Houses across the Okanagan have tacked on at least $100,000 of assessed value in the last year and many others have seen much larger gains, according to the latest from BC Assessment.

Its 2022 data was released Monday, reflecting the heightened assessed market value of homes across B.C. as of July 1, 2021. Depending on where a property is within the limits of the Thompson Okanagan, values have gone up by 17 per cent to 42 per cent.

Kelowna’s 2022 typical assessed house value, for example, now sits at $869,000, which is a 34 per cent increase from $650,000 in 2021. West Kelowna homes have a typical value of $856,000, up 34 per cent from last year’s $632,000 assessment and Lake Country now has a typical assessed value of $886,000 from $672,000 which is an increase of 32 per cent.

The biggest per cent gains were in Spallumcheen which saw values rise 42 per cent, to $521,000 from $367,000 year over year. Lumby saw the least amount of growth in the Okanagan, rising by 29 per cent to $521,000 from $384,000.

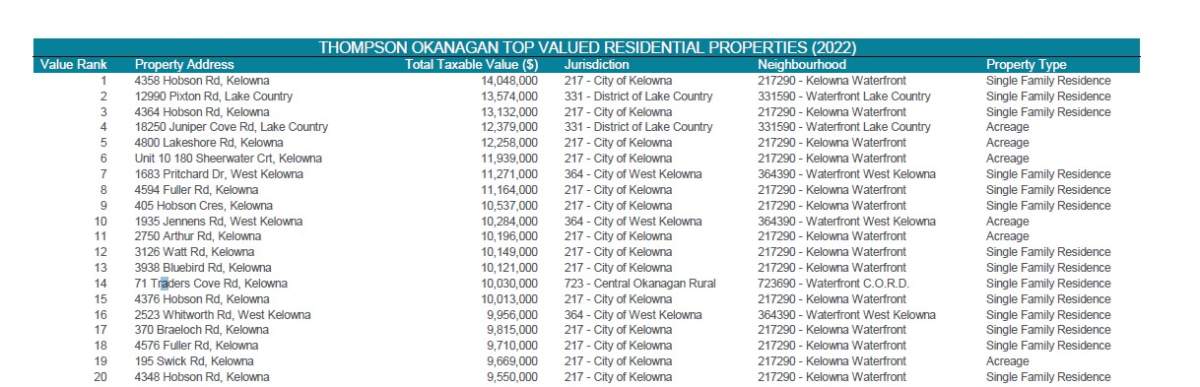

While percentage gains varied most in the far-flung areas of the valley, only four of the top 100 most expensive homes within the Thompson Okanagan are outside the Central Okanagan.

The most valuable property this year, like last year, is at 4358 Hobson Rd. in Kelowna. The home said to be built in 1974, is valued at $14,048,000. Last year it was worth $10,600,000. It has four bedrooms, six bathrooms and is on 1.74 acres.

The next-highest assessment was at 12990 Pixton Rd. in Lake Country, valued at $13,574,000. Last year the home that was built in 2009 was valued at $10,741,000. It’s a five-bedroom, nine-bathroom house on .86 acres.

Get breaking National news

The third most valuable property assessment is at 4364 Hobson Rd., in Kelowna. Its assessed value is $13,132,000; the fourth is 18250 Juniper Cover Rd. in Lake Country, valued at $12,379,000 and the fifth-highest assessed is 4800 Lakeshore Rd., Kelowna, valued at $12,250,000.

While rising Okanagan home values may be the talk of the town, values pale in comparison to the Lower Mainland, where the top 10 most expensive homes range in value from $33 to $73 million. Only six Central Okanagan homes broke into the top 500 expensive homes in the Okanagan. The Hobson Road property that tops the list in the Okanagan is only 365th when stacked against the rest of the province.

“The real estate market has been robust in the Okanagan and most property owners can expect higher assessment values for 2022 with many communities seeing increases over 30 per cent,” Okanagan area Deputy Assessor Tracy Wall said in a press release.

“Sadly, we recognize that some Okanagan homeowners have been impacted by wildfires and flooding and they are encouraged to contact BC Assessment to discuss the damage to their property,” Wall said.

Overall, the Thompson Okanagan’s total assessments increased to $204.2 billion this year, from $159.3 billion in 2021.

A total of about $3.3 billion of the region’s updated assessments is from new construction, subdivisions and the rezoning of properties. BC Assessment’s Thompson Okanagan region includes the urban centres of Kelowna and Kamloops as well as all surrounding Okanagan and Thompson communities.

Assessments are used for taxation. If a property owner’s home has risen in value by the city average, they can expect their municipal tax increase to be what the city set it at. If the home has risen in value by more than the city average, they will likely pay more than the city tax rate in extra in taxes. On the other hand, if a property has risen in value by less than the city average, the homeowner will likely pay less tax next summer than they did in 2021.

- Tumbler Ridge B.C. mass shooting: What we know about the victims

- ‘We now have to figure out how to live life without her’: Mother of Tumbler Ridge shooting victim speaks

- Trump slams Canada as U.S. House passes symbolic vote to end tariffs

- Mental health support after Tumbler Ridge shooting ‘essential,’ experts say

_848x480_1397405763961.jpg?h=article-hero-560-keepratio&w=article-hero-small-keepratio&crop=1&quality=70&strip=all)

Comments

Want to discuss? Please read our Commenting Policy first.