Wondering what the best credit card is to help you save points for free flights?

Choosing the right travel rewards credit card comes down to how you want to be rewarded, as well as how and where you spend.

“Probably the biggest thing is flexibility — so, what you can use your points on,” said Patrick Sojka, founder of Rewards Canada.

This is the ninth year the Calgarian has compared the more than 75 credit cards available to Canadians, to find the ones that offer the best returns.

WATCH: Last year’s top travel rewards credit cards

Sojka has broken up his top picks into six categories (you can see the full rankings here):

1. Top Travel Rewards Card Overall: American Express Gold Rewards

2. Top Travel Points Credit Card (with annual fee): Capital One Aspire Travel World Elite MasterCard

3. Top Travel Points Credit Card (with no annual fee): Scotiabank More Rewards Visa Card

4. Top Hybrid Travel Credit/Charge Card (with annual fee): American Express Gold Rewards Card

5. Top Airline Credit/Charge Card: TD Aeroplan Visa Infinite Card

6. Top Hotel Points Credit Card: Starwood Preferred Guest Credit Card from American Express

He believes people should have at least one Visa, one Mastercard and an AMEX to maximize their rewards — but only if you don’t plan to run a balance.

“Honestly, if you’re running a balance on your credit card, most of these travel rewards cards … are not recommended,” said Sojka.

“If you plan to run a balance for more than a month or two, I would recommend going to a low-interest credit card. Don’t even worry about the rewards that come with it.”

Here’s a more in-depth look at the five cards he thinks are best overall:

1. American Express Gold Rewards Card

Points: 2 points/$1 for gas/grocery/drug store/travel purchases; $1/$1 on all other spending

Pros: Sojka says this “is the most flexible card in Canada” in terms of using the points you earn.

For example, you can convert the points to frequent flyer programs like Aeroplan, British Airways Avios, Hilton Hotels and book the travel whenever you want.

Cons: AMEX isn’t accepted everywhere.

Income requirement: $20,000 (this can be a combined income with your partner)

Travel insurance: You’re covered for:

- Emergency medical coverage for the first 15 days of your trip if you’re under the age of 65; no coverage over 65.

- Trip interruption/flight delay insurance — this gives you up to $500 to spend on accommodations and/or food if your flight is delayed four hours or more (something you won’t get from an airline).

- Car rental insurance.

- Lost or stolen baggage insurance (up to a maximum of $500 per trip).

Sign-up bonus 25,000 rewards points if you spend $1,500 in the first three months

Annual fee: $150, but the first year is free

Pro tip: If you have a partner, even though supplementary cards are free, Sojka suggests both of you sign up for a card. Since the first year is free, one or both of you can cancel before the free year is up. Once you spend $1,500 in the first three months, you can convert 26,000 points to the British Airways Avios program, where you’ll be able to redeem them for a free round-trip flight from Toronto to Dublin.

The same flight on Air Canada, according to Sojka, is 60,000 Aeroplan miles.

“You kind of have to learn the ins and outs,” Sojka said.

Interest rate: 30%

The AMEX Gold is actually a charge card, which means you’re supposed to pay off your balance every month.

2. Capital One Aspire Travel World Elite MasterCard

Points: 2 points/$1 on all purchases

Pros: More widely accepted than AMEX; strong insurance package; supplementary cards are free

Cons: You can’t convert points to other programs.

Income requirement: $80,000, or a household income of $150,000

Travel insurance: You’re covered for:

- Emergency medical coverage for up to 22 days if under 65, and up to 8 days if 65 or older (pre-existing conditions may not be covered).

- Trip-interruption insurance (up to $5,000/person if you can’t continue your trip due to illness or injury).

- Flight delay ($250 per day, up to $1000/trip, for “reasonable expenses” incurred due to a missed connection or flight delay of more than four hours).

- Baggage loss (up to $1,000/trip).

- Baggage delay (up to $100/person up to three days if your bag is delayed for more than four hours).

- Car rental insurance (up to 48 days).

Annual fee: $150

Sign-up bonus: You get 40,000 miles (equal to $400 in travel) if you spend $1,000 within the first three months.

Interest rate: 19.8%

3. Starwood Preferred Guest Credit Card from American Express

Points: 2 points/$1 for purchases made at participating hotels (until Nov. 15, 2017); 1 point/$1 on all other purchases

Pros: You can convert points to 30-plus airlines. And for every 20,000 Aeroplan points, Starwood kicks in another 5,000 miles. It’s ideal for frequent travellers who like to stay at Starwood or Marriott hotels.

Cons: AMEX isn’t accepted everywhere. You’re also limited to redeeming points at Starwood or Marriott Hotels or its 30-plus airline partners (which does not include WestJet).

Income requirement: $15,000

Travel insurance: You’re covered for:

- Flight delay insurance (up to $500).

- Baggage delay insurance (up to $500).

- Lost or stolen baggage (up to $500).

- Car rental insurance (up to $85,000).

Sign-up bonus: 20,000 welcome points (equivalent to five free nights at a Starwood hotel) if you spend $1,500 in first three months

Annual fee: $120

Interest: 19.99%

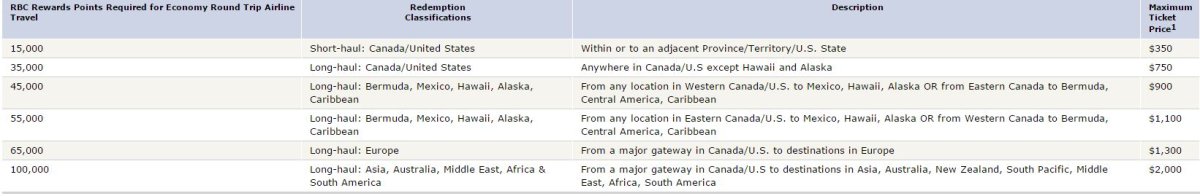

4. RBC Visa Infinite Avion

- What is a halal mortgage? How interest-free home financing works in Canada

- Ontario doctors offer solutions to help address shortage of family physicians

- Capital gains changes are ‘really fair,’ Freeland says, as doctors cry foul

- ‘Dangerous message’: Experts slam anti-sunscreen claims circulating online

Points: 1 point/$1

Pros: Quite flexible; no blackout dates; you can also convert points to WestJet Dollars, British Airways Avios , American Airlines, and a number of other rewards programs like Shoppers Optimum and Esso Extra.

Cons: You have to book 14 days ahead. Plus, there’s a set chart with defined regions and maximum ticket values. If there’s a seat sale, it may not be worth it to redeem your points.

Income requirement: $60,000, or $100,000 household income

Travel insurance: You’re covered for:

- Emergency medical (up to 15 days if you’re under 65; three days if you’re over 65, exclusions may apply).

- Trip cancellation (up to $1,500/person to max. of $5,000, restriction apply).

- Trip interruption (up to $5,000/person to max of $25,000).

- Flight delay ($250/occurrence/person if flight delayed more than four hours).

- Emergency purchases (up to $500/person).

- Car rental insurance.

Sign-up bonus: 15,000 welcome points

Annual fee: $120

Interest: 19.99%

5. Scotiabank Gold American Express

Points: 4 points/$1 spent at eligible gas stations, grocery stores, dining and entertainment (up to $50,000 per year in those categories); 1 point/$1 everywhere else

Pro-tip: An “ideal strategy” for this card would be to try to use it only where you get the 4 per cent return.

Pros: High return on certain purchases

Cons: You’re limited to spending on certain categories

Income requirement: $12,000

Insurance: You’re covered for:

- Price protection (you get up to $100 back if there’s a price drop one something you’ve purchased within 60 days).

- Extended warranty (gives you an extra year of warranty on top of the manufacturer’s warranty).

- Emergency medical (first 25 days of a trip are covered for travellers under 65, or first 10 days for those over 65; certain restrictions may apply around pre-existing conditions).

- Trip cancellation or interruption (up to $2,500/person/trip up to $10,000, restrictions apply).

- Flight delay (up to $500/person for expenses incurred if flight is delayed by more than four hours).

- Delayed or lost luggage (up to $1,000/trip).

- Rental car insurance (car must not exceed $65,000 in value).

Sign-up bonus: 20,000 (worth $200 in travel) if you spend at least $750 in the first three months

Annual fee: $99, but the first year is free

Interest: 19.99%

Comments