Even though many financial institutions are moving away from paper, there are still millions of cheques that pass through banks every single day. Global News has learned that most financial institutions have a policy not to review signatures on cheques under a certain amount.

One Calgary business owner learned the hard way his business bank account was not as secure as he thought.

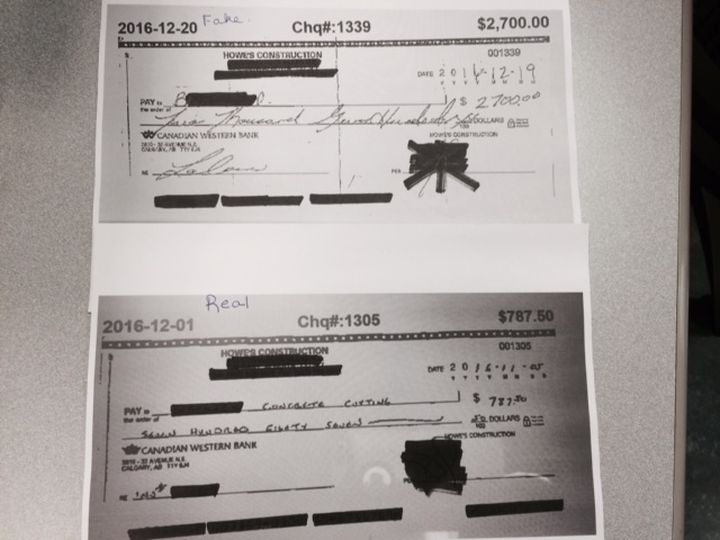

David Howe contacted Global News Thursday regarding what he calls “a fraudulent cheque” that was written from his business account Dec. 20, 2016.

Howe said he was working on the GST for his construction company in January 2017, when he discovered a cheque had been written from his business account to someone he has never met.

The cheque, for $2,700, looks like it was written in someone else’s handwriting.

Howe told Global News he has owned this company for 20 years, has never allowed anyone to write a cheque from that account before, and that his writing is unique in that he always prints.

Get daily National news

The cheque from Dec. 20, 2016 was handwritten.

Howe said he contacted his bank, Canadian Western Bank (CWB), immediately and told them about the fraudulent cheque. Howe told Global News CWB initially told him they could not do anything about that money because he waited too long to contact them. However, CWB HAS since said it will reimburse Howe the $2,700.

According to Howe, when he asked the bank about its security measures-specifically how a cheque with such obviously different writing could have been cashed – he was advised the bank does not verify signatures on cheques under $5,000.

Global News contacted CWB to see if it has a policy regarding cheque verification minimal amounts and it provided this statement:

“Millions of cheques are written in Canada every day and financial institutions generally have a policy to review signatures on cheques over a certain dollar amount. As this is an internal policy, our limit at CWB is not public information.”

-Angela Saveraux

Senior Manager, Corporate Communications

We contacted the Royal Bank of Canada (RBC) for comparison purposes and it told us the same thing.

Monica with RBC Business Banking said its policy is to have every cheque verified either through an automated system or by a teller, but due to the sheer volume of cheques that are cashed every single day, some will get through without getting flagged, especially if they are a lower dollar value and are being cashed through automated teller machines (ATMs).

Howe said CWB told him this cheque had been cashed in another bank’s ATM in Edmonton.

The representative from RBC said they encourage their customers to regularly check their accounts to make sure everything is legitimate. She also said it is the client’s responsibility to contact the bank immediately if a cheque or chequebook gets lost.

In Howe’s case, he said he did not know the blank cheque had been stolen until he was doing his monthly paperwork and saw the cashed cheque.

According to Monica, fraudulent activity, like what Howe described, is one of the reasons her bank is encouraging clients to go paperless-by offering free e-transfers on some accounts and allowing clients to deposit cheques through pictures.

Monica said it is easy to follow the paper trail of cashed cheques, so the RBC encourages clients to report fraudulent situations as soon as possible in order to allow the bank to investigate and help the client out.

Comments