Life in big cities is expensive, so you’d think young people there would be drowning in debt and have little at the end of the month to set aside. But that’s not what a recent survey found.

Millennials in Greater Vancouver and the Greater Toronto Area are significantly less likely to have debt and more likely to save than their peers living in other cities and town, according to research by financial comparisons site RateHub.

READ MORE: Time to stop shaming millennials for living with their parents, personal finance experts say

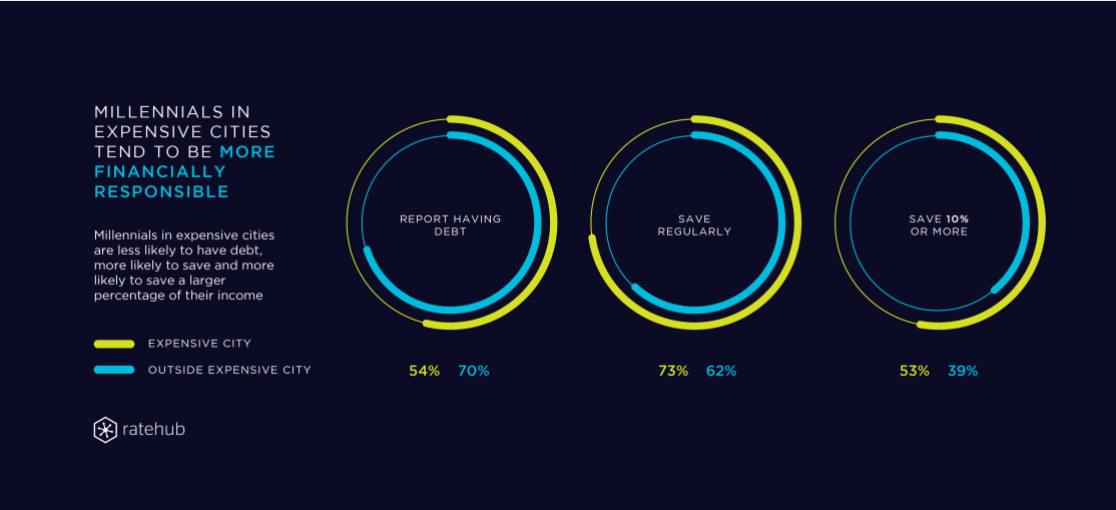

In those two cities, only 54 per cent of millennials reported having debt, compared to a whopping 70 per cent among young people elsewhere. Nearly three-quarters (73 per cent) of Vancouverites and Torontonians said they were saving, compared to an average of 62 per cent in smaller urban areas. And of those who saved, over half in Vancouver and Toronto said they were setting aside 10 per cent of their income or more, while under 40 per cent in the other regions said they were saving that much.

RateHub surveyed over 1,200 Canadians between the ages of 21 and 39 in early May.

How can this be?

Get weekly money news

RateHub itself was surprised by the results. But it may be that “because the GTA and GVA are more expensive than other cities in Canada, city dwellers are basically forced to become financially responsible, lest they drown in debt,” the company noted in a blog post discussing the survey outcome.

READ MORE: The number of young Canadians going bankrupt is rising — but student debt isn’t the whole story

Editor’s note: A previous version of the following paragraph incorrectly referred to Toronto and Vancouver as Canada’s two largest cities. Montreal is Canada’s second largest city.

RateHub also found millennials in two of Canada’s largest cities are more likely to have student debt, rather than other types of liabilities. Forty-four per cent reported having student loans, compared to 26 per cent outside those cities.

And 53 per cent of young people in Vancouver and Toronto cited having to pay off debt as the primary reason for being unable to save. The majority of those living in smaller urban centres, on the other hand, cited not having enough money left at the end of the month as the main factor behind a lack of savings.

READ MORE: Financially helping adult kids may just be a return to an old normal

“It’s possible that those in expensive cities have a steady stream of income but are paying down student loans, whereas those outside are not making as much and therefore can’t save,” noted RateHub.

According to Statistics Canada, though, the median family income in Vancouver and Toronto is actually lower than in many smaller metropolitan centres. The median annual income in Vancouver was $76,000 and just over $75,000 in Toronto in 2014. Both of those figures are below the Canadian average of $78,000. Calgary topped the list, at $104,000 and Edmonton was not far behind, at $101,000.

Still, RateHub’s results do match a recent Equifax survey, which showed that Vancouverites and Torontonians have lower debt from credit cards and lines of credit compared to most of their peers in other cities. Interestingly, Canadians in Fort McMurray, Alta., Calgary and Edmonton (in that order) topped the charts in terms of debt amounts.

READ MORE: Canadian provinces ranked by average consumer debt: Equifax report

It’s possible that millennials in Vancouver and Toronto are more likely to have jobs, rather higher incomes. British Columbia and Ontario are experiencing faster growth than most of the rest of the country (Alberta’s economy is also expanding fast but that mostly reflects a bounce back from the oil shock). And it’s generally easier to find a job in big cities, compared to smaller towns, so millennials in Canada’s two largest urban centres may have also experience shorter spells of unemployment.

READ MORE: Here are the Canadian towns and cities that could lose the most jobs to robots

Also, homes in Vancouver and Toronto cost a lot. Many millennials likely aren’t homeowners yet, but they likely are saving up to buy a house. Those in sizzling-hot housing markets likely feel the pressure to squirrel away as much as they can for a down payment.

As those born in the 1980s and 1990s start becoming homeowners, the scales may tip.

Comments

Want to discuss? Please read our Commenting Policy first.