It’s Canada’s birthday, so why would you want to spend your summer vacation anywhere else?

It isn’t just that Canada is breathtakingly beautiful. Its’ also that Canada 150 is also a great time to travel our vast country far and wide, thanks to a slew of special offerings — on anything from park permits to train passes — that make it cheaper to do so.

READ MORE: Top natural wonders to see in Canada before you die

And as if the great outdoors and patriotic pride weren’t good enough reasons to confine your summer plans to Canada this year, here’s another one: the loonie.

READ MORE: Free 2017 Parks Canada pass only good for national parks, Ontario warns

“Until the end of last week, the Canadian dollar was the worst performing major currency of 2017,” Krishen Rangasamy of National Bank of Canada noted in a research report this morning.

READ MORE: Via Rail youth passes sold out after delays with reservation system

The loonie has been hovering around 0.73 cents per U.S. dollar, the lowest it’s been for the past five years except for a brief period in late 2015 and early 2016.

- Indian government no longer targeting Canadians, senior official says on eve of PM’s visit

- Best friends who played on Jasper hockey team remembered as ‘bright shining lights’

- Cervical cancer is ‘fastest-rising’ form in Canada as doctors urge action

- Canada’s military recruitment surged amid sovereignty threats: data

A trip to Europe is likely to be even more expensive:

The euro had a rough ride earlier this year, as investors fretted over the possibility of France electing the right-wing and euro-skeptic Marine Le Pen to the presidency, a vote that some feared might have led to the country’s exit from the European Union. However, centrist candidate Emmanuel Macron’s victory at the polls has laid those concerns to rest, at least for now.

READ MORE: Emmanuel Macron takes power as French President, vows to overcome divisions

Get weekly money news

For Canadians, it means one loonie now buys only about 67 euro cents.

Why the Canadian dollar is so weak right now

A weak currency usually reflects a weak economy, but that’s not the case for the loonie this year. Canada is widely expected to post gangbusters growth of 4 per cent during the first three months of 2017. The U.S., by contrast, inched forward by a meagre 0.7 per cent during the same period.

But despite Canada’s strong GDP numbers, investors have been worrying about the health of the housing market, trade tussles with the U.S. and slumping oil prices, wrote Rangasamy.

READ MORE: Moody’s downgrades Canadian banks: Beginning of the end for the housing market?

The market also expects the Federal Reserve to further raise interest rates in the U.S. this year, which will put more pressure on the Canadian loonie as long as the Bank of Canada maintains its current commitment to keeping Canada’s rate unchanged.

The weakness of the loonie also reflects a slew of bets against it by currency traders, fuelled by a string of negative headlines in recent weeks, Bank of Montreal economist Robert Kavcic wrote in a research note this morning.

READ MORE: Why trouble at alternative lender Home Capital could reduce your mortgage options

First there was news of trouble at alternative mortgage lender Home Capital, then credit rating agency Moody’s downgraded all of Canada’s largest banks last week, citing concern over high home prices and household debt. And then there was U.S. President Trump, who promised “massive” changes to NAFTA, Kavcic noted.

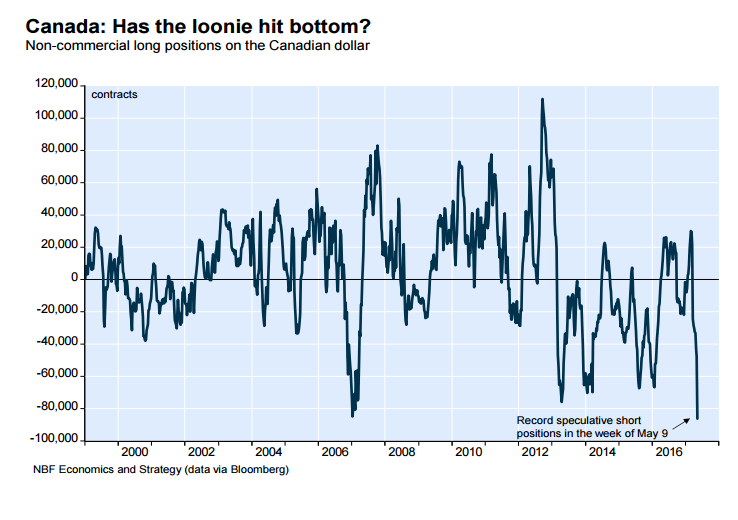

All this has prompted a record volume of currency bets against the Canadian dollar, Rangasamy wrote.

Going forward, Rangasamy, Kavcic and others believe the loonie may have bottomed out for now.

Saudi Arabia and Russia just announced they’re considering extending oil supply cuts to March 2018, which would support oil prices as well as the Canadian dollar. Soft inflation numbers in the U.S. have diminished the chance of an imminent interest rate hike in the U.S., which would spare a further hit to the loonie. And signs that the worst might be for Canada’s providers of risky mortgages might also likely help prop up the loonie, according to Derek Holt at Bank of Nova Scotia.

READ MORE: Why trouble at alternative lender Home Capital could reduce your mortgage options

Still, the relief could prove to be only temporary, as the loonie could come under renewed pressure over the next few months, wrote Rangasamy.

Canadians looking for a summer gateway that doesn’t break the bank may want to take another look at everything that Canada 150 has to offer.

Comments

Want to discuss? Please read our Commenting Policy first.