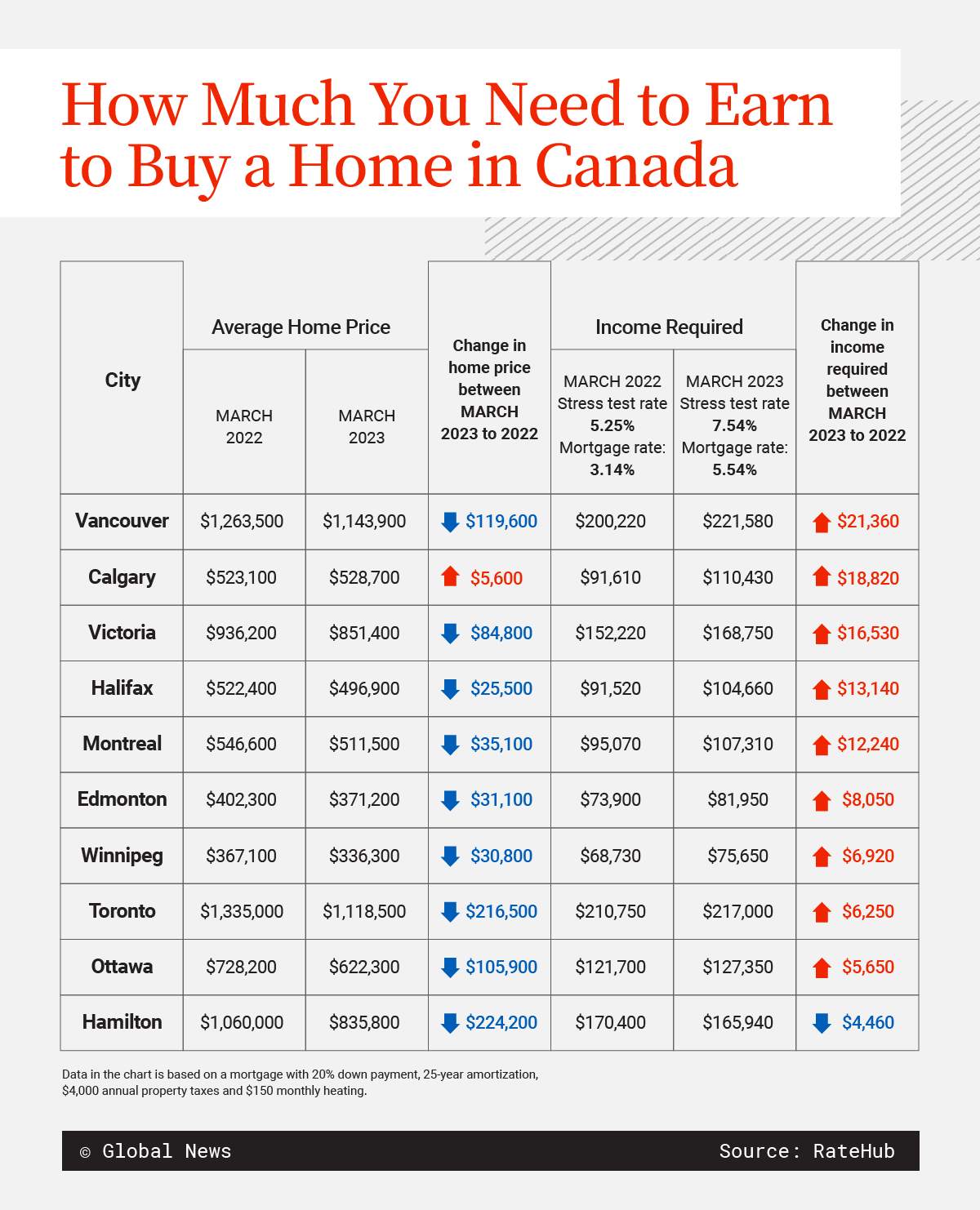

Despite home prices lowering across much of the country, Canadians will still need to earn more to be able to buy a home than compared to last year, according to a new report from RateHub.

The report shows that homebuyers will need an annual income of $217,000 in Toronto as of March 2023 to afford to buy a $1,118,500 home. That’s a $6,250 increase in income compared to March 2022, even though the average home price fell by more than $200,000 in the city in that time, according to RateHub.

You will also need to earn over $200,000 in Vancouver to afford a home, while the rest of the country requires between $75,000 and $170,000.

RateHub co-CEO James Laird told Global News that Canadians now need to earn more to buy a home because interest rates have increased to over five per cent from closer to three per cent last year.

Get weekly money news

“There’s never been a harder time to purchase a home in Canada,” he said.

Laird said that unless the homebuyer is an extremely high earner, they will need a partner to qualify for the average home in Canada. The increase in mortgage rates also pushes up the required income needed to pass the stress test to be approved for a loan, the report says.

The report found that for nine of 10 cities in Canada, homebuyers need to earn between $5,650 and $21,360 more in annual income to afford a home than they did last year, a trend that is expected to worsen.

“With supply of new listings tight and some home buyers returning to the market, don’t expect home affordability to improve in the coming months,” Laird said.

Other cities on the list showed an increase in how much income a home buyer needs, even while average home prices fell.

Halifax requires close to $105,000 in income, Montreal is over $107,000, Winnipeg is over $75,000, and Ottawa is under $130,000.

Calgary is the one outlier on home values, where the average home price rose modestly. Calgary requires a little over $110,000 in income to fetch the average-priced home.

Hamilton was the only city on the report’s list to require less income, with $4,460 less needed year-over-year to afford a home there.

Laird said that the income requirement posed by most banks means that some may need to rent longer or rely on their parents for help either with the downpayment or co-sign to boost their income level. He recommends for homebuyers to consider small cities, where they may find a better deal.

“Home prices vary a lot in this country,” Laird said. “It’s probably why we’re seeing a lot of young people move out to the Prairies and Alberta — homes are relatively affordable versus Toronto and Vancouver.”

To learn more about how you can break into Canada’s housing market, check out Global News’ Home School series here

Comments

Want to discuss? Please read our Commenting Policy first.