The new year has come with a fresh reason to worry. The killing of a top Iranian general by a U.S. airstrike in Iraq is stoking fears of renewed instability in the Middle East, with ripple effects for both financial markets and gasoline prices.

Oil prices rose by more than three per cent on Friday Jan. 3, after news of the attack, and briefly floated above US $70 a barrel on Monday amid escalating rhetoric from Iran, Iraq and the U.S.

READ MORE: Iran’s supreme leader weeps, prays over general killed by U.S. airstrike

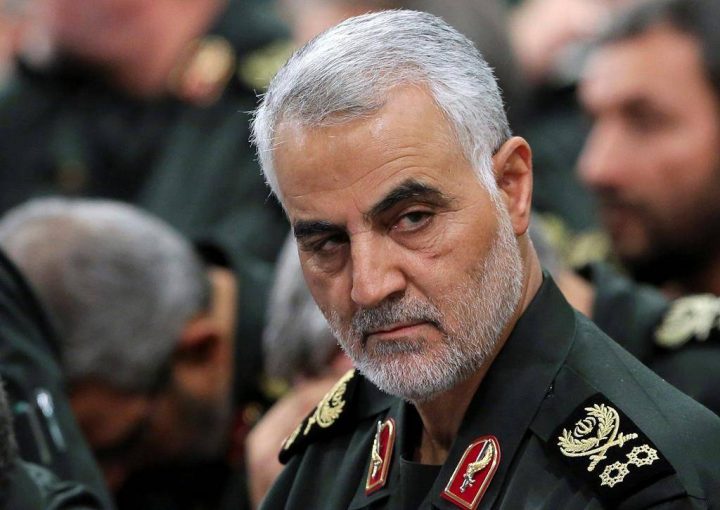

Late Thursday night, the U.S. confirmed the killing of Gen. Qassem Soleimani, the head of Iran’s elite Quds force, who Washington accused of planning attacks on U.S. diplomats and service members in the region, and approving the attack on the U.S. embassy in Iraq on Dec. 31.

While an outright military conflict between the U.S. and Iran remains unlikely, Iran is bound to seek revenge, including by targeting the energy infrastructure in Iraq and Saudi Arabia and disrupting oil flows in the region, analysts say.

“We believe that an Iranian retaliation is almost certain,” Paul Sheldon, chief geopolitical risk analyst at S&P Global Platts, wrote in a recent report.

READ MORE: NATO calls for ‘restraint and de-escalation’ amid tensions between U.S., Iran

The stakes for Canadian investors and motorists, however, may not be as high as the political headlines suggest, experts say.

While the stock market stages a sell-off in the aftermath of the attack, that “could have happened for any reason,” Gregory Taylor, chief investment officer at Purpose Investments, said speaking mid-day on Monday.

U.S. and Canadian stocks ended higher on Monday, with the S&P 500 up 11.44 points at 3,246.29, and The S&P/TSX composite index closed up 39.35 points at 17,105.4.

Global markets are also keeping a close eye on economic indicators out of the U.S., where an important gauge of manufacturing activity yielded some underwhelming results on Friday, Taylor noted.

READ MORE: COMMENTARY: Canada-led NATO training mission in Iraq in deep jeopardy

And north of the border, investors have their own economic red flags to monitor. The biggest one is the latest jobs report, which showed Canada’s labour market shedding 71,000 net positions in November, the largest one-month loss since the financial crisis of 2009.

READ MORE: Canadian economy shed 71K jobs in November — biggest loss since the financial crisis

While Canadian job numbers are notoriously volatile, markets will be closely watching the December labour market survey due out on Friday, Jan. 10, Taylor said.

“There’s really a lot of concern that western Canada is heading into recession.”

There are also worries about the financial health of Canadian consumers, as well as some disappointing earnings results from the country’s major banks, Taylor said.

Financial markets closed on a high in 2019 that wasn’t warranted by corporate earnings, and investors have plenty of reasons to pare back some of those gains, including developments around the U.S. federal elections and the U.S.-China trade negotiations, Taylor concluded. Rising tensions in the Middle East are just one of many reasons for markets to fret, he added.

The takeaway?

“2020 could be more volatile than not.”

Gas prices, on the other hand, are very unlikely to see any dramatic swings, said Dan McTeague, president of Canadians for Affordable Energy.

Canadians in major cities have seen only a minor jump in prices at the pump so far — between one and two cents a litre — McTeague noted. They aren’t likely to see prices climb much more than that, he added.

That’s mostly thanks to the U.S. shale boom. America’s crude oil production stood at 12 million barrels per day in 2018, much higher than the previous peak of 9.6 million in 1970, according to the U.S. Energy Information Administration. In September, the U.S. for the first time exported more crude oil and petroleum products than it imported, according to the agency.

That’s been a game-changer for the oil market and the main reason why Canada’s gasoline prices — with the notable exception of Vancouver — have remained remarkably stable, with swings of no more than five cents a litre, save for the larger seasonal increase due to the switch to the more expensive summer gasoline blend in spring, according to McTeague.

Even the Maritime provinces, which are more reliant on foreign crude imports, are unlikely to feel much of an impact, said Michael Ervin, senior vice-president at Kent Group. Saint John’s Irving refinery, the largest in Canada, is waterborne, meaning it can receive shipments from anywhere in the world, he noted.

But Ervin also believes any disruption of oil shipments through the crucial Strait of Hormuz, the entry point to the Persian Gulf, will be limited.

“I expect there will be a great deal of attention is being paid by military assets in the Western world to ensure those sea lines of communication are kept open.”

Comments