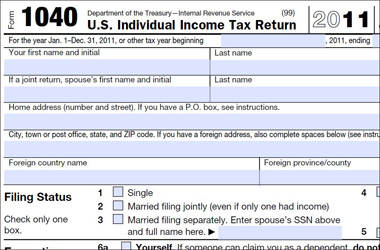

Tax rules affecting Americans living outside the United States can be too complicated and expensive for ordinary people to follow, and have led directly to soaring rates of renunciations of U.S. citizenships, the IRS’s internal watchdog has reported to Congress.

The rules affect hundreds of thousands of U.S. citizens living in Canada, few of whom filed U.S. tax returns until recently.

The issue got new attention last summer, when the IRS threatened people who had failed to file annual reports on their Canadian bank accounts with fines of up to $10,000 per year per account.

Finance Minister Jim Flaherty has announced that Canadian tax authorities would not help to collect those penalties here.

“The complexity of international tax law combined with the procedural burden placed on individual U.S. taxpayers working, living, and doing business abroad creates an environment where taxpayers who are trying their best to comply simply cannot,” U.S. National Taxpayer Advocate Nina Olson wrote.

“Many U.S. taxpayers abroad are confused by the complex legal and reporting requirements and overwhelmed by the prospect of having to comply with them.”

Americans in Canada range from true expatriates to ‘accidental Americans,’ considered U.S. citizens because of birth there or having a U.S. citizen parent. Estimates of their numbers vary wildly. The U.S. Embassy says that there are about a million, while the 2006 census found 298,000 people in Canada self-reporting as U.S. citizens. Just over half of those were also Canadian citizens, the census showed.

In theory, all are supposed to be filing annual U.S. tax returns if their income is above minimal thresholds. But only 30,067 U.S. citizens reported Canadian-earned income to the IRS in 2006, the most recent year statistics are available.

Olson observes that the tax rules governing U.S. citizens abroad, when other publications they reference are taken into account, total 7,322 pages.

U.S. taxpayers abroad are bewildered by their complex returns and get little help from the IRS, Olson reported. Hiring accountants can cost up to $2,000 per return.

The number of Americans renouncing their citizenship increased more than tenfold between 2008 and 2010, the report says.

“The IRS recognizes the issues faced by individual United States taxpayers working, living, or doing business abroad,” the service said in a response.

After deductions and exclusions are allowed for, few Americans in Canada would owe any American taxes.

Only 9% of people filing U.S. tax returns from outside the country owed the IRS any taxes, Olson’s report shows.

Starting in 2013, Canadian financial institutions with U.S. investments will be required to identify their U.S. citizen clients and report them to the IRS. The Canadian Bankers Association recently published FAQs on the issue. (link, link)

Comments