The Canadian Taxpayers Federation is calling on Ottawa to scrap the carbon tax after it has found that people in New Brunswick are now paying some of the highest gas taxes in the country.

The carbon tax was imposed on April 1 with the goal of reducing greenhouse gas emissions.

“That’s $30 every time you fill up on a Toyota Camry or any other sort of 64-litre mid-size car,” said Paige MacPherson, Atlantic director of the Canadian Taxpayers Federation, a federally incorporated, non-profit organization in Canada.

READ MORE: Canada’s inflation up 2% in April, as carbon tax helps push gas prices higher

The Conservation Council of New Brunswick believes there’s another way to combat climate change

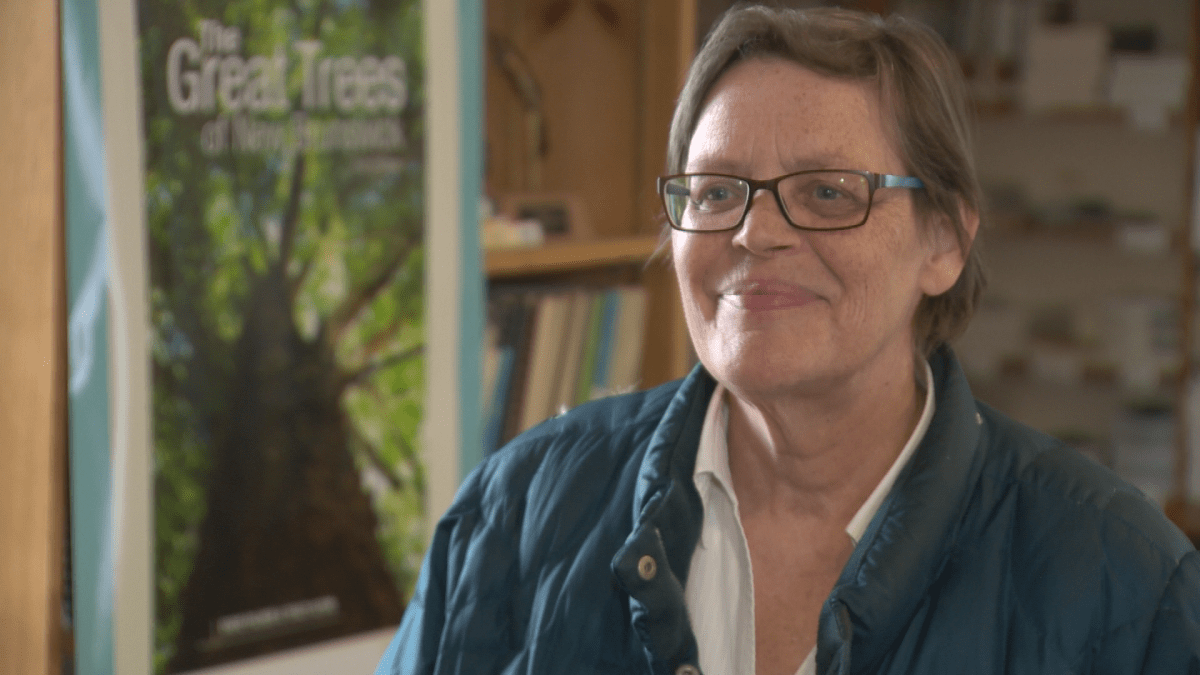

“A price or a penalty on pollution is a positive step forward, but it’s not the only tool that we have in this great toolbox to fight this emergency called climate change,” said Lois Corbett, director of the council.

“That toolbox includes everything from more insulation in your basement and your attic to solar power on your roofs to new types of vehicles altogether.”

MacPherson said that New Brunswick has already lowered its emissions by 28 per cent from 2005 levels.

Get breaking National news

“That means that the province, according to the government, is already on track to meet the Paris climate targets that Ottawa set out,” he said.

On Wednesday, a heated debate took place in the House of Commons, where the federal government has said the rebate families receive will pay for the increased tax costs.

“Mr. Speaker, if you’re like the party opposite, you’re worried about costs. You should be worried about the costs that we are passing on to our kids — the cost of climate change,” said Catherine McKenna, minister of environment and climate change.

The Atlantic Provinces Trucking Association says the carbon tax is hurting the bottom line.

WATCH: Your climate, your choice: Analyzing Federal Green Party’s climate plan

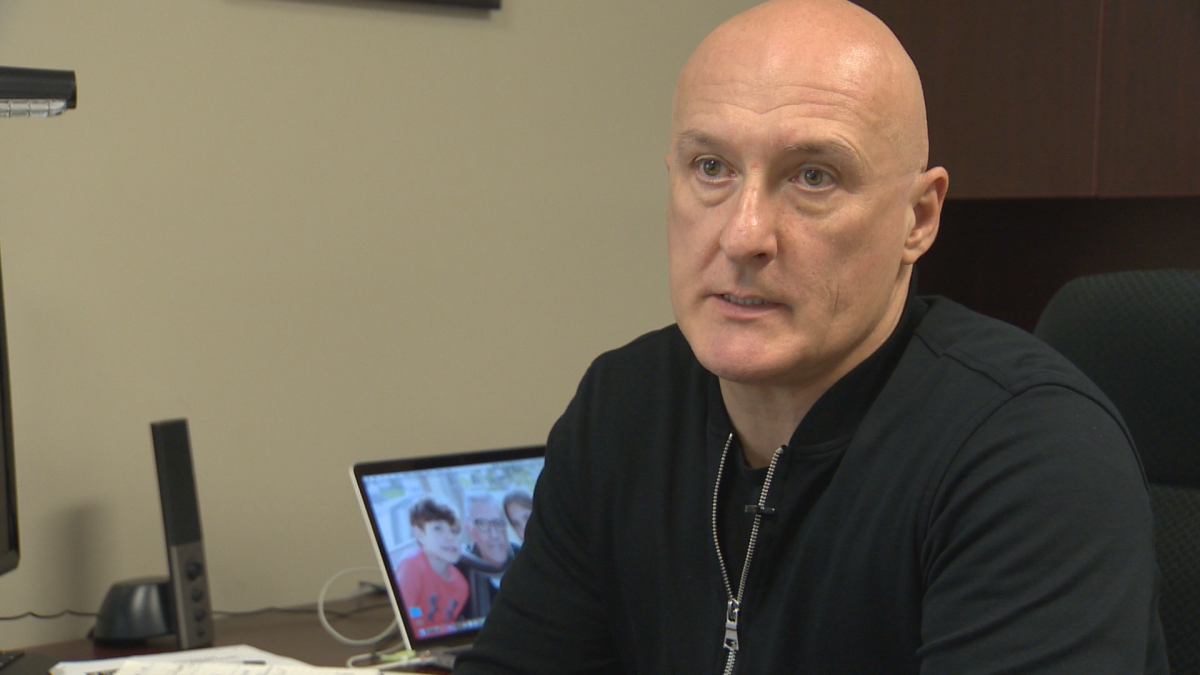

“Some carriers have told their customers that they were going to add some sort of addition on their invoice to cover the carbon tax, unfortunately,” said Jean-Marc Picard, executive director of the association.

Picard says the money should be returned to the industry to help improve trucks and technology to reduce emissions since there are no electric trucks.

Corbett says incentives like a rebate for an electric vehicle will also continue to help.

“Citizens need to be informed. Put the carbon tax in the context that it deserves — one tool in the toolbox — and also take advantage of the incentives for change that currently exist,” said Corbett.

WATCH (April 1): Andrew Scheer speaks out about federal carbon tax in New Brunswick

Comments