New Brunswick’s auditor general will review the province’s property assessment system in the wake of a series of errors, while a former judge who was examining the same issue is bowing out.

The reviews were launched after a whistleblower alleged in March that more than 2,000 property owners were given improper and inflated tax bills. Premier Brian Gallant has said his government is committed to getting to the bottom of the thousands of mistakes with assessments going back to 2011.

On April 3, the government announced that former Court of Appeal justice, Joseph Robertson, had agreed to undertake a review.

READ MORE: N.B. Premier says opposition leader’s call for his resignation ‘political opportunism’

But on Monday, Attorney General Serge Rousselle announced that Robertson is discontinuing his probe – citing the potential for overlap with a review being done by auditor general Kim MacPherson.

“We were comfortable that both of them could do the review, but obviously former justice Robertson decided to discontinue his review. We respect that and thank him for his service,” Rousselle told a news conference in Fredericton.

In a separate release Monday, Service New Brunswick said that as of June 1, they had reissued 1,858 bills to property owners that had an arbitrary formula applied to their March bill. It said that 93 per cent of the reissued bills decreased, six per cent stayed the same and one per cent increased.

To date, Service New Brunswick has received 16,416 requests from property owners for a review of their property tax assessments. So far 23 per cent have been processed, and it could be early next year before they are all processed.

READ MORE: New Brunswick getting out of property assessment business following controversy: premier

Robertson said he was engaged to perform an independent review and that two people seeking the same information could cause a number of problems, such as compromising anonymity and confidentiality of staff within Service New Brunswick.

“A continuation of the review could lead to conflicting findings and recommendations as between myself and the auditor general,” Robertson wrote.

Robertson said he only became aware of MacPherson’s intention to investigate the issue after he had begun his own work.

“Had I known of the audit and its ambit, I would not have undertaken the review,” he wrote.

READ MORE: NB sees record number of property assessment appeals in with more likely to come

Robertson won’t be releasing a preliminary report or his findings. Instead, Rousselle said Robertson will share his notes with MacPherson.

“There will be a transition phase, so the work that has been done will be transferred to the auditor general. She can do what she wants with that information, because we do not dictate how she fulfills her mandate,” Rousselle said.

Rousselle said the government did encourage Robertson to continue his work, but respects his decision.

Robertson was to release a report by mid-August. Work on the audit of the province’s financial statements is expected to delay MacPherson’s report to the legislature until late November.

READ MORE: N.B. Premier’s office to blame for inflated property assessments, not assessors: union

MacPherson will have the same mandate as Robertson, and cabinet is using Section 12 of the Auditor General Act to also give her subpoena powers.

“Our goal remains ensuring that the public gets a clear explanation of what happened and steps that can be taken to fix the issue going forward,” Rousselle said.

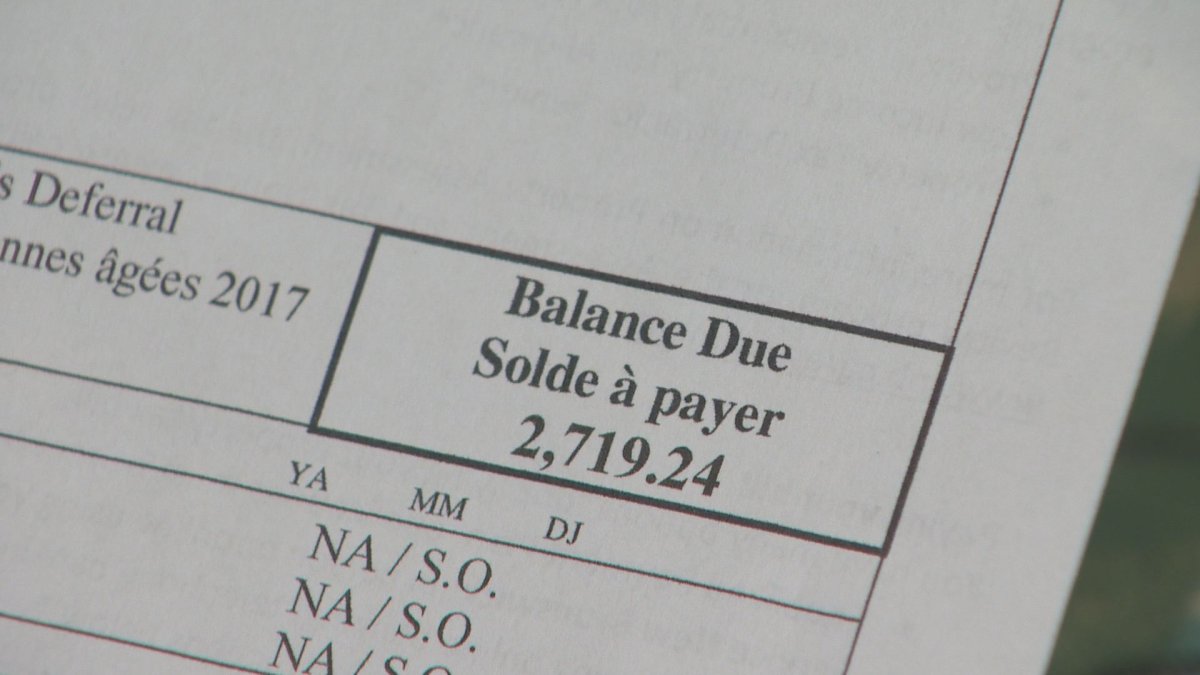

Many people across the province received bills that showed a huge jump in their property assessments.

A newlywed couple in New Maryland, near Fredericton, said they were stunned when they received a bill stating their property’s assessed value had doubled to $347,000 from about $170,000.

- Life in the forest: How Stanley Park’s longest resident survived a changing landscape

- ‘They knew’: Victims of sexual abuse by Ontario youth leader sue Anglican Church

- Buzz kill? Gen Z less interested in coffee than older Canadians, survey shows

- Mental health support still lacking 4 years after mass shooting: Nova Scotia mayor

Comments