Tyler and Cameron Winklevoss, who famously sued Mark Zuckerberg saying he stole their idea for Facebook, have reportedly become Bitcoin billionaires.

The two said in April of 2013 that they owned US$11 million worth of the digital tokens, which is now worth over US$1 billion.

But the Winklevoss brothers, also known as Winklevii, may only be the first Bitcoin billionaires we know of. Satoshi Nakamoto, the mysterious inventor of Bitcoin, is rumoured to have about one million bitcoins, which would be worth about $10 billion.

With the cryptocurrency once again above US$11,000 and briefly reaching an all-time high of US $11,855 on Sunday, there may be others who have crossed the 9-zeros mark.

READ MORE: Tempted to invest in Bitcoin? Here are a few things to consider

Bitcoin lost some of that ground, dropping to US$10,855 on Sunday evening. But it was back above US$11,400 on Monday.

WATCH: Bitcoin: hot investment opportunity or looming bubble?

Is it wise to imitate the Winklevii?

Get weekly money news

It depends. If you had an extra $11 million sitting around at the start of 2013, investing it in Bitcoin would have made you far richer than just about anything else.

But if $11 million was all you had in 2013, gambling it all on Bitcoin would have been – and still is – an enormous risk.

“Many investors are piling into Bitcoin because they fear being left behind. They see some of their friends getting rich in Bitcoin and they jump on the bandwagon. Some are borrowing to invest in Bitcoin or putting Bitcoin into their pension,” according to Campbell Harvey, professor of finance at Duke University’s Fuqua School of Business.

Harvey worries about that. “Holding any single asset – that is, an undiversified portfolio, is not wise.”

READ MORE: New Bitcoin fraud sends real police officers to your door

Never mind the fact that Bitcoin is six times more volatile than equities markets.

The digital currency’s price swings make the global financial crisis look tame. The S&P 500 dropped 9 per cent on Oct. 15, 2008, which was its second-worst day since the 1940s. Since 2011 alone, Bitcoin had over 60 drops that were worse than that, said Harvey.

Just last week, the cryptocurrency dropped over 16 per cent, from over US$11,500 to below US$9,600 on Nov. 29.

Harvey believes this extreme volatility is due to the fact that there is sharp disagreement about what, if anything, Bitcoin is worth.

“For a company’s stock, with some research you can come up with the forecast cash flows and an assessment of the risk. The present value of those cash flows give a fair market valuation of the stock. Sure, people can disagree, so there is a range of values – but the range is relatively narrow,” he noted.

The same is true for traditional currencies, whose value – every investor would agree – hinges on GDP growth and expected inflation.

It’s not clear, though, what Bitcoin’s value should be based on.

“Many believe the true value is zero. Many believe the value of a single bitcoin could be $1 million,” according to Harvey. “This massive range of disagreement surely contributes to the volatility.”

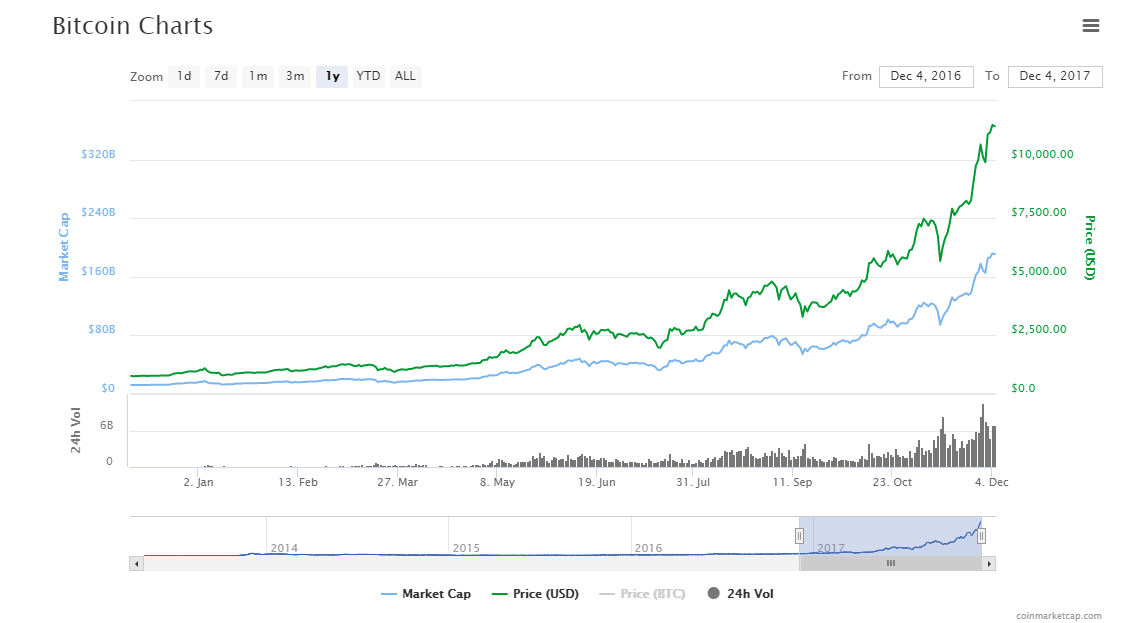

On the other hand, despite the ups and downs, the longer-term trend for Bitcoin has unquestionably to be up. The currency has shot up 1,000 per cent this year, a performance few other investments can match.

READ MORE: Want to buy Bitcoin? Do your homework first: B.C. regulators

So where does that leave you?

“If you are speculating, only gamble as much as you can afford to lose,” said Harvey.

Hopefully, that’s what the Winklevoss twins did, too.

Comments