Canadian homebuilders kept up a brisk pace of new housing starts heading into the fall, but with rising interest rates and soaring costs putting pressure on buyers and builders alike, experts warn a looming winter could chill efforts to grow Canada’s housing stock.

Canada Mortgage and Housing Corp. (CMHC) released a pair of reports Tuesday gauging current efforts to boost the supply of homes on a national and city-by-city basis.

The agency said September marked a strong month for housing starts after a mixed first half of the year, with the seasonally adjusted rate coming in just shy of 300,000 last month, up 11 per cent from August and hitting the highest level since November 2021.

While the construction industry has struggled with worker shortages and uncertain material delivery schedules through much of the year, CIBC senior economist Andrew Grantham suggested in a note to clients Tuesday morning that recent easing in the jobs market might have allowed companies to scoop up skilled labour and get started on already-issued permits from the summer.

CMHC says housing starts were down five per cent year-over-year through the first six months of 2022 in Canada’s six largest cities, though Toronto, Calgary and Edmonton saw overall lifts in new construction as Ottawa, Montreal and Vancouver faltered.

The return to November’s housing start levels last month is significant as 2021 was a “very strong year” for new builds, says Eric Bond, an economist with CMHC in Vancouver.

But Bond, and other experts and stakeholders in the industry, expects high interest rates will soon start to weigh on the sector, which he says could face a relative slowdown in housing starts come 2023.

How do high interest rates impact construction?

The Bank of Canada has raised its benchmark interest rate by three percentage points since the start of the year and is widely expected to hike the rate again at its next decision Oct. 26. This, in turn, makes the cost of borrowing more expensive and drives up mortgage rates.

Bond says that this affects homebuilding from two perspectives: not only can buyers afford less of a home due to higher mortgage costs, but developers are pushed to scale back or shelve projects completely if they can’t finance the build or it becomes financially unviable.

Get breaking National news

“For the developer, that means then that they need to ensure that they have products that can fit with the budgets of homebuyers,” Bond explains. “When you layer on, say, a rising cost environment for materials and labour and so on, that poses a bit of a challenge for projects underway.”

Just because construction of new housing units gets started doesn’t mean they get finished, either.

Richard Lyall, president of the Residential Construction Council of Ontario (RESCON), says that he’s seeing more projects get “delayed or shuttered” as the environment worsens for building.

He points to the ongoing inflation challenge — the very thing higher interest rates are meant to fight — as a major uncertainty for builders trying to figure out whether a project can stay on budget.

The construction industry, which tends to be a “sell first and then build later” business, can’t operate efficiently in those conditions, he argues.

“This is a very difficult market to predict what your construction costs are going to be down the road,” Lyall says.

“The inflation situation isn’t under control yet and rates are still going up. So we don’t know when that corner is going to get turned. I don’t think anybody does.”

The housing market has cooled significantly since the Bank of Canada began its rate-hike cycle in March, but Lyall says the demand from buyers hasn’t gone anywhere — it’s just on hold.

He argues that when demand returns to the market as interest rates stabilize and immigration levels continue to tick up, Canada could soon have to grapple with its housing supply crunch.

“When some people have said, ‘Oh, well, there’s a market correction now, that will take care of the supply problem.’ That is not going to do it,” Lyall says.

“We really have a lot of work to do now in the next 12 months, in fact, I’d say in the next six months, to fix things.”

How to keep building to meet demand

Tu Nguyen, economist with RSM Canada, says that after 2021’s banner year for new home construction, “the party is sort of coming to an end.”

She tells Global News it’s imperative to find ways to maintain whatever momentum Canada can in residential construction in advance of the wave of demand set to follow in the coming years.

“If we don’t have as many projects and housing starts (as we do) right now, what will happen is in two to three to five years, the housing shortage could get even worse than it is right now,” Nguyen says.

“I anticipate that the housing shortage will get even worse. And with this low supply and high demand, of course, the prices go up and affordability worsens as well.”

Tuesday’s CMHC housing supply report also compared different styles of building and found one solution to Canada’s inventory crunch might not come from the highest-density housing.

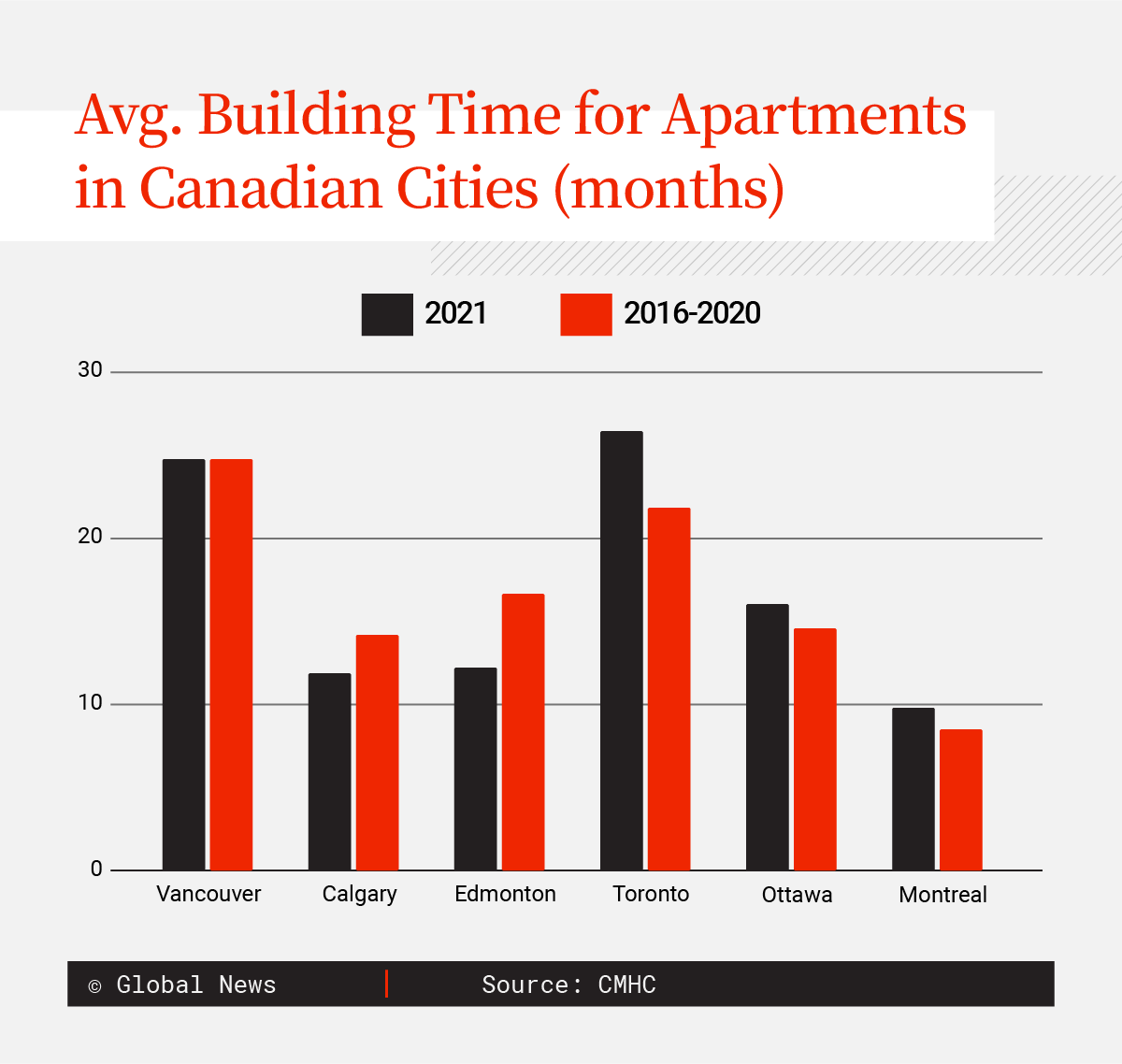

While the report did state that the style of high-rise building common in Toronto and Vancouver is the most efficient way to build the highest number of units over a set period of time, these builds on average take much longer and are more “complex” than their low-rise counterparts.

“Cities that build a lot of large, tall apartment structures will risk having housing construction sectors that are less responsive to a rapid need for new housing units,” the report reads.

Bond also says low-rise builds such as row houses can also be made out of cheaper materials like wood and take about as long to construct as a single detached home would, but with four times as many units for the time allotted.

“We see opportunities (in) growing the diversity of our housing supply and also delivering more units more quickly,” he says.

Lyall says there are opportunities to improve the business case for building without lowering interest rates or reducing the cost to build.

While he’s pleased with recent provincial actions such as the Strong Mayors Act giving municipal leaders in Ottawa and Toronto the ability to push through more development, he says the approvals processes in cities are “antiquated” and in dire need of digitization to “streamline” and “modernize” building.

And while Canada’s immigration targets are a significant source of looming demand in the housing sector, Lyall says more needs to be done to attract migrants specifically to the construction industry — building the homes that others like themselves will need to live in.

The building executive says he’s optimistic with Ontario’s target to build 1.5 million homes by 2031, but worries policymakers will move too slowly to overhaul the approach needed to address the looming supply crunch.

“I think it can be done. But I’m just hoping that it doesn’t take us too long to get there because sometimes, we Canadians are cautious,” Lyall says. “We like to incrementally approach problems. And this is not a time for incrementalism at all.”

Comments

Want to discuss? Please read our Commenting Policy first.