate assets, such as rental or investment properties, real estate holding companies, vacant land, recreational properties, or income from or significant interests in real estate brokerages.

Of those 42, 30 are not in cabinet, while 12 are the members of cabinet whose holdings were previously reported on by Global News last week.

In total, according to publicly available data listed on the registry, those 30 Liberal MPs own a total of 38 properties listed as being for rental or investment purposes. They also disclosed a range of other real estate assets including ownership of real estate holding companies, income from real estate brokerages, or either “controlling” or “significant” interests in brokerages.

Those 42 Liberals who disclosed rental or investment real estate represent 26 per cent of the caucus.

In comparison, at least 16 per cent of the Conservative caucus — 19 MPs — disclosed owning rental or investment real estate, including vacant land, farmland that is being leased out, residential rental properties or commercial rental properties as well as real estate holding companies.

The biggest property owner by far is Conservative MP Marty Morantz, with a total of 21 properties.

Get breaking National news

Morantz disclosed joint ownership of five residential rental properties in Winnipeg, Man., as well as of 12 multi-unit residential rental properties in the same city.

- ‘Alarming trend’ of more international students claiming asylum: minister

- TD Bank moves to seize home of Russian-Canadian jailed for smuggling tech to Kremlin

- Why B.C. election could serve as a ‘trial run’ for next federal campaign

- Justin Trudeau headed to UN Summit of the Future amid international instability

He also disclosed joint ownership of two multi-unit residential rental properties in Edmonton, Alta., and two commercial rental properties also in Winnipeg.

Conservative MP Mike Lake disclosed joint ownership of two rental properties in southwestern Ontario, as well as sole ownership of a rental property in Ottawa and a rental duplex in Edmonton.

Alistair MacGregor was the only NDP MP to disclose joint ownership of a rental property on Vancouver Island, while Matthew Green disclosed sole ownership of a real estate holding company.

Rhéal Fortin from the Bloc Quebecois disclosed sole ownership of a rental property in Saint-Sauveur, Que., while no independent or Green MPs disclosed any rental or investment real estate assets to date.

The numbers do not include MPs who hold multiple mortgages if they did not list those as being for rental or investment purposes. They also do not include MPs such as the NDP’s Alexandre Boulerice who disclosed that his spouse, but not him, owns a rental property in Montreal.

“In our current cultural context, there is no problem with someone buying another home and treating it as a rental property. That has been a common part of Canadian culture these days,” said Paul Kershaw, founder of Generation Squeeze.

He noted, though, that when politicians talk about financialization — the trend of viewing real estate as an investment vehicle rather than a place to live — they are leaving out part of the conversation by focusing on corporate players like companies, pension trusts and real estate investment trusts.

“It also happens more at the regular, everyday person level.”

According to a Bank of Canada analysis earlier this year, home purchases by investors have outpaced those of first-time homebuyers or even repeat homebuyers during the COVID-19 pandemic.

Investors account for one-fifth of home purchases in Canada, that analysis found, while the share of purchases by first-time homebuyers hit a new low last year.

Will anti-flipping tax, foreign buyers ban help?

Canadian governments of all levels are facing mounting pressure to act as the country grapples with a major housing crunch spawning red-hot home prices, soaring rents, and dimming hopes for a generation hit hard by the 2008 financial crash, the COVID-19 pandemic, and now the current frenzy.

Wages — and savings — too often simply cannot keep up.

Coupled with soaring costs of living, the issue of housing unaffordability and its spillover effects on Millennials and younger Canadians has smashed into the political realities of NIMBY-ism and the financialization of Canadian real estate.

Financialization is a term increasingly being used in reference to investors buying up real estate — typically residential real estate that could otherwise serve as starter homes or affordable rental units — and then treating those as financial assets to generate profit, either through resale or raising rents.

Deputy Prime Minister and Finance Minister Chrystia Freeland pointed to the sky-high home prices fuelled by the financialization of housing as an “intergenerational injustice” earlier this month.

Prime Minister Justin Trudeau also pointed the finger at the trend.

“We will be cracking down on the financialization of the housing market,” Trudeau said on April 8 during a press conference about the promises in the budget. “Houses aren’t supposed to be assets for wealthy investors, they’re supposed to be homes where families can raise their kids.”

He also added: “When foreign investors and corporations use housing as an asset, it drives prices higher and higher and makes homes out of reach for the middle class.”

But when asked on Tuesday what he would say to the 30 per cent of his cabinet ministers — and dozens of caucus members — who are also using real estate as an investment, he appeared to defend them.

“I think there are a lot of people across the country who have rental properties as part of their retirement plans, as part of their lives. Lots of Canadians need to rent,” he said.

“What we’re cracking down on is the fact there are foreign investors and big corporations that buy homes in Canada and then just let them sit, and bid up the prices so that they get more and more expensive, and use them as an asset class for revenue for people who have a lot of money.”

The federal Liberals promised actions in the budget such as an anti-flipping tax for residential properties resold within 12 months, along with a two-year ban on foreign buyers and a homebuyer’s bill of rights.

Those had formed a central plank in the party’s 2021 campaign platform, amid a race that saw one of their own candidates under scrutiny for flipping properties.

CityNews reported in August 2021 that Taleeb Noormohamed, who won the Vancouver-Granville riding, had “bought and sold at least 21 homes within a year of buying them since 2005.”

The NDP later released a statement suggested Noormohamed had made $5 million since 2005 on the sale of 41 properties in the province, citing BC Assessment property sale records.

Global News asked Noormohamed on Tuesday whether he has sold any properties that he has owned for 12 months or less, or purchased any properties that he does not intend to live in, since being elected.

A spokesperson for Noormohamed said he has done neither and that he will approve the publication of his submitted disclosures to the conflict of interest commissioner once the process is done.

Comments