Home sales and average prices have fallen sharply throughout Canada since the pandemic peaks, but that correction has “slowed considerably” overall, though some communities are expected to continue seeing the biggest declines, a new report indicates.

A report published Monday by financial service company Desjardins took a look at expectations for Ontario’s housing market.

It notes that there is “significant variability” in real estate data throughout Ontario communities.

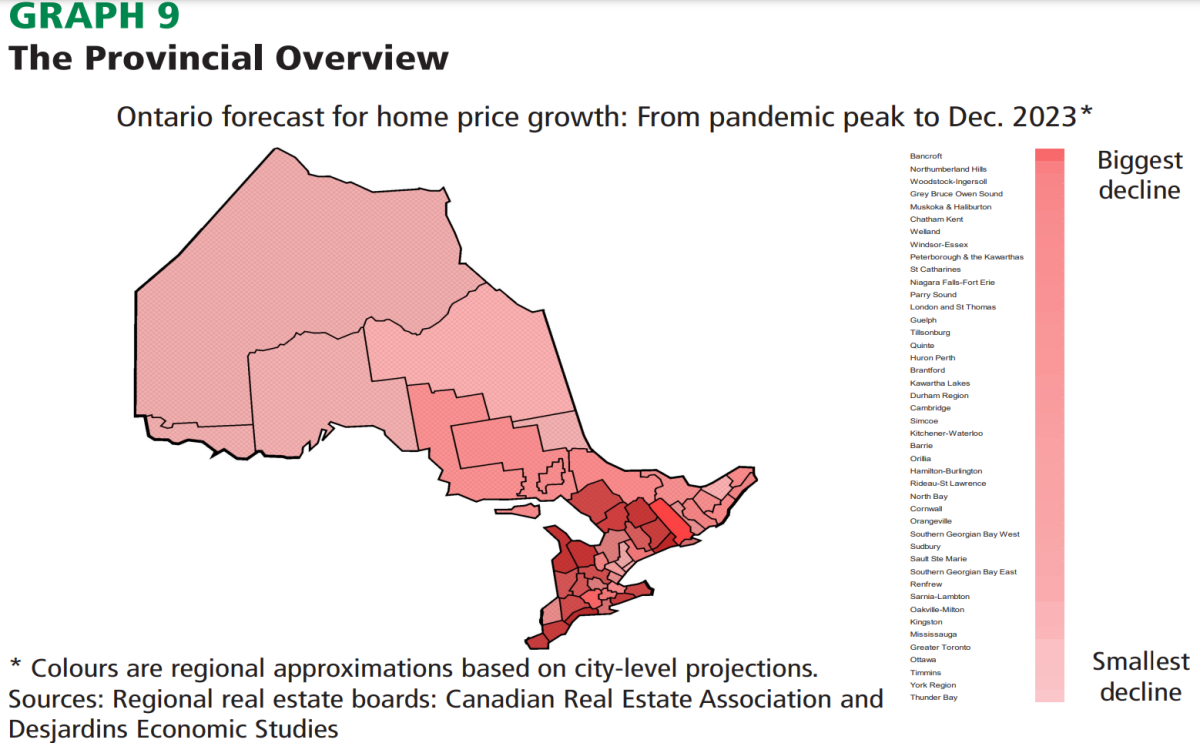

“Supported by buyers’ desire for more space when working and educating children from home, homebuying activity surged most significantly in smaller Ontario centres during the pandemic,” the report states.

“While we expect home sales and values to find a bottom in the second half of 2023, these smaller cities should continue to experience some of the most pronounced corrections in Ontario.”

Desjardins noted that the main catalyst for the housing correction was the tightening of monetary policy that began in March 2022.

But the company says Canadian prices will likely start rising after bottoming out in the second half of this year, and new home builds — which have also fallen — should bottom out early next year before climbing higher.

“This change in fortune will likely be the result of interest rate cuts following a prolonged pause by the Bank of Canada,” the report states.

“A persistently tight labour market, still elevated household savings and high levels of immigration will also play a role in supporting housing demand in Canada.”

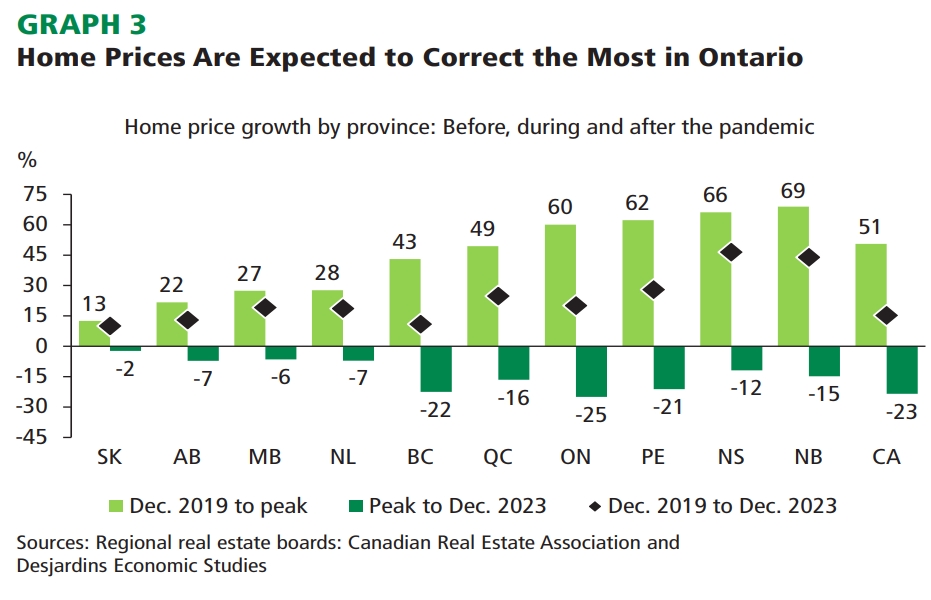

Desjardins states that the provinces most exposed to real estate are seeing the largest home price corrections — namely Ontario and British Columbia with expected declines of 25 per cent and 22 per cent from the peak until December 2023, respectively.

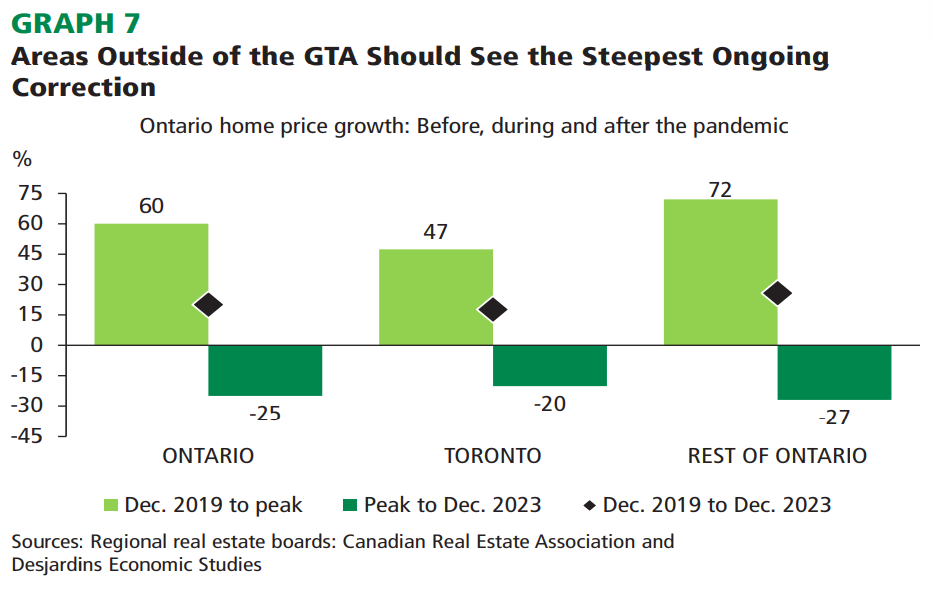

In Ontario, home prices rose in the Greater Toronto Area, but “not nearly as much” as they did in smaller communities, the report says.

“And these places are expected to continue seeing the biggest correction,” the company states.

Get daily National news

From the peak until December 2023, Ontario overall is expected to see a decline of 25 per cent, Toronto 20 per cent and the rest of the province a decline of 27 per cent, the report states.

Desjardins states that the most pronounced price increases during the pandemic mostly happened within a few hundred kilometres of the Greater Toronto Area, with some exceptions like Bancroft, Parry Sound, Quinte, Renfrew, Northumberland Hill, Muskoka and other locations where average home prices more than doubled from December 2019 to the peak. Those communities have seen the largest declines, the company said, and that’s expected to continue.

But overall affordability, while it will improve as housing prices fall and borrowing costs come down, Desjardins says it doesn’t expect that it will return to its pre-pandemic level by the end of 2024.

“This is a very difficult time for households in Canada,” the report states.

“But reduced affordability isn’t just a GTA story. In fact, affordability fell most in urban centres outside of The Big Smoke during the pandemic….

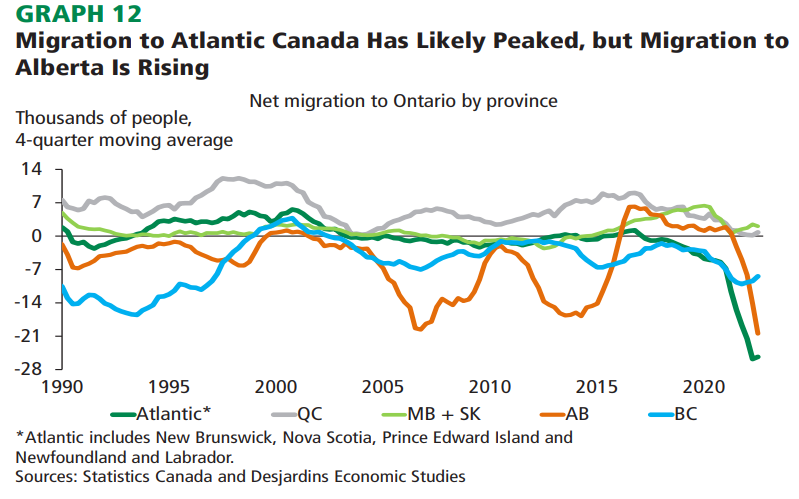

“This erosion of housing affordability has had further unintended consequences for the province of Ontario. Families have been leaving the least affordable parts of the province for greener pastures elsewhere in Ontario. Residents have also been leaving Ontario altogether, with the Atlantic provinces being the preferred destination since the start of the pandemic, and Alberta more recently.”

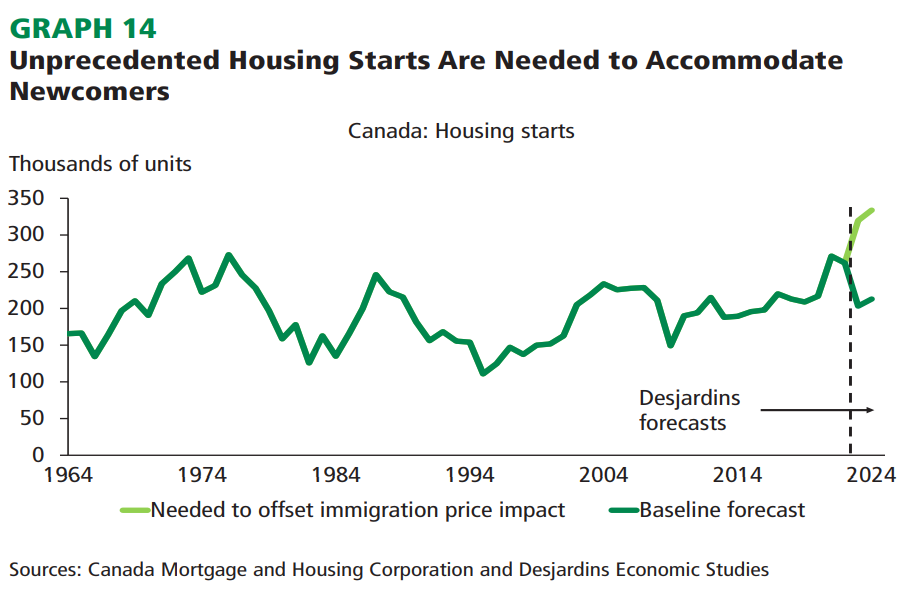

But international migration and net non-permanent resident admissions will likely keep housing demand high.

“Further, the recent downturn in housing starts is expected to continue throughout 2023, implying that supply will continue to fall short of demand from the rapidly growing population both in Ontario and nationwide.”

The full Desjardins report can be found here.

Comments

Want to discuss? Please read our Commenting Policy first.