More than half of Canadian companies have experienced fraud in the past two years — that’s up 18 per cent from 2016.

The findings, presented in the “Economic Crime and Fraud Survey” by accounting firm PriceWaterhouseCoopers, suggest that Canadian businesses may be lagging in the fight against cybercrime.

WATCH: Young women at high risk of investment fraud, poll says

According to the survey, 46 per cent of companies said they experienced cybercrime, 38 per cent reported asset misappropriation, and 36 per cent experienced consumer fraud.

Several other types of fraud were also reported by Canadian companies, including business misconduct, procurement fraud, human resources and accounting fraud.

Cybercrimes the “most disruptive”

The survey noted that cybercrime is the “most disruptive” for businesses, and can lead to compromised security, lawsuits and more.

Domenic Marino, the national forensics leader at PwC, told Global News cybercrime is disruptive because it can take place on a large scale, and lead to negative publicity.

READ MORE: Canadians at higher risk of hacks, thanks to their smart devices, report says

“Cybercrimes, a perpetrator can do it in the comfort of their own homes, and just the speed at which technology is moving enables fraudsters to often get the upper hand,” he explained. “It can have a huge impact on an organization’s bottom line, or often more importantly on their brand.”

Most companies who dealt with the issue said they received it through phishing mail, malware, or network scanning. About 11 per cent of companies who experienced cybercrimes weren’t sure of how exactly it happened.

Satyamoorthy Kabilan, a cybersecurity expert at The Conference Board of Canada, explained that a lack of awareness about cybercrimes is common.

WATCH: When it comes to scams, do you think millennials or seniors have lost more money?

“It can be months before you actually pick up that there’s a compromise in your system, or someone has been snooping in your system,” he said.

Kabilan added that once discovered, some companies don’t disclose the problem in an effort to maintain reputation. That means the issue could occur more frequently than reported.

One concerning factor, the survey pointed out, was Canadian companies were more likely to experience cybercrimes, at 46 per cent, than their global counterparts, at 31 per cent. But this may be improving — 64 per cent of Canadian businesses in the survey said they have cybercrime response plans in place, up from 31 per cent who did two years ago.

Consumer fraud

Consumer fraud — which encompasses things like credit card, insurance and mortgage fraud — is becoming more prevalent with new technologies, the PwC report says.

- Northern lights could appear across Canada as ‘severe’ geomagnetic storm nears

- ‘Significant risk’: How will wildfires spread over the next two months?

- London Drugs issues apology, says no evidence of compromised data in cyberattack

- As Canada eyes AI growth, could electricity demands fuel climate change?

This type of fraud can range widely. With housing prices rising in some provinces, many consumers tend to “embellish” mortgage applications. With online shopping, there is also a rise in buying and selling counterfeit goods.

READ MORE: Online purchase scams and wire fraud top list of scams for 2017

Asset misappropriation

Marino explains that asset misappropriation is likely one of the “oldest schemes that fraudsters have used.”

It entails those with internal access to a company misusing funds or services. One example would be employees not reimbursing, or exaggerating expenses.

How concerned should consumers be?

The survey’s findings should be of concern for consumers, Marino explained, especially because he expects the actual number of companies experiencing fraud is higher than the survey states.

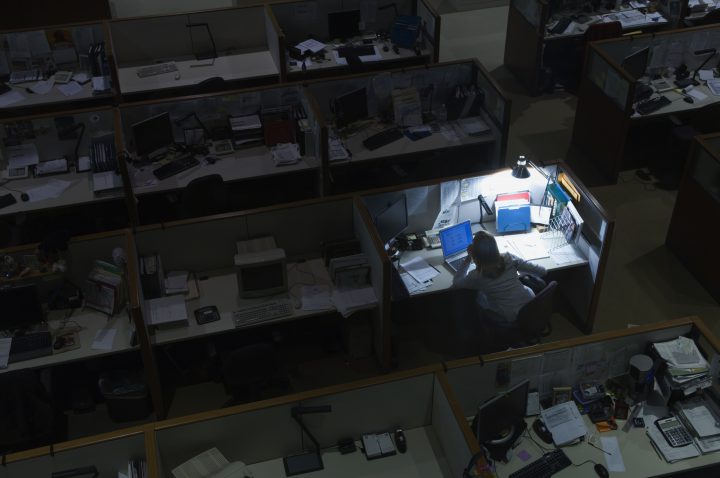

“The 55 per cent, that is really just an organization’s awareness of fraud. It’s our view that the number is actually much higher,” he said. “And the reason for that is that fraud sometimes hides in dark corners of an organization. It’s not necessarily going to be fraud that makes front-page news.”

WATCH: Vancouver woman victim of Twitter bot fraud

Another cause for concern is privacy.

“It’s impossible to undo a cyberattack. You can often replace the funds of your bank account if they’ve been stolen, but you can’t replace your identity.”

Marino added that sometimes companies recuperating from such crimes may have to increase the prices of their products and services.

WATCH: Cyber security expert explains how the dark web is used by criminal organizations

Fighting fraud

The accounting firm report highlights that Canadian companies can do more to fight fraud in four key ways — how they identify an issue, how they manage it once it occurs, what they invest in fraud-fighting technology, and how much they invest in employees.

WATCH: Online threats and how to protect yourself

Kabilan explained that these suggestions are largely in line with what he has found to be helpful, but he would put an extra emphasis on educating and training workers.

“We keep investing in technology to deal with cyber crime, but the most critical investment is an employee,” he said. “Humans are more adaptable as the threat changes. If they’re trained well, they might be the ones who are able to spot the change.”

Comments