Looming interest rate hikes usually have overleveraged homeowners looking over their shoulders, and with their pricey housing markets, one would think B.C. and Ontario would feel the sting of surging interest rates the most in Canada, but that’s not the case, according to a report released on Tuesday.

Alberta will be the province that is hardest hit by rising interest rates, an analysis done by RBC suggests.

READ MORE: Bank of Canada keeps key interest rate steady at 1.25% but eyes future hikes

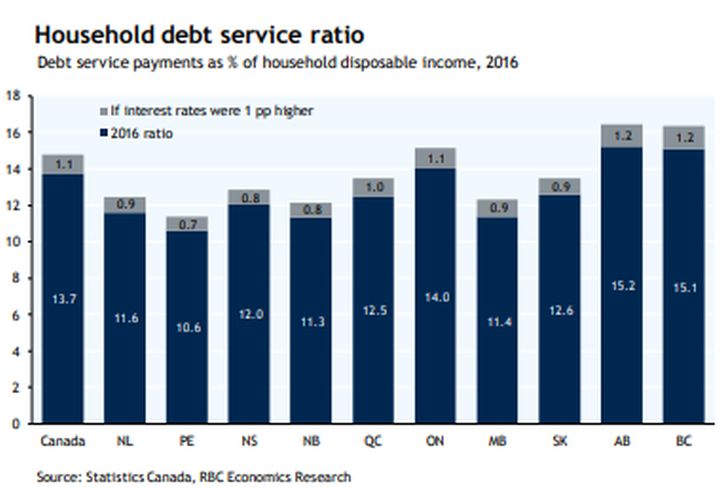

“Our research shows that Albertans would see the biggest increase in debt-service payments in Canada — more than $1,200 a year, on average — if interest rates rose by one percentage point,” the report says. “Households in B.C. and Ontario are also more indebted than the national average, but Albertans carry the heaviest debt loads.

“This is a bit of an eyeopener when you look at more recent data published by Statistics Canada,” Robert Hogue, a senior economist with RBC Economics Research, told Global News on Tuesday.

READ MORE: Canadian household debt-to-income ratio slips: Statistics Canada

Hogue added that most of household debt in Alberta really accumulated between 2010 and 2014, when the economy was booming and before the price of oil crashed.

The RBC report comes as speculation swirls that the Bank of Canada will once again hike interest rates in the coming months, possibly as soon as next week. RBC says that’s because the Canadian economy continues to trend upwards, reducing the “need for policy stimulus.”

According to the report, Albertans’ total liabilities jumped from an average of $164,000 per household in 2010 to $192,000 in 2016.

“These numbers include households who are debt-free, so actual outstanding balances for those carrying debt are even higher,” RBC says. “Mortgages took up the lion’s share of Albertans’ household debt.

“The average household was carrying a mortgage of $124,000 in 2016, up from $96,000 in 2010.”

“Between 2010 and 2014, we were talking about a booming economy in Alberta with household incomes rising very rapidly and a lot of people moving into Alberta, so requiring housing and buying into the housing market,” Hogue said.

“We’ve seen very strong growth in home resale activity during that period, so all of those factors have contributed to a substantial rise in household debt between 2010 and 2014.”

View various graphs from RBC’s report on the impact of rising interest rates in the gallery below:

The report found the amount of other debts held by Albertans in the form of term loans, lines of credit and leases remained unchanged from 2010.

RBC notes households in B.C. and Ontario carried the second- and third-heaviest debt loads in the country and that over two-thirds of that debt is also tied to mortgages and also accounted for most of the rising debt since 2010.

The report found Albertans already spend more than any other Canadians to service their debt which is why households in the province also face the largest increase in debt-service payments.

“In 2016, the average debt-service payment was $15,300 per Alberta household (including both principal and interest),” RBC says. “This exceeded the $13,700 paid by British Columbians, the $12,600 paid by Ontarians and the average of $11,600 by Canadians on average.”

- What is a halal mortgage? How interest-free home financing works in Canada

- Capital gains changes are ‘really fair,’ Freeland says, as doctors cry foul

- Budget 2024 failed to spark ‘political reboot’ for Liberals, polling suggests

- Tesla’s net income drops 55% in first quarter amid falling global sales

The report also notes that when interest rates do rise, the accompanying increase in debt-servicing costs is “bound to cause many households to spend more cautiously on other goods and services. That could potentially restrain economic growth more in Alberta — and in B.C. and Ontario — than in other provinces.”

However, the fact that Alberta households still bring in higher incomes that other Canadians is described by RBC as a “mitigating factor” for the province, saying it “provides them with a little more room to service heavier debt

loads.”

READ MORE: Alberta economy rebounding, but deficit will remain: Conference Board of Canada

Hogue said Alberta households will have to adjust their budgets accordingly as interest rates rise but that he still expects household spending to grow in the oil-rich province, just not at the pace that it had been growing at. He also indicated it was premature if not altogether incorrect to suggest RBC’s report has any implications for personal bankruptcies.

“Personal bankruptcies usually are more tied towards the economy at large, but more particularly to the labour market, and we’re seeing in Alberta the labour market is recovering,” he said. “It’s been a bit of a bumpy road in this recovery but nonetheless, the unemployment rate is trending lower so probably the more likely outcome is going to be that household spending is going to be a bit more restrained.”

Watch below: On Jan. 5, 2018, Tom Vernon filed this report about how Alberta’s economy seems to be getting back on track.

The Bank of Canada’s next interest rate announcement is scheduled for April 12.

Comments