Hundreds of Canadians fall victim to scams through text message each year. It’s a costly mistake that can result in losing thousands of dollars.

Global News spoke with three people who were tricked by a common scam, the “Mystery Shopper” job offer. Here is how the scam works.

Step 1: The ad

Leela Hafezi was 17 years old and had recently had a baby when she received a text message on her cell phone this summer. It said she could make $400 per week as a mystery shopper and asked her to send her postal code to an email address.

It seemed like “easy money”, Hafezi said. “Money is tight for me.” With a new baby and college to pay for, she was hoping to make some extra money. She replied to the email address.

READ MORE: Text message fraud cost Canadians half a million dollars so far in 2016

Valerie Chappell, 68, is semi-retired and lives in Nova Scotia. Government pensions are the bulk of her income, and she supplements that with occasional work at an antique store or providing home care.

She used to work for the Circle K convenience store at Irving gas stations, where she was sometimes asked to visit other stores and report on how well they were serving customers. “So I thought the mystery shop would be something similar. So that’s why I did it,” she said. She enjoyed that work and wanted to travel around and meet people and pay off her debt, so she replied to the text message.

For Jim Brown, 36, the invitation arrived through email. The auto factory worker had been looking for work online and received an email advertising the mystery shopper job.

“I wrote back, said, ‘Yeah, I’m kind of interested. Can you give me more details?’ And that’s where it all started,” he said.

Step 2: Correspondence

The mystery job people wrote Brown back, he said, and it sounded legitimate to him. They said they were from Desjardins Financial Services (the name of a real financial co-operative) and when he researched it, it looked ok.

“I guess something that I should have picked up on is they were pretty trusting. They didn’t really ask a lot of questions of me, like a regular potential employer would,” he said.

All they wanted was his address — not his social insurance number or banking information — and they sent him a cheque, once he replied.

After replying to the text message, Hafezi also got an email. “When I sent them an email, they were like, ‘Oh yes, we’re a legit business. We work with Walmart and we work with the bank and the banks know about us and we’re here in Canada.’”

They asked if she was a student, what bank she used and her birthday. “I gave them that information. I gave them my address, then I got an email back saying that within a week’s time I would receive a cheque and with that would come more information.”

Step 3: The cheque

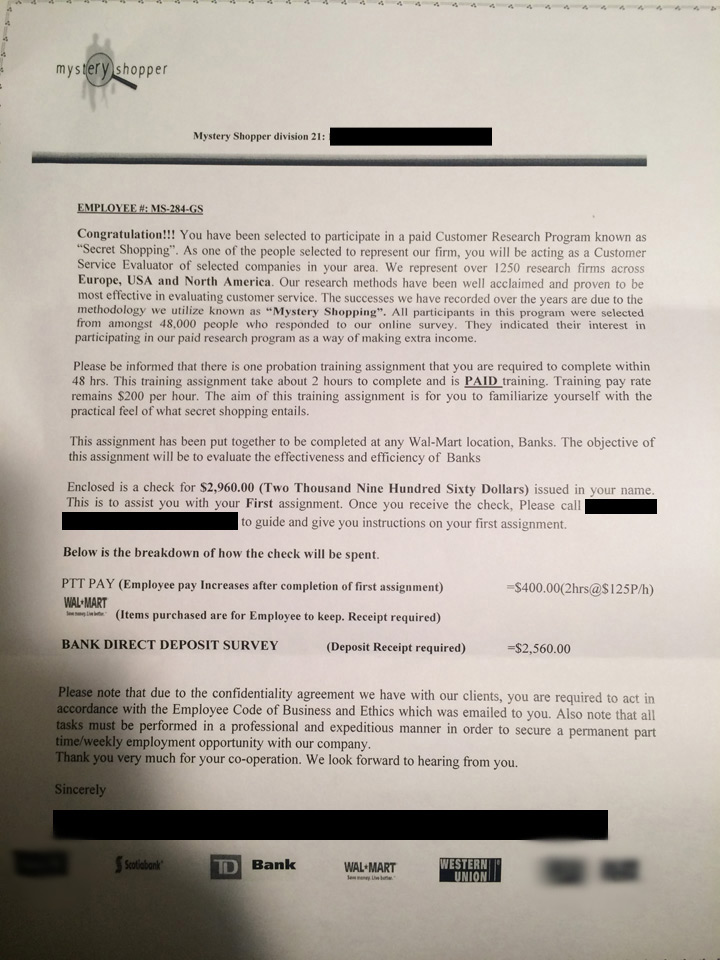

Hafezi, Brown and Chappell all got a cheque in the mail. Hafezi was sent $2,980, Brown was sent $2,300 and Chappell got $2,100, they said.

All three were given similar instructions: deposit the cheque in your bank. Keep $400 as payment. Then, cash the rest and spend it at various stores and send in an evaluation of their customer service.

Although That Franchise Inc.’s name appears on the cheque sent to Hafezi, the company says it was a victim of the same fraud and had no knowledge its name was being used. TD Canada Trust (also on the cheque) wouldn’t comment on individual cases but encourages affected customers to contact them or their bank manager so they can investigate the situation.

Scotiabank and Western Union, whose company logos also appear on the letter accompanying Hafezi’s cheque, said that they were not involved in the scheme. Western Union urges customers to report suspicious emails or letters that mention the company.

“I was supposed to spend $100 at the Walmart,” said Chappell. “I’ve never in my life spent $100 at any store in my life, so that was something totally different.”

Walmart said that it was not involved in this scheme and does not hire shoppers this way. According to Alex Roberton, senior director of corporate affairs for Walmart Canada, Walmart has seen similar frauds in the past, sometimes involving gift cards.

“We take these situations seriously and immediately work with police to resolve them,” he said. The company also sometimes warns its customers of possible scams directly.

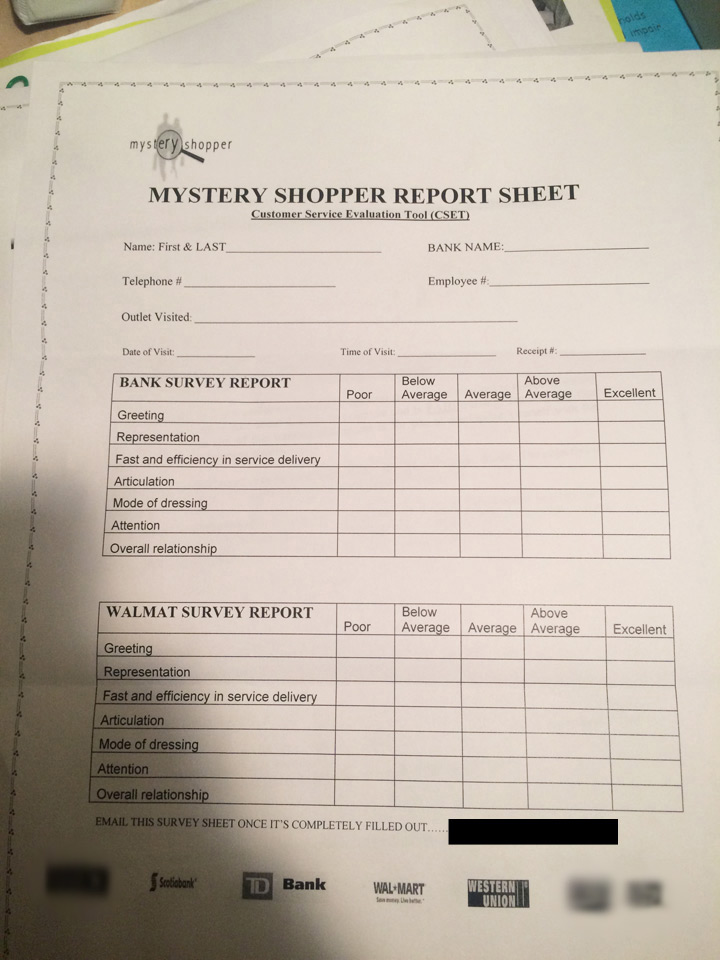

“I have to go into Walmart and survey the greeting, the representation and how effective they are,” said Hafezi. “Then I have to go into the bank and do the same thing.” She was asked to deposit money into an account at BMO and evaluate that process.

“Nobody said anything to me when I brought up the whole mystery shopper thing when I was taking out my money. And no one questioned anything because of my age — I was under aged at the time, I was 17,” she said.

Chappell was asked to deposit money at Scotiabank. Brown was asked to go to Canada Post and send money to two British addresses using the Money Gram service available at their post offices.

Then, they were asked to call or email the Mystery Shopper company and say that the job was done. The scammers had their money — sent through Money Gram or deposited directly into a bank account.

Step 4: The cheque is rejected

Then came the bad news. “I went online and looked at my account and it was in the negatives and I went, ‘Uh oh. Something happened here,’” said Brown. When he went to the bank, he found out that the cheque he had been sent was fraudulent.

Hafezi was on vacation with her family when her bank called her. “I had a panic attack,” she said. “My rent was due. I have a little one, I have things that need to be paid. Money is already tight enough as it is. The bank took the remaining money that was in my account to pay for the cheque.”

Chappell found out the cheque was bad while she was at the bank, depositing a second fraudulent cheque. The teller wasn’t sympathetic, she said, and had her almost in tears.

“Yes I agree I was scammed and yes I agree I owe them money but the humiliation was beyond anything I’ve ever experienced in my life.”

All three were required to pay the bank back for all the money they spent. Brown dipped into his RRSP. Hafezi had to borrow money to cover her rent that month. And Chappell is now even further in debt.

“It’s very unfortunate,” said Maura Drew-Lytle, director of media relations and communications for the Canadian Bankers Association.

“The problem with a cheque is, your bank has no way of knowing if it’s fraudulent until it goes through the cheque-clearing system,” she said. It will send the cheque to the other bank, which has to determine that the account doesn’t exist or has insufficient funds and inform your bank – a process that can take days.

“Then your original bank will then say, we have advanced you the money up front for that $2,000 or whatever it is, so we are going to take that out of your account.”

Cheques are an agreement between people, not an individual and their bank, she said, and it’s up to individuals to try to get payment if the cheque bounces.

“People do get confused about it sometimes because they do have access to the money quite often, the full amount of the cheque. But that doesn’t mean that it is a good cheque.”

All three reported the fraud to the police, who took the report but were unable to track down the perpetrators or get the money back.

“It’s one of those things that I guess I had to learn the hard way in order to know that there’s people out there who are willing to take advantage of people,” said Brown. “That’s disappointing to me because I’m a pretty trusting person.”

What to do about it

Brown, Hafezi and Chappell shared their stories so that people would know what these scams look like.

“I’m young enough, I can work and I can get that money back eventually. But there’s people out there who are on fixed incomes and they’re looking to get a little extra money for Christmas or whatever, and they need to know to be careful,” said Brown.

According to Marc Choma, spokesperson for the Canadian Wireless Telecommunications Association, there “isn’t too much” customers can do to stop receiving spam texts on their cell phones.

The texts aren’t targeted either. “A lot of people when they get these spam texts, they think it’s coming from someone else’s phone, that there is a person sitting in a room and punching in these phone numbers. And that really isn’t the way that it works,” he said.

“It’s not coming from a phone. It’s coming from the Internet. And just attempt after attempt, it would be putting in all the possible combinations of numbers.”

Wireless carriers are able to filter out many spam messages, but they’re not able to catch them all, he said. If you find they’re too frequent, or if your cell phone plan charges you for receiving texts, you should report it to your wireless provider.

And if you do get a text or email from an unknown sender, “do not respond to that because that then sort of validates that they’ve reached you,” he said. Do not click any links or attachments.

Daniel Williams of the Canadian Anti-Fraud Centre told Global News earlier this week that people who think they might have been the victim of a scam should report it to their local police and to the Anti-Fraud Centre.

He also urges people to carefully research a company or individual before sending any personal or financial information.

Drew-Lytle recommends that people ask for payment through emailed e-transfers rather than a cheque, she said, as those funds aren’t subject to the same kinds of holds as cheques. “So if someone e-transfers you money, once it’s in your account, that’s guaranteed.”

TD Bank suggests verifying that a cheque is legitimate by having it certified at the issuing branch before funds are released from your account.

Comments