BlackBerry’s recent resurgence has a lot to do with its decision to ditch phones and focus on software for self-driving cars. But it may also have something to do with how it pays its CEO.

READ MORE: Is BlackBerry back? Why the company’s stock just hit a 4-year high

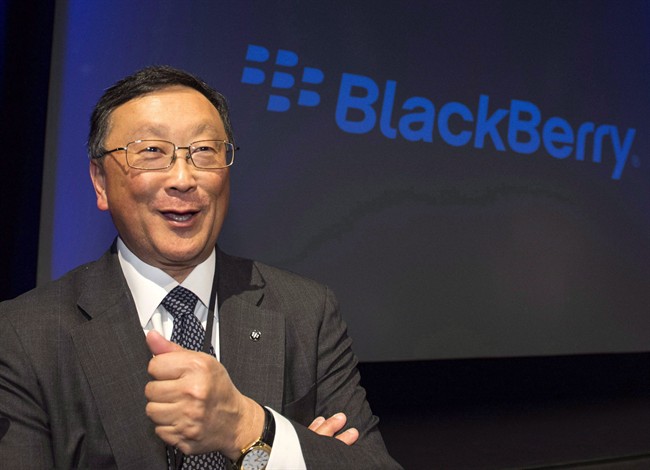

BlackBerry “is run by talented CEO John Chen, whose compensation is heavily pegged to the long-term outcome of the stock,” U.S.-based Citron Research, recently noted in a report that raved about the company’s stock market performance and its future potential.

READ MORE: BlackBerry ‘likely’ to become a takeover target: report

Indeed, when Chen joined a troubled BlackBerry in 2013, much of his pay package was made up of 13 million so-called restricted share units that he would only be able to access gradually over a period of five years. The share units were worth $85 million based on the stock price at the time.

It was a hefty pay package for the standards of Canadian executives, but Chen’s take-home pay was set at $1 million, with another $2 million as a performance bonus.

Chen’s compensation made headlines when the Canadian Centre for Policy Alternatives (CCPA) reported in 2016 that he was the highest-paid CEO in Canada in 2014. But as BlackBerry noted, 95 per cent of the the $89-million pay the CCPA attributed to Chen was made up of those restricted stock units, from which he had not yet benefited.

READ MORE: Canada’s highest-paid CEOs make 193 times the average wage: report

The point of awarding time-based share units was “to align Mr. Chen with the long-term interests of BlackBerry shareholders,” the company noted.

The incentive seems to be working. Less than five years since the start of Chen’s tenure, BlackBerry seems to have finally found its footing as one of the world’s top providers of secure software.

Get weekly money news

WATCH: Blackberry’s QNX system has been called the most secure OS in cars today

More companies in Canada keeping a closer eye on CEO pay

BlackBerry-style compensation schemes are becoming more and more common in Canada.

“There’s been a shift toward a higher percentage of executive compensation being variable or at risk,” said Jeff Mo, portfolio manager at Mawer Investment Management.

“Variable” means that how much executives get depends on how well they perform. “At risk” denotes a type of compensation that won’t materialize at all, if corporate leaders don’t achieve certain objectives.

READ: CEO pay: what can you buy for $8.96M?

North America, in general, has come a long way since 2005 when the board of Hewlett-Packard fired then-CEO Carly Fiorina (you might remember her as a 2016 Republican presidential hopeful) and still awarded her $40 million in cash, stock and pension benefits.

Shareholders and corporate boards today are much more aware of the risks of pay packages that allow executives to drive up a company’s share price in the short-term, cash in and not worry about what happens afterwards, said Steve Chan, an adviser to boards at Hugessen Consulting.

READ MORE: Bombardier delays executive pay hikes amid public outcry

Some industries, though, have been slower than others to catch on. Canada’s resource sector, for example, is a laggard, according to Mo, whose analysis focuses on smaller companies.

Compensation packages that rely heavily on stock options allow executives to reap huge rewards when shares go up without suffering any losses if the stock falls or underperforms.

In a sector prone to sharp ups and downs such as the oil and gas industry, loading executive pay packages with stock options is “doubly bad,” said Mo.

WATCH: By lunchtime on Jan. 3, 2017, the top CEO’s in Canada had already made more than the average Canadian does in a year

And CEO pay in Canada continues to be more likely to rise than to stagnate or fall, regardless of performance.

“We believe industry uses a flawed model of comparing compensation,” Mo told Global News.

In order to attract and retain the best and brightest in their executive ranks, many companies try to set pay for their corporate leaders just above the median of what their industry competitors offer.

READ: Top CEO pay has rebounded since crisis: study

This creates “a ratchet upward effect upward over time, where everyone likes to think they’re paying their executives above the median,” said Mo.

It’s a kind of pay inflation that regular Canadians can only dream of.

Comments

Want to discuss? Please read our Commenting Policy first.