Home prices in B.C. are very high — almost no one denies that.

Foreign buying is one of the reasons why — that’s still a matter of dispute, if you listen to politicians on different sides of the aisle.

Coverage of foreign buyers on Globalnews.ca:

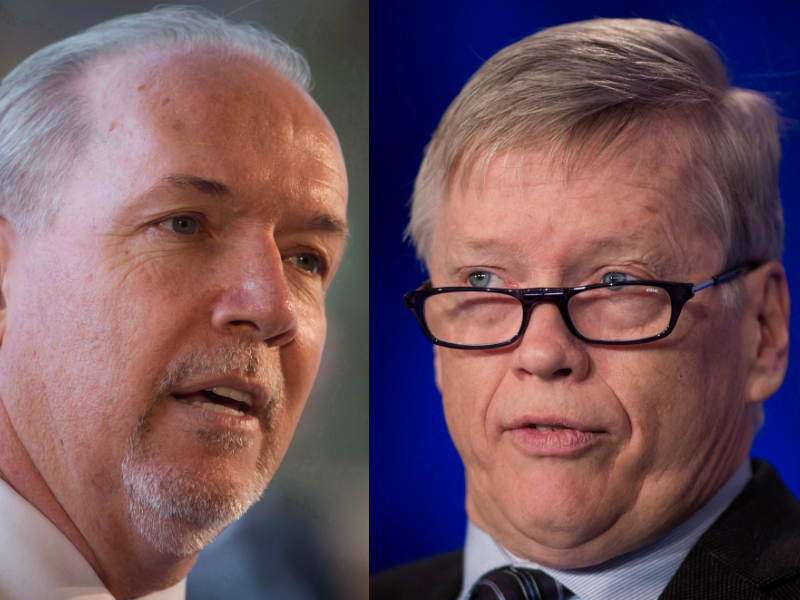

On Tuesday, in his first press conference of 2018, B.C. Premier John Horgan said that “money raised in other parts of the world is distorting our housing market and we want to take steps to address that.”

His remarks came after he was asked to respond to BC Green Party leader Andrew Weaver’s proposal for a ban on foreign buying of real estate in the province, much like what’s been done in New Zealand.

Get breaking National news

Horgan isn’t exactly on board with the idea: “I just don’t believe that in an open economy, that’s the way to proceed.”

But he added, “I believe we need to knock back the speculation and make sure we are penalizing that behaviour in the interest of reducing demand and softening prices.

“And that will also be assisted if you bring on more supply, but you have to do both.”

He promised action on the housing file in February’s budget.

A very different account of the cause for Vancouver’s soaring house prices emerged Monday, from former mayor and current BC Liberal MLA Sam Sullivan.

He spoke with CKNW’s Lynda Steele and John Daly after he published a column in the Georgia Straight titled, “High house prices — foreign buyer fact or fiction?”

In the interview, Sullivan, who is running for the BC Liberal leadership, blamed Vancouver’s home prices on an “anti-density revolution” that emerged in the 1970s that “made it practically illegal to densify suburban areas.”

READ MORE: In Vancouver, you’re competing with non-residents for condos worth as little as $600K

He said development was subsequently concentrated in industrial areas like Coal Harbour.

“Areas that used to be providing jobs are now where we have the density,” he said.

- U.S. border crossings from Canada down 24 per cent as U.S. projected to lose billions

- Vancouver Island wood chip plant’s closure ‘a difficult moment,’ says CEO

- Man shot, killed in Burnaby had connection to B.C. gang conflict, investigators say

- Westham Island Bridge closed indefinitely as repairs more extensive, TransLink says

He later said that a recent release by Statistics Canada and the Canada Mortgage and Housing Corporation (CMHC) showed that non-residents only own a small portion of all housing in Metro Vancouver.

Steele challenged this, noting that when you drill down into those numbers, they show that non-residents own as much as 11 per cent of the condos in the City of Vancouver.

Sullivan later said that StatsCan data showed non-residents owning 7.9 per cent of condominium apartments in the Vancouver region.

That’s true — but the numbers went up when you looked at ownership of condos built in 2016 and 2017.

Steele said she once tried to buy a condo and found herself outbid by about $150,000 after attending an open house where there were “lots of Asian realtors speaking Chinese to Asian clients.”

To that, Sullivan said, “well you know what, there are a lot of people in Vancouver who look Chinese, and these people are Canadian.”

“I appreciate that, but when I’m talking to realtors, the realtor would say, yes, the buyer was from offshore,” Steele said.

“OK, well we can listen to you and say, my cousin’s friend or I saw a Chinese person buying a condo, or we can look at StatsCan research that just came out and they say that the 7.9 per cent of condominiums are owned by non-residents,” Sullivan said.

BC Liberal Party members will vote on a new leader from Feb. 1 through 3.

Comments