The B.C. government is facing a legal challenge over the 20 per cent foreign home-buyers’ tax.

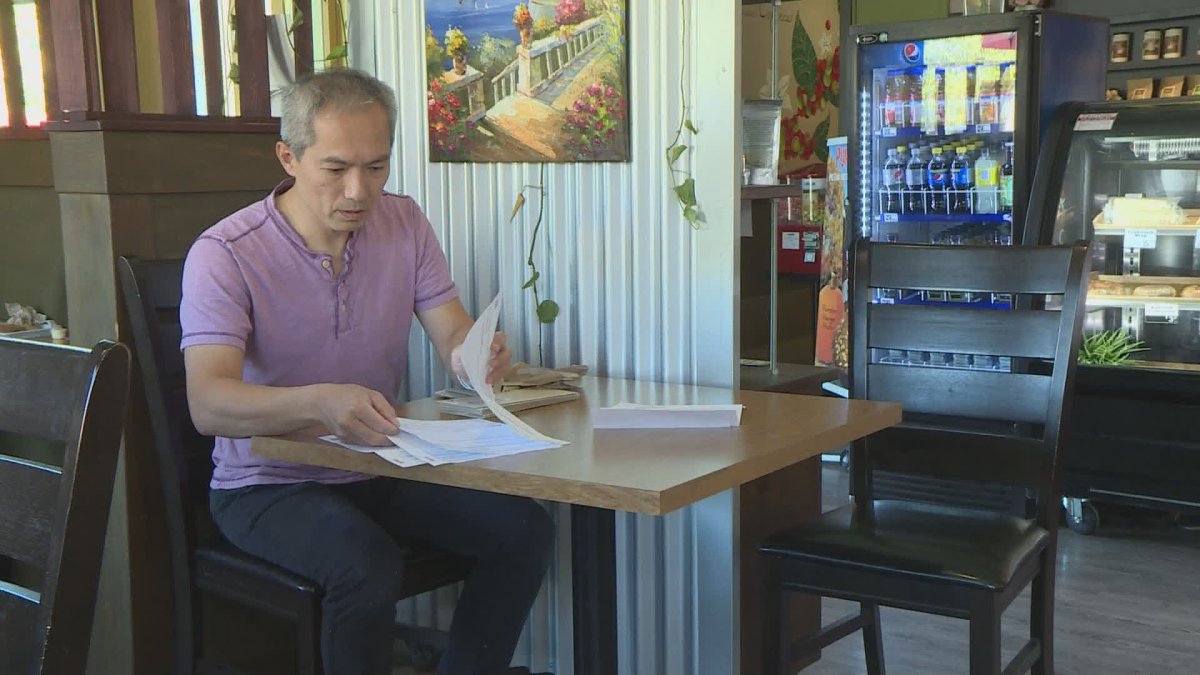

Taiwanese citizen and Victoria resident Eric Chang is claiming he is being unfairly targeted because he is not a foreigner speculating in the province’s overheated housing market.

Chang was confirmed as a member of the B.C. Provincial Nominee Program to set up a business here and moved here in 2016. His nomination was eventually approved in 2018 with the expectation of his long-term intention to live and work in British Columbia.

But Chang is worried that will no longer be the case considering he now faces a tax bill from the provincial government of $269,000, and it’s growing because of interest.

“This is so unfair. My family doesn’t deserve this,” Chang said.

Before being accepted to the program, and before knowing he would own and operate a Serious Coffee in the Victoria area, Chang entered a pre-sale contract for his home in Coquitlam.

His sister, who is a Canadian citizen, was on title with 98 per cent ownership of the home.

WATCH (aired December 19, 2017): New numbers on foreign home ownership in B.C.

Chang and his wife each own one per cent of the property.

By the time the housing deal had closed, the BC Liberals had introduced a then-15 per cent foreign buyer’s tax. It has since gone up to 20 per cent under the NDP government’s housing affordability strategy.

Chang is currently waiting on his permanent residency application.

WATCH (aired March 27, 2019): Concerns about possible loophole in foreign buyers tax

In order to stay in British Columbia he must own and operate a business, but Chang says in order to afford the massive tax bill he would have to sell his assets. Chang is worried that if he loses the court case he will have to sell all his assets to pay the bill and move back to Taiwan.

“This is someone who is coming here with his family to start a business, this is not a speculator,” Chang’s lawyer Bruce Hallsor said.

“This is the sort of person we should want, and do want and it’s a shame the province is essential telling him to go back to Taiwan.”

The British Columbia government is aware of the civil action filed by Chang and his lawyers, but said it cannot comment on the case because it is before the courts.

WATCH (aired June 25, 2019): Factors cooling Metro Vancouver’s real estate market

“As with any tax measure, ministry staff worked closely with legal experts to ensure that the tax would be lawful,” a statement from the Ministry of Finance reads.

The Changs sold the Coquitlam home to comply with the nominee program and bought a house in the Capital Regional District, closer to the business. Before filing court action, Chang had an appeal to the Ministry of Finance denied.

In the legal filings, Chang’s lawyer argues the province erred in not factoring in foreign nationals who are part of the provincial nominee program.

“No relief was provided by the BC legislature in the Act to accommodate an exemption for foreign nationals who were accepted as Provincial Nominees in the business immigration stream to become permanent residents, and had in good faith placed their trust in the Government of BC and had relied to their detriment upon Government of BC which had induced them into investing in BC and then inflicted a severe financial penalty for doing so,” the claim reads.

- Three B.C. men fined, banned from hunting after killing pregnant deer

- B.C. child-killer’s attempt to keep new identity secret draws widespread outrage

- Inquest hears B.C. hostage was lying on her captor before fatal shooting

- ‘We’ve had to make a 180’: What Oregonians say they got wrong with decriminalization

Comments