Baby boomers are set to become one lucky group of Canadians, as the beneficiaries of the “largest intergenerational wealth transfer in Canadian history.”

This could make the richer members in this group into some powerful consumers in the Great White North’s housing markets — and sustain wealth inequality from “one generation to the next,” said a report released by Sotheby’s International Realty Canada on Tuesday.

Coverage of housing affordability on Globalnews.ca:

The report noted that baby boomers are set to inherit as much as $750 billion, for an average of $180,000 per bequest, based on calculations by CIBC.

Such a transfer means that boomers could have a “multi-level effect” on Canadian real estate.

One of the most palpable effects could be that they become “indirect influencers through the support of next generation home buyers,” the report said.

READ MORE: Baby boomers will inherit $750 billion over the next decade: CIBC

The Sotheby’s report, which was carried out alongside public opinion firm Mustel Group, derived its findings from a survey of 2,026 urban baby boomers between the ages of 52 and 71 years old in Canada’s four biggest metropolitan areas: Toronto, Montreal, Vancouver and Calgary.

It found that many baby boomers are already supporting the next generation of homebuyers, or are set to do so in the coming years.

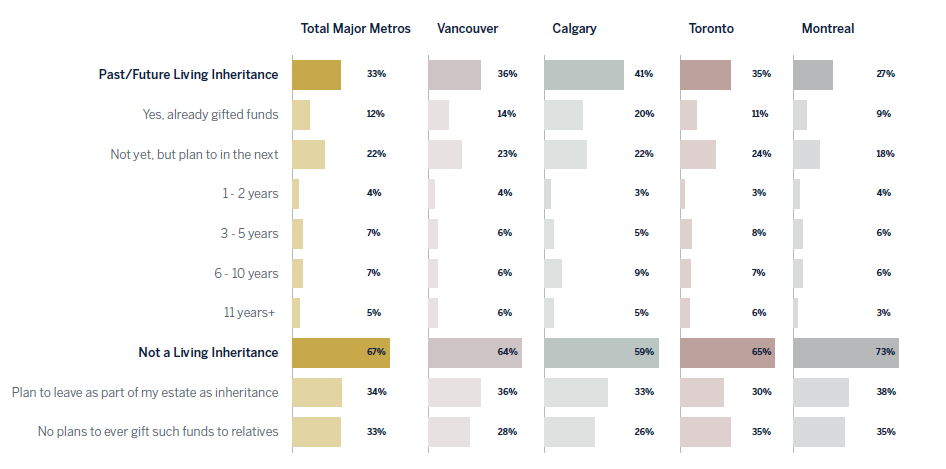

Across Canada, 33 per cent of survey respondents said they had already bequeathed a “living inheritance,” or handed money down while they were still alive — either that, or they planned to do so in the future.

The highest share of respondents handing out a living inheritance was found in Calgary, where 41 per cent planned to do so. In Vancouver, 36 per cent of respondents said they would do this, followed by Toronto with 35 per cent and Montreal with 27 per cent.

People who planned to bequeath a living inheritance largely planned to do so in the next three to 10 years.

And the wealthier they were, the more likely baby boomers would be to hand over an inheritance so that the next generation could buy a home.

The report showed that urban boomers with household incomes of over $100,000 were nearly twice as likely to use a living inheritance to help someone buy real estate.

As many as 49 per cent of people making over $100,000 said they planned to, or had already handed over funds for this purpose, next to 27 per cent of respondents who made less than $100,000.

READ MORE: Baby boomers are pricing young families out of cottage country

Baby boomers who make less than $100,000 gave a median amount of about $25,000, and as many as 72 per cent of living inheritances fell below $50,000.

Meanwhile, wealthy boomers have been handing over more money, with only 53 per cent of living inheritances falling under $50,000, and 25 per cent falling between $50,000 and $100,000.

“It’s really not surprising that the people that are making over $100,000 would have a higher propensity to want to give, let alone have the ability to give more to their kids, compared to people with more modest incomes,” Brad Henderson, CEO of Sotheby’s International Realty Canada, told Global News.

“I also think that the people in the much more modest income group would probably be more inclined to want to see their kids earn it themselves as opposed to gifting it, which is definitely something that the more wealthy Canadians tend to be much more giving to their kids and some would argue that maybe that’s not a good thing.”

The report was released after the Canadian Real Estate Association (CREA) urged the federal government to let parents withdraw money from their registered retirement savings plans (RRSPs) to help their kids buy a home.

READ MORE: Average Canadian mortgage balance up nearly 5% year-over-year: TransUnion

The withdrawals would finance loans to young Canadians who are trying to enter the home market for the first time.

But it’s an idea that has met with concern from experts who worry it could jack up home prices.

For his part, Henderson doesn’t feel the idea has been studied enough — and he worried that people who withdraw the money could be more financially stressed in future.

“Most retirement experts will tell you that Canadians are under-saving for their retirement,” he said.

“So there is a worry out there that this may in effect create some challenges down the road for people that have to retire if their kids can’t pay it back, or if adults need it before it’s paid back, so a lot of the detail needs to be thought through and flushed out.”

LISTEN: Personal finance blogger Jessica Moorhouse joins Tasha Kheiriddin on 640 Toronto

Personal finance blogger Jessica Moorhouse was more pointed when she criticized the idea of parents financing their kids’ home purchases with RRSP withdrawals.

“By withdrawing money from their RRSPs, they are sacrificing their future and a financially secure retirement for their children’s present needs,” she told Global News in an email.

“My personal stance, I would never let my parents risk their retirement to help me buy a home.

“And I think if it means that those parents’ kids have to delay home ownership so they can afford it themselves, then that’s what should happen.”

Methodology: A total of 2,026 urban baby boomers (ages 52-71) were surveyed in the four greater metropolitan areas of interest: Vancouver, Calgary, Toronto and Montreal, with data using a disproportionate sampling method to enable analysis within each metropolitan area, as well as across the combined Census Metropolitan Areas (CMAs). Data collection dates were August 29 to September 25, 2017. The sample was weighted to match Canada census on the basis of age, household income and home ownership within each CMA and to bring the total sample into proper proportion based on relative populations. An online methodology was employed, using a robust national panel representative of the Canadian population. Panelists are recruited by a double opt-in method from large databases of reputable channels using industry standards of panel quality assurance, validation, verification and best practices for panel management. Respondents were screened on the basis of age and area of residence to meet the study criteria.

- With files from The Canadian Press

Comments