The Canada Energy Regulator has decided it won’t do a deep dive into what caused the billion-dollar cost overruns incurred by the Trans Mountain Pipeline Expansion project.

The federal energy regulator will not be scrutinizing any actual construction company contracts or specific invoices from suppliers for materials or services supplied to the massive project.

Instead, a panel of CER commissioners opted only for a “targeted review” of some of the project’s cost increase expenses. Their review will rely on information supplied by the federal government-owned company, not original documents involving bills, construction contracts or audits of them.

The Ottawa-based federal energy regulator shared its decision this week in a letter which it sent to oil companies that will use the expanded pipeline when it opens sometime in 2024. In a press release, the CER called its review effort a “robust process.”

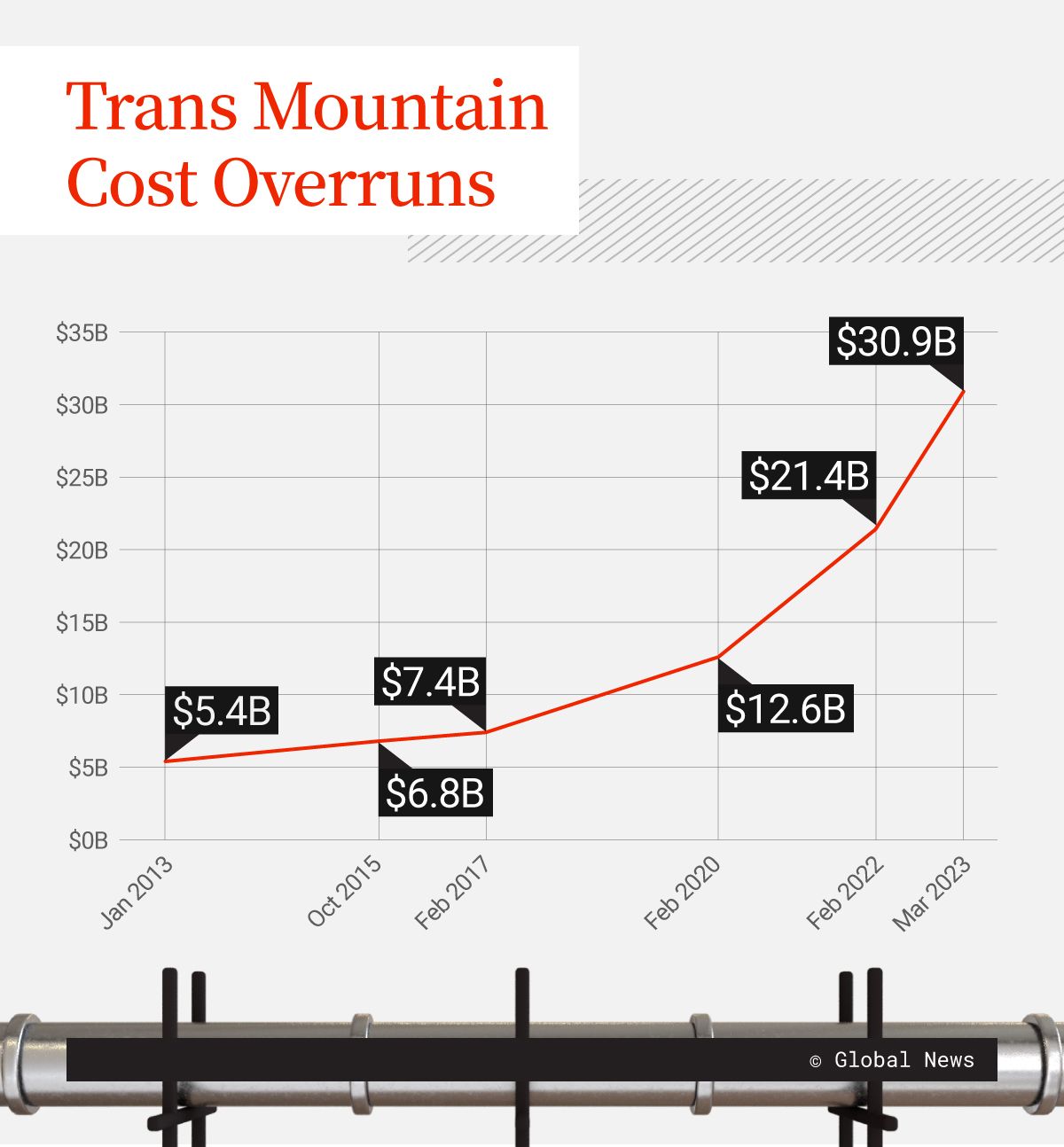

The Trans Mountain Pipeline expansion has so far exceeded its original cost estimate by a factor of six, soaring from the first $5.4-billion estimate to top $30.9 billion, with costs still rising.

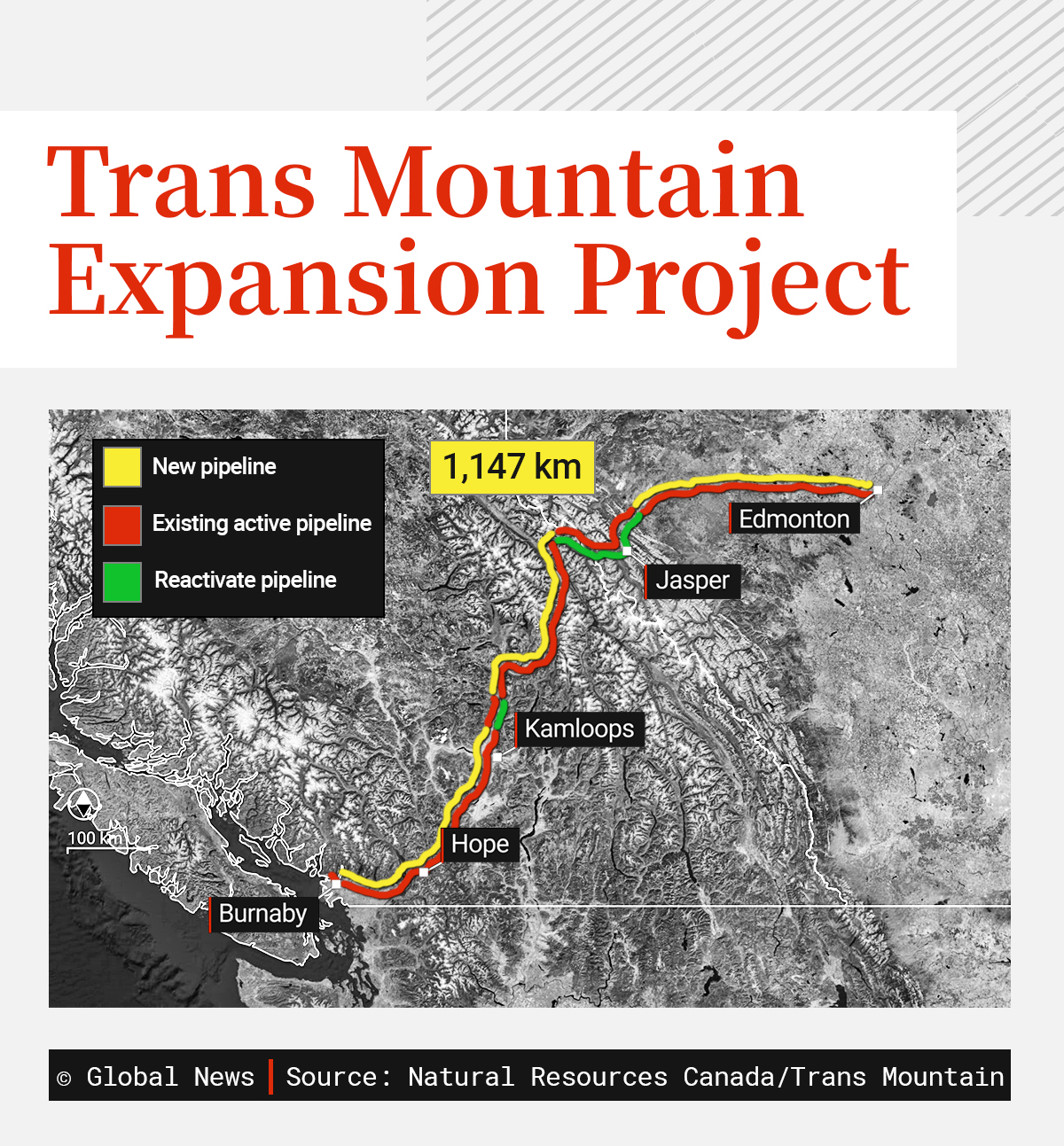

When the project is finished, the pipeline will triple Trans Mountain’s ability to carry oil from Edmonton to British Columbia’s Lower Mainland and Puget Sound area in Washington state.

Once the Alberta crude gets to coastal B.C., marine tankers will transport it to Asia, opening new markets for Canadian producers. Until now, they could only ship south to the United States.

The CER’s targeted review of project expenses is part of an effort by the regulator to set preliminary toll rates, or fees, for oil producers to ship crude on the expanded pipeline when it opens. Final tolls to ship crude will be set later and involve more CER hearings.

Trans Mountain Pipeline has sought permission to increase the tolls significantly on an interim basis to help recover some of the cost overruns as soon as the expanded pipeline opens.

But oil companies such as Canadian Natural Resources and others have opposed TMP’s move, calling for a more vigorous audit of the expansion’s staggering cost increases.

Oil industry players contend that Trans Mountain has neither properly explained nor justified the project’s costs as they surged well beyond what companies expected and agreed to when the expansion project launched.

Get daily National news

At the time they signed on for the project, oil producers and the pipeline company (then Kinder Morgan) adopted cost sharing models that “did not contemplate that the sole shareholder would be motivated by anything other than maximizing its return from the efficient delivery of crude,” Canadian Natural Resources lawyer Martin Ignasiak told the CER in a letter last month.

But since the Liberal government bought the project from Kinder Morgan, Ignasiak argued the government corporation now seeks to charge much higher tolls for crude shipments to recover expenses which Canadian Natural Resources considers political spending, not oil industry goals.

“The sole shareholder obtains benefits from achieving certain policy objectives, including advancing Indigenous reconciliation, environmental protection and positive intergovernmental relations,” Ignasiak wrote, suggesting pipeline users should not be stuck footing political bills.

For example, Global News has reported that amounts allocated to Indigenous accommodations, were initially estimated to cost $99 million. They ended up costing almost 10 times that amount, around $900 million so far. Few details about those deals have been publicly shared.

In their letter this week, three commissioners of the Ottawa-based Canada Energy Regulator said that instead of looking into why specific cost overruns came about by eyeballing actual bills and invoices from construction companies, they will target their review to specific areas where there were “material” or significant overruns.

The Canada Energy Regulator appears to have accepted Trans Mountain’s claims that because there are thousands of individual cost items associated with the pipeline expansion project, the company would need months to respond to sweeping information requests about cost overruns. It claimed it would need even more months to review responses from other parties.

Instead, three CER’s commissioners have directed TMP to give the regulator more detailed financial information than the company has previously shared, ordering that this new information be grouped into certain “cost categories” and cover a period between 2017 and 2023.

Such categories must “provide a meaningful level of detail to track costs and calculate variances related to the Trans Moutain Expansion Project,” they said in their letter.

“The Commission encourages Trans Mountain to be forthcoming in providing the level of detail that parties and the Commission will require to appropriately assess Trans Mountain Expansion Project costs,” the CER letter stated.

The regulator said the new cost information it has requested must be “sufficiently disaggregated” or broken down for the Commission and other parties “to identify potential areas of concern, including material cost components and cost increases.”

Trans Mountain was also directed to explain what it has done over the years to mitigate cost increases.

andrew.mcintosh@corusent.com

Comments

Want to discuss? Please read our Commenting Policy first.