A foreign buyer tax in the Greater Toronto Area (GTA) would be “misguided” at a time of decaying affordability in the city, say realtors.

Such a tax, like the one that B.C. implemented for Metro Vancouver in August, would lead to “tighter market conditions and stronger price growth in neighbouring communities/regions without a tax,” the Toronto Real Estate Board (TREB) said in a news release accompanying its “Market Year in Review” on Tuesday.

But that’s not all it would do, the TREB argued. A foreign buyers tax would also lead to “less rental supply, because the number of investors looking to purchase and rent out a property could decline.”

The TREB boosted its position using an Ipsos survey of its members that was conducted in November 2016.

The poll found that “only an estimated 4.9 per cent of GTA transactions, in which TREB Members acted on behalf of a buyer, involved a foreign purchaser.”

It also said that “the great majority of foreign buyers purchased a home as a primary residence (40 per cent), to rent out to tenants in an extremely tight GTA rental market (25 per cent), or for another family member to live in (15 per cent).”

The survey came in a release that said the average selling price was expected to grow by between 10 and 16 per cent this year. TREB has forecast the average selling price to hit $825,000, which is up from $730,482 in December and $729,922 for 2016.

TREB CEO John DiMichele admitted that home affordability is a “growing concern,” but said governments should tackle the region’s “housing supply issue,” when they’ve been focusing on policy solutions for “allaying demand.”

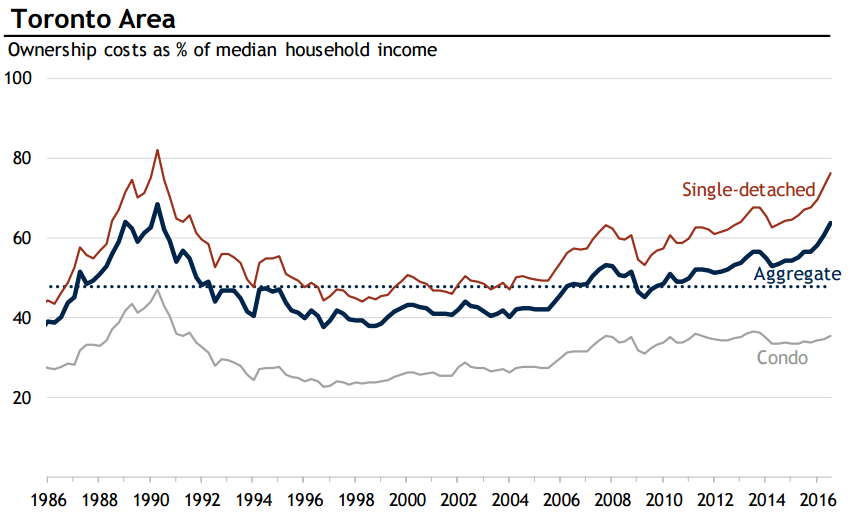

Meanwhile, there is plenty of evidence to suggest that home affordability in Toronto is deteriorating.

A “Housing Trends and Affordability” report released by RBC in December showed “intense affordability stress in Toronto,” with housing taking up as much as 63.7 per cent of median household income in the third quarter of last year.

That’s well above the threshold set down by the Canada Mortgage and Housing Corporation (CMHC), which says housing can be considered affordable if it takes up less than 30 per cent of a household’s before-tax income.

Most of this stress was seen in the detached home market, where a property could take up 76.1 per cent of income. Apartments were more affordable at 35.5 per cent, although that, too, is above the CMHC threshold for affordability.

READ MORE: B.C. foreign buyers tax really did yank down Vancouver home prices: BMO

As for TREB’s contention that a tax could drive up prices in neighbouring communities: that’s already happening.

Areas such as Oshawa and Oakville are seeing more growth as prices continue to climb in Toronto, Royal LePage president and CEO Phil Soper told Global News last month.

Oshawa alone has seen the average house price grow by 26 per cent recently, to $453,975.

Analysis provided by BMO titled “One way to tame house prices” suggested that B.C.’s foreign buyer tax has pulled down prices in the Metro Vancouver area.

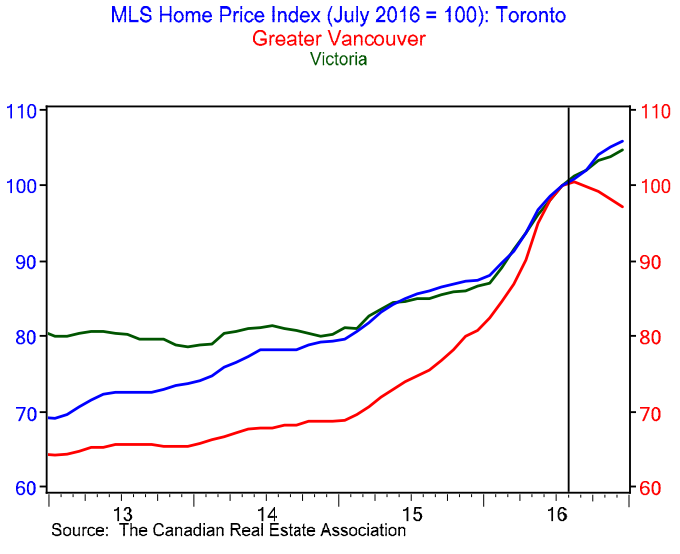

The MLS home price index (HPI) clearly shows Vancouver prices dropping after the province implemented a 15 per cent property transfer tax on foreign buyers.

Vancouver is, of course, a different market than Toronto. But the HPI showed that prices in areas that were not hit by such a tax (but were affected by changes to federal mortgage rules), kept climbing.

“In case there was any doubt what force is at play, note that Victoria has tracked closer to Toronto’s behaviour than Vancouver’s (no tax in Victoria either),” chief economist Douglas Porter wrote.

READ MORE: B.C. real estate data show sharp decline in foreign investment after tax

Initial figures collected by B.C.’s provincial government in July, before it implemented the tax, showed that 3.3 per cent of all purchases in Metro Vancouver involved foreign nationals.

But that only covered sales in a 19-day period in June 2016. Updated figures showed that foreign buyers made up 9.7 per cent of sales in the region in a five-week period between June and July of last year.

- Life in the forest: How Stanley Park’s longest resident survived a changing landscape

- ‘Love at first sight’: Snow leopard at Toronto Zoo pregnant for 1st time

- Buzz kill? Gen Z less interested in coffee than older Canadians, survey shows

- Carbon rebate labelling in bank deposits fuelling confusion, minister says

_848x480_776633923927.jpg?w=1200&quality=70&strip=all)

Comments