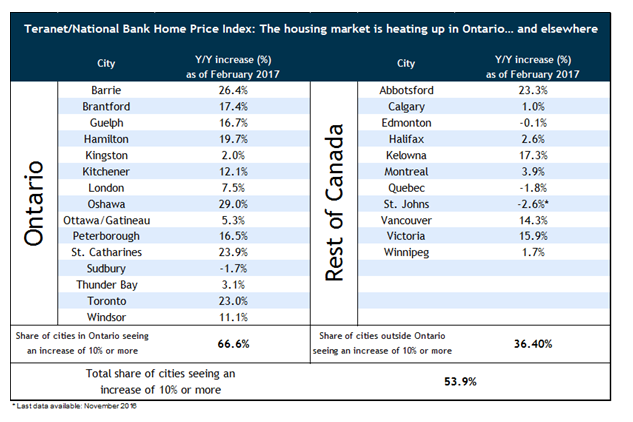

Over half of urban markets tracked by National Bank of Canada are seeing home prices increase by 10 per cent or more a year.

“This record proportion is very similar to that observed in the United States in 2005 at the peak of the market,” chief economist Stefane Marion wrote in a recent research note.

READ MORE: Canadians are delaying home buying on the hope that prices will fall: poll

The bank illustrated the trend with the two charts below:

Price surge confined to Ontario and British Columbia but spreading outside Toronto and Vancouver

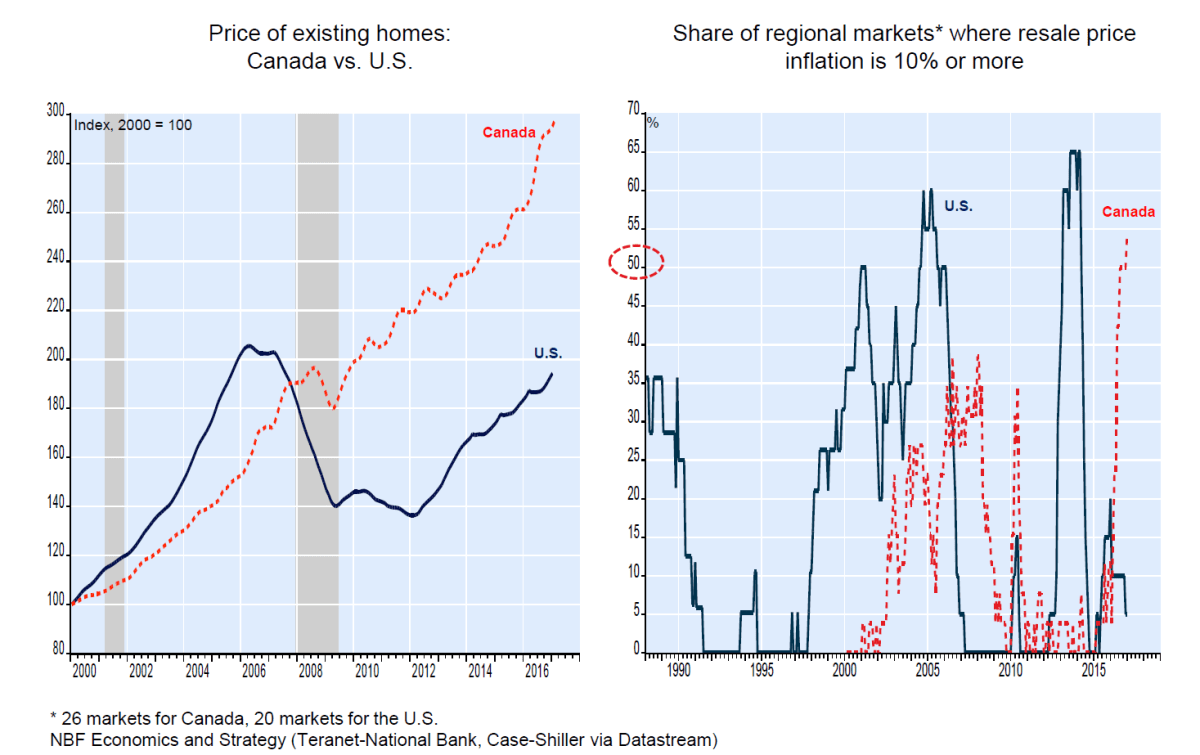

Most of the housing market craziness is happening in Ontario, according to the following breakdown of the data, which National Bank provided to Global News.

As the table shows, a whopping 66.6 per cent of Ontario communities tracked by National Bank are seeing home prices rise by 10 per cent or more year-over-year.

“There seems to be a contagion from Toronto in terms of rapid price increases,” National Bank senior economist Matthieu Arseneau told Global News.

READ MORE: Ontario housing affordability measures coming ‘very soon’: Kathleen Wynne

Even in Windsor, some 330 km away from Toronto, home prices have been climbing by roughly 11 per cent year over year.

A similar phenomenon is underway in B.C., where contagion is reaching urban centres as far from Vancouver as Kelowna.

WATCH: City of Vancouver resets housing strategy

Housing crash unlikely in Canada

Despite the similarities with the U.S., National Bank doesn’t see an impending housing bust in Canada.

“A housing crash in Canada would be as devastating as in the U.S., but the likelihood of this to happen is low for several reasons,” Arseneau told Global News via email.

Among them are several rounds of mortgage rules tightening, which have reduced amortization limits, raised down payment requirements, and introduced a stress test for all insured mortgage applications.

READ MORE: Are federal mortgage rules actually working? Not really.

“There are no subprime and ninja loans in Canada,” noted Arseneau.

Subprime mortgages are generally granted to individuals with poor credit histories, who wouldn’t normally qualify for a regular mortgage. Ninja loans, a type of subprime lending, are extended to borrowers without the need to show a sufficient stream of income or put down enough collateral.

Immigration is also helping prop up Canada’s housing market, by providing a steady inflow of educated newcomers that tend to turn into home-buyers, said Arseneau.

READ MORE: Canadian house prices post largest February increase on record: Teranet Index

“Canada has the best demographic profile among advanced countries,” he said.

And while residential construction in the U.S. had outstripped population growth at the height of the bubble, that is not currently the case in Canada, Arseneau added.

WATCH: Huge housing boom hits Toronto & suburbs

“Another key element protecting the Canadian housing market from a major correction is the fact that loans are mostly recourse, as opposed to the U.S., which means that a wave of strategic defaults is unlikely,” he noted.

A recourse loan in real estate allows lenders to seek financial damages from a defaulting borrower if the value of the house is not enough to cover liabilities.

READ MORE: Foreign buyer tax alone won’t cool down scorching Toronto housing market: report

A soft landing is the most likely scenario for Canada’s housing market

With the Canadian economy picking up speed and churning out jobs in 2017, National Bank sees a soft landing for the housing market, if prices do slow at all.

An interest hike by the Bank of Canada (BoC) would likely help bring about such a slowdown, the bank suggested.

National Bank’s latest forecast saw the first rate increase happening during the first three months of 2018. However, recent momentum in the economy and surging home prices “increase substantially” the likelihood that the BoC will implement a rate hike before the end of 2017, Arseneau said.

WATCH: Canadian economy beats expectations

Comments