The City of Vancouver is staring down the barrel of a pandemic-driven deficit, and will have to make budget trade offs to avoid a 12 per cent property tax increase, according to a staff report heading to council next week.

Staff are recommending transferring up to $57 million from the city’s reserves in order to hold the tax hike to 5 per cent or less. Municipalities are required to balance their annual budgets under B.C. law.

The report cites increased cost pressures from COVID-19, the growing homeless crisis and the overdose crisis, along with decreased revenue from parking, development fees and facilities and programs.

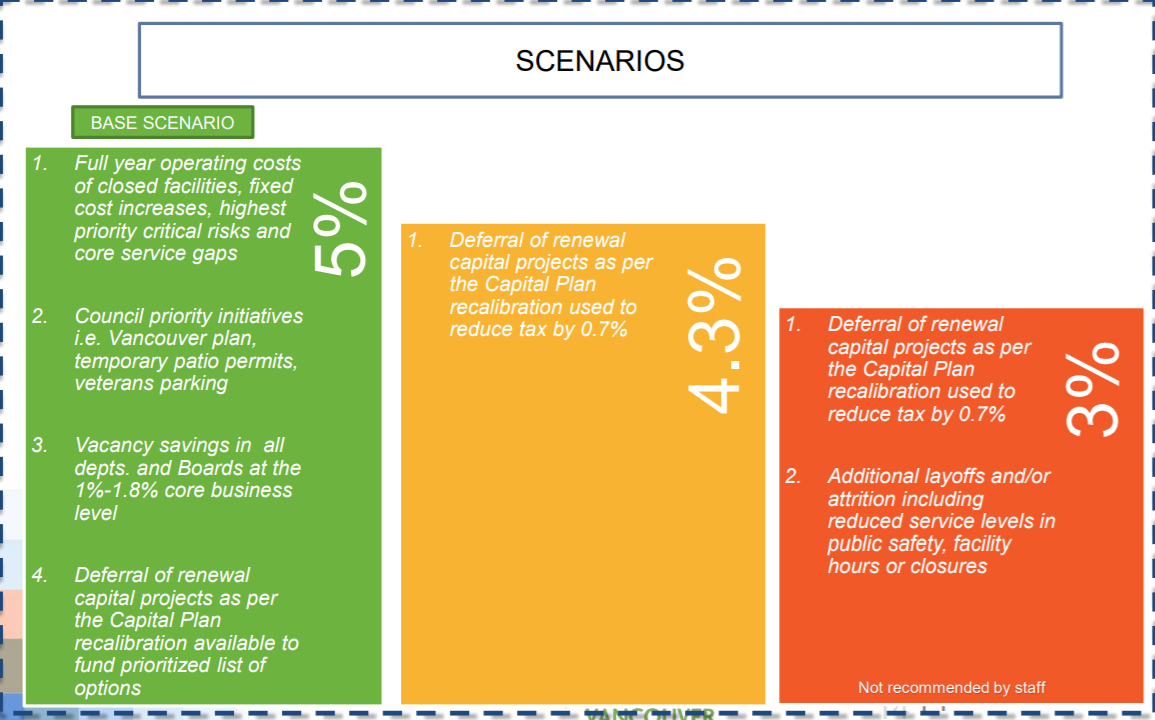

The report provides three property tax scenarios (5 per cent, 4.3 per cent and 3 per cent), which come with a variety of more severe trade offs in service delivery and council priorities.

In the report, staff warn that $57 million top-up will draw reserves down to 3 per cent, adding that using the fund as a crutch is unsustainable.

Get daily National news

“Reserves are a one-time funding sources, and a balance needs to be maintained to respond to future potential events (for example snow/storm),” states the report.

“If revenue declines continue in 2022 and beyond, it will be necessary to adjust service levels and/or raise taxes.”

Under the five per cent tax hike scenario, staff say the city could fund full-year operating costs for closed facilities and meet fixed cost increases. Council priorities such as free veterans parking, temporary patio permits and the Vancouver plan could be met.

Some capital plan projects would also be deferred, freeing up $8 million for city priorities.

Under this scenario, staffing levels would still be held between one and two per cent 2020 budget levels, with “associated service impacts.”

The 4.3 per cent option is roughly the same as the five per cent option, but imagines the $8 million being used to reduce the property tax increase by 0.7 per cent.

The three per cent tax hike scenario incorporates that $8 million, along with additional layoffs, staff attrition and “reduced service level in public safety, facility ours or closures.”

“This would be in addition to the 1-2 per cent built into the base scenario, and is not recommended by staff at this point, given the impact on services during the pandemic,” reads the report.

The report comes amid criticism over several spending decisions at city hall, including a merit pay increase for managers, the purchase of high-end furniture and a renovation to reduce the colonial representation of the city at City Hall.

Vancouver Mayor Kennedy Stewart has also made several appeals to senior levels of government for funding to help offset pandemic impacts.

Last year, the City of Vancouver raised residential property taxes by nearly 7.7 per cent.

- Can Trump decertify aircraft? What experts say amid Bombardier threat

- Bombardier warns of ‘significant impact’ to travellers from Trump’s threat

- Corus to seek court approval of recapitalization plan after shareholder vote narrowly fails

- Canadians have billions in uncashed cheques, rebates. Are you one of them?

Comments