Gas prices have been a fickle passenger along the highs and lows of the pandemic ride.

From just over 60 cents per litre, as initial lockdowns left Canadians with few places to go, to record highs.

And now predictions that increases will continue alongside the rising price of crude.

“That’s the cost that’s changing sort of month to month, quarter to quarter as we work our way through demand shocks based on the pandemic,” said Kent Fellows, an associate professor of economics at the University of Calgary.

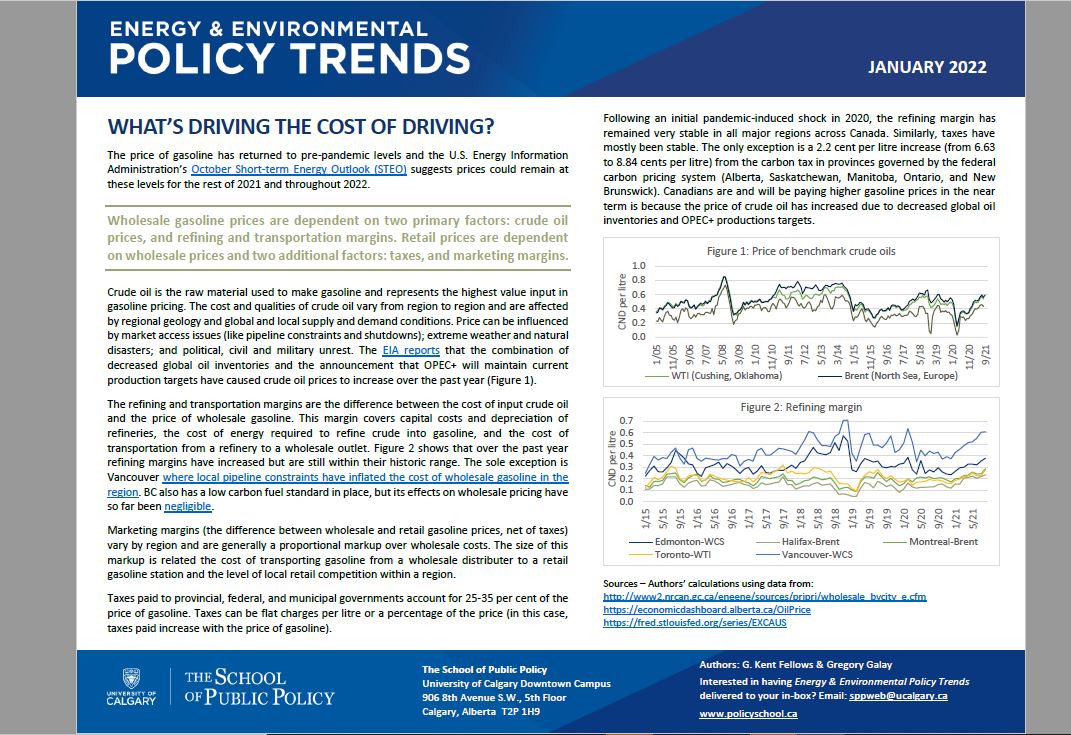

The University’s School of Public Policy released a report on Thursday outlining reasons for the recent volatility in prices. Some analysts are forecasting oil prices to rise to about $100 a barrel this year, an attractive prospect for producers, but still a risky move in yet another COVID wave.

“Depending on on how this new variant hits different countries, you could see a drop off in demand, and then they’re stuck with the crude oil,” said Fellows. “So I think that level of uncertainty is going to be playing out in terms of less production, not more.”

The good news, at least for producers and energy royalties, is that less production generally means more demand.

Comments

Want to discuss? Please read our Commenting Policy first.