The Toronto real estate market is showing no signs of slowing down, but the latest numbers suggest the suburbs are continuing to catch up — with the average price of homes in some areas outside of the downtown core rising more than 25 per cent.

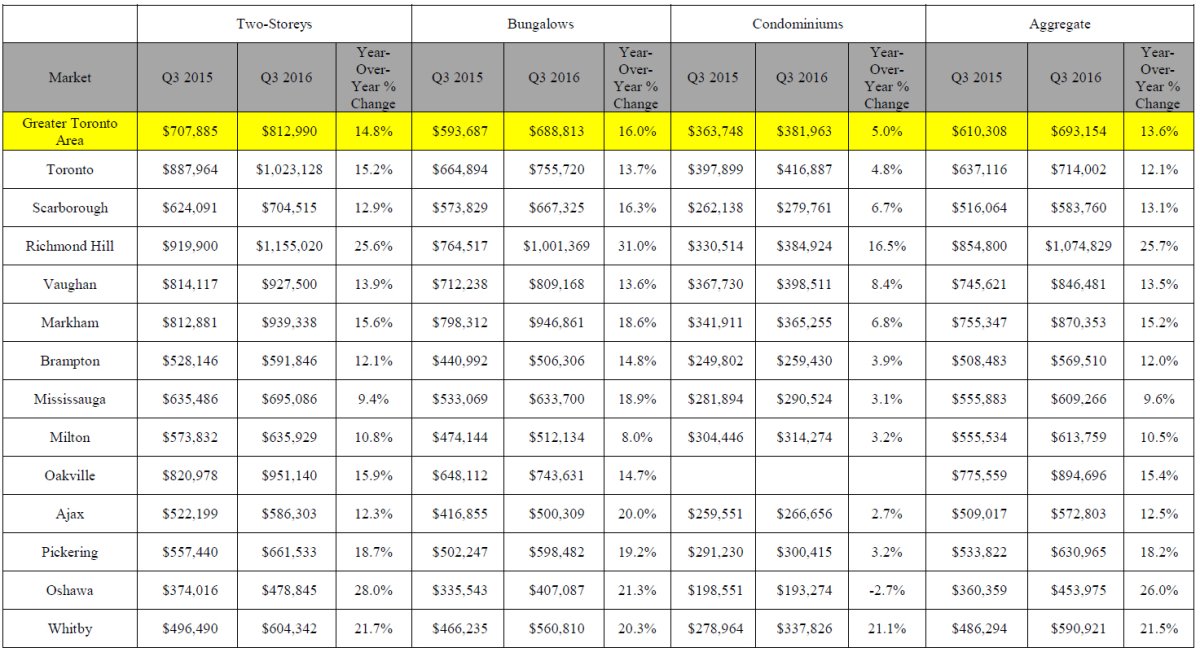

The Greater Toronto Area continues to see double-digit growth in the third quarter of 2016 with the aggregate price of a home rising 13.6 per cent to $693,154 year-over-year, according to the latest Royal LePage House Price Survey.

The median price of a two-storey home in the GTA climbed 14.8 per cent to $812,990 and bungalows rose 16 per cent to $688,813. Condos in the region also saw a “healthy increase,” rising five per cent to $381,963 during the same period.

READ MORE: New real estate rules to dampen home sales beyond Toronto and Vancouver, banks say

Royal LePage President and CEO Phil Soper told Global News he’s recently seen more growth in other areas of the province such as Windsor, Cambridge, Sudbury, Hamilton, St. Catharines, Burlington, Oakville and Oshawa — which has seen the average house price grow 26 per cent to $453,975.

“It’s a really, really active, vibrant real estate market as people look to those regions for more house for the money, for more affordable homes,” Soper said.

“The aggregate price of a home in Oshawa is less than half of what it would be for a similar home in Toronto. … If you boil down to single detached homes, perhaps of similar size, that number is going to be three times higher four times higher in Toronto proper, versus what you see in Oshawa.

“If people aren’t working in the region or didn’t grow up there, affordability is what is driving the new wave of growth and investment in cities like Oshawa.”

- What is a halal mortgage? How interest-free home financing works in Canada

- Ontario doctors offer solutions to help address shortage of family physicians

- Capital gains changes are ‘really fair,’ Freeland says, as doctors cry foul

- LGBTQ2 rallies will be held across Canada next month. Here’s what to know

READ MORE: Ottawa’s new mortgage requirements could make it harder to secure a mortgage

In Toronto, the report said home prices continued to soar in the third quarter, seeing a 12.1 per cent year-over-year increase to $714,002.

Soper said there is a “seesaw effect” where prices will rise in the suburbs at certain times and later cool down when there is a supply shortage in Toronto.

“So right now in the severely supply-constrained city core, Toronto city core, we are seeing more interest and activity in the suburbs than is normal,” he said.

“But that won’t continue unabated. These things are cyclical and there will be a return to more normal prices in the future.”

READ MORE: Canada’s housing market nears ‘extreme bubble,’ warns ex-Lehman Brothers trader

Soper said factors such as the low price of gasoline and shorter commute times can lead to a “discounted suburban price” that allows the housing market to expand.

“So, is the market poised for cooling? I’d say absolutely. Will it happen this year or through the spring of next year? Unlikely,” he said.

“I believe the momentum that the market has in Ontario will be strong enough to carry it through at least the spring market of 2017 before we see significant drops in activity.”

Rumours of a foreign buyer tax in Toronto, similar to the one recently imposed on the Vancouver real estate market, have not yet come to fruition. But Soper said no one has yet been able to effectively analyze the impact of the tax on Vancouver and if imposed, he doesn’t think it would hurt real estate growth in Toronto.

READ MORE: Goodbye Vancouver: Foreign buyers now flooding Seattle and Toronto real estate markets

“The vast majority of the changes that we will see in that city will be driven by a natural, cyclical erosion of affordability. In other words, homes are too expensive and people are getting priced out of the market,” he said.

“The very narrowly aimed tax at a very small, discrete group can negatively impact consumer confidence and therefore slow the market, but as a tool for actually changing the asset values in a big metropolis like the Greater Toronto Area, it wouldn’t be that effective.”

Real estate growth in Ontario for Q3 2016:

Comments