Ever get a text asking if you want to earn extra money as a mystery shopper? Or by putting ads on your car?

If so, you’ve been the target of fraud. It’s a growing problem: 767 Canadians have fallen victim to fraud through text message so far this year, according to data from the Canadian Anti-Fraud Centre. And that’s just the reported cases – the Centre estimates that they only hear about five per cent of such frauds.

That’s a huge jump from 2014, when there were only 211 victims.

“Anything criminals have ever done by mail or by email, they’re also doing by text,” said Daniel Williams, senior fraud specialist at the Canadian Anti-Fraud Centre. “I think why it’s going up so much is the scammers go where people go. Everybody’s got their smartphone now. Nice and cheap and easy to do it by text, so that’s what they’re using.”

It’s a big business too. So far this year, Canadians have reported losing $567,453 in scams that started with text messages.

“Most of this is based on random chance,” said Williams. “They’re sending these out to tens or hundreds of thousands of people at a time, hoping that they’ll hook up with someone who the message actually makes sense to.

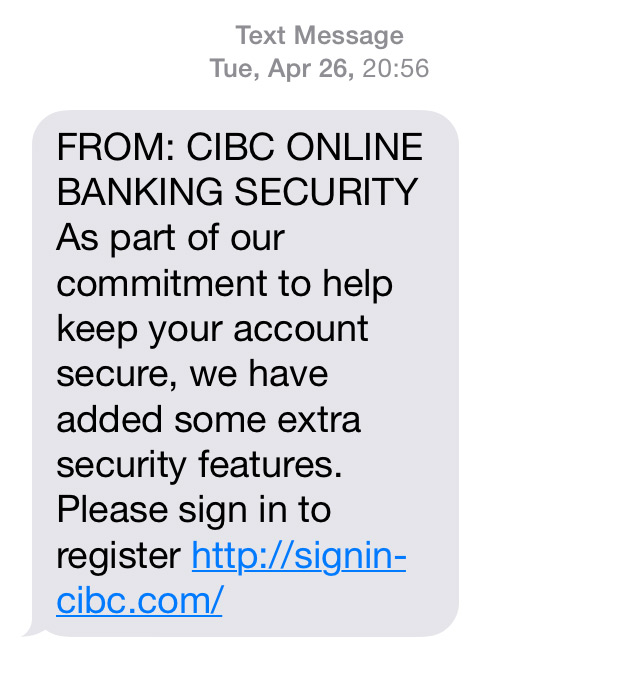

“Like, ‘Your bank account has been frozen.’ They really don’t know what bank you’re dealing with. They don’t have a clue whether you have an account with that bank. They’re hoping that you do and that you’ll click on it because you think the message is from your bank.”

Because it’s so easy to send a message to thousands of people, not very many of them have to reply to make the venture worthwhile, he said.

Here’s how one common kind of scheme works, according to Williams. First, you receive a text message on your phone. It can take many forms, from saying that you’ve gotten an inheritance, saying that you’ve won a lottery or prize, or advertising some kind of job or money-making opportunity. It then invites you to contact someone for more details, usually via email.

After a conversation, the person will often send you a cheque. They’ll ask you to deposit it into your account and keep some as payment for your services. You’re generally asked to send the rest somewhere – through a money transfer or some other means.

So, if you’re asked to be a mystery shopper, you get a list of stores to shop at and report on, and a cheque is mailed to you to cover money you spend at the stores. Typically, said Williams, one of the companies you have to report on is Western Union or some other kind of money transfer service. You test it by sending some money to a specific account.

The problem is, that cheque you were sent was counterfeit and will bounce – leaving you on the hook for all the money you spent. And that money you wired elsewhere? It’s gone, into the pocket of a scammer – often someone in a different country.

“When the cheque comes back as a counterfeit, you’re left high and dry,” said Williams.

People typically lose between $1,800 and $4,500 in these scams.

“We’ve had some really sad people at the end of all of that.”

Preventing fraud

If you get a text message from a number you don’t know, take a closer look before sending any personal information, money or property, he said.

“Is it too good to be true?” he asked. “You’ve won a lottery that you didn’t enter. How on earth is that happening?”

Try searching for the company or the content of the message, he said, as common frauds are often written about online.

“As soon as you put in 30 seconds of effort into verifying who you’re dealing with, the scams are revealed.”

And if you did send information that you shouldn’t have, you can still prevent damage if you act quickly, he said. Contact your financial institution immediately, and also contact the credit bureaus to make sure that they don’t give out your contact or credit card information.

He’d also like you to report the scam to the local police and the Canadian Anti-Fraud Centre.

“If you have been scammed, if you have encountered a scam, report it. The authorities need the information, we want the information, your friends and family need the information. The worst thing is to be victimized and be embarrassed about it, keep that information to yourself, and then see your friend, your neighbour go through the exact same thing two weeks later.”

Watch below: Scammers are turning to text messages to con people out of their money.

Have you been a victim of a text message scam? Tell us your story using the form below.

Note: We may use your response in this or other stories. While we may contact you to follow up we won’t publish your contact info.

Comments