Prime Minister Justin Trudeau will get a first-hand look at the housing affordability crisis in Vancouver as he sits down with a round table of experts and politicians Friday to discuss the issue.

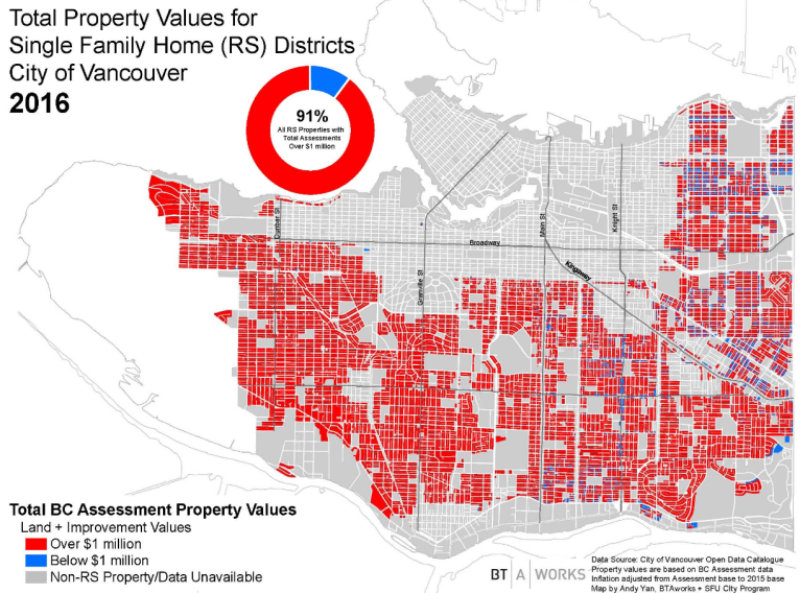

Andy Yan, acting director of Simon Fraser University’s City Program, has been documenting the rapid rise in housing prices over the last decade in the city of Vancouver with a series of maps that provide a sobering reality check on the soaring costs of owning a home.

According to Yan’s analysis, more than 90 per cent of all detached homes in Vancouver are now worth more than $1 million, compared to 65 per cent in 2015 and 41 per cent in 2014.

New numbers from the Canadian Real Estate Association also highlighted the eye popping housing numbers in Vancouver. According to CREA’s house price index, housing costs in Greater Vancouver increased 29.7 per cent in the year to May.

“This is a very significant crisis,” Trudeau told reporters in Vancouver Thursday. “We know that we need to take measures so that the affordability of homes is accessible for more Canadians who increasingly look at markets like here in the lower mainland and in Toronto as significant barriers to achieving their dreams and successes.”

Reality check: Can Canada’s red-hot housing markets be reined in?

Trudeau was short on specifics in how action will be taken to address housing prices but that it will involve all three levels of government.

- Three B.C. men fined, banned from hunting after killing pregnant deer

- B.C. child-killer’s attempt to keep new identity secret draws widespread outrage

- Inquest hears B.C. hostage was lying on her captor before fatal shooting

- ‘We’ve had to make a 180’: What Oregonians say they got wrong with decriminalization

Josh Gordon, an assistant professor in the School of Public Policy at Simon Fraser University, published a study last month that blamed money from foreign investors, specifically China, for fuelling the housing crisis.

READ MORE: Vancouver housing prices jump over 30%; Toronto also sees spike

The report, titled “Vancouver’s Housing Affordability Crisis: Causes, Consequences and Conclusions,” says political inaction by the Canadian and B.C. government has allowed the problem to grow.

‘Party will come to an end,’ TD warns

In Toronto, there have been repeated warnings about the red-hot housing markets where property values for single-family homes have jumped 36 per cent since 2012 to an average of $770,000 in 2016.

READ MORE: Want to buy a house in Canada? It’ll cost you 400 weeks of work

Toronto-Dominion Bank said Friday that Canada’s hottest housing markets “are ripe for a correction” but it won’t happen until next year.

“Over the second half of 2016, some moderation in resale activity and price growth should become evident as bond yields pull off their lows and stretched affordability leads to a cooling in domestic and foreign housing demand,” TD economists said in a new outlook.

“However, barring significant new government regulatory measures to curb housing market speculation later this more (month?), more concrete signs of a housing market slowdown are unlikely to be seen until 2017.”

*With files from the Canadian Press

Comments