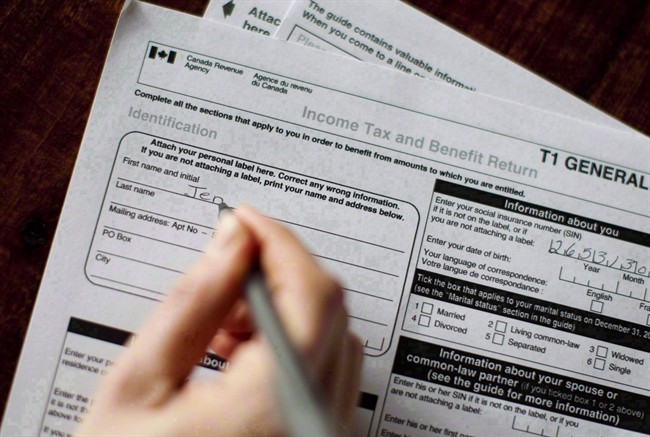

OTTAWA – The tax rules are changing in 2016 and even if you don’t make enough to be hit by the new top federal income tax rate, experts advise taking a look at your financial plans to make sure you’re on track.

The vast majority of Canadians will not be affected by the new tax bracket for income over 200-thousand dollars a year, but everyone will see their annual tax-free savings account contribution limit be reduced back to 55-hundred dollars.

READ MORE: Liberals’ key election vow to change income tax rates passes through House

Get weekly money news

Peter Bowen of Fidelity Investments says this might be the most important tax planning season many people have ever had.

He says what you need to do depends on your tax bracket and that you should carefully consider your future financial needs when weighing TFSA and RRSP contributions.

Bowen notes the lower TFSA limits may hurt retirees looking to shelter a portion of their nest egg from tax even though they may fall into the low-income category.

More changes are expected as the Liberals move to deliver on a child benefit program to replace the universal child care benefit starting in July 2016.

WATCH: Prime Minister Trudeau weighs in on economy

Comments