What would you do with a million dollars? Two young Canadians quit their jobs and plan to live off the million they saved.

Travis and Amanda, who don’t want their last name used, became millionaires when they were 30 and 32, respectively.

The couple decided to take early retirement in March, and have since been living in a rented beach house in Costa Rica.

They met in Calgary where Amanda, now 33, moved to from Montreal after graduating with a chemical engineering degree.

Travis, who got a degree in Information Systems in Nova Scotia, was about to start a summer internship there for Shell Canada.

He had worked through university and paid off his student loan within a few years of finishing school.

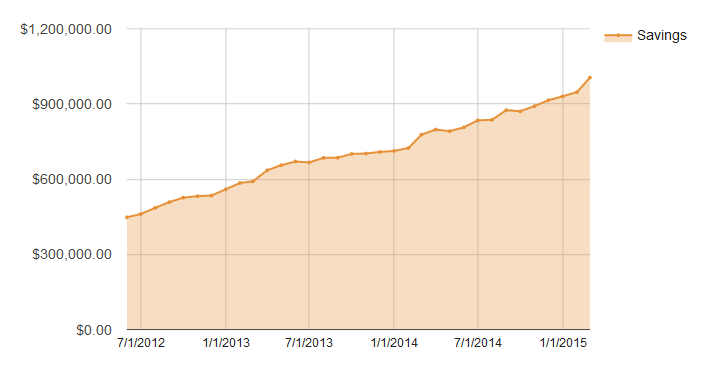

How they saved $1M by their early 30s

“Both of our first jobs out of university paid annual salaries of just over $50,000. Over the next 10 years that we worked, our salaries grew to be six figures,” Amanda said.

While their incomes certainly helped, not everyone who earns six figures is able to save $1 million by their early 30s.

Unlike many millionaires, their riches didn’t come from investing in real estate. They owned one property: a condo in Calgary that they “hardly made any money off of” when they sold it seven years later in 2013.

Their parents’ financial contribution to their wealth was also minimal.

Amanda’s parents paid for her schooling in Quebec, where tuition is the cheapest in Canada.

And their parents helped with their down payment, which was paid back with interest within a year.

It was the mindset that was ingrained in them that seems to have proven most valuable.

“Both Amanda and I grew up in families that taught financial responsibility… that one shouldn’t spend money needlessly and that saving is important,” Travis explained.

That would become especially beneficial when a 2008 road trip up the California coast inspired a search for greener pastures (literally).

“When we flew back to Calgary, we were greeted by a huge snow storm, which further solidified our desire to move,” Travis said.

“There are several oil refineries around Los Angeles and San Francisco that Amanda was interested in working at, and there were lots of tech jobs for me in either city.”

The two settled in Oakland, just outside San Francisco, and were soon on a fast-track to savings.

They began to track their expenses on Mint.com and realized most of their money was spent on dining out.

“Reducing our restaurant eating has been the biggest money saver for us,” Travis said.

“We hung our clothes out in the sunshine instead of using the dryer to save on electricity,” Amanda added.

In the winter, they wore sweaters around the house instead of cranking the heat. They also used bikes and public transit whenever possible, and chose low-cost cellphone plans.

“All of these little things added up,” Amanda said.

The cash they saved all went into a portfolio with Vanguard, an investment management company. (More on that can be found here on their blog.)

They plan to live on $40,000 a year, by withdrawing approximately four per cent of their nest egg every year.

“If you don’t live in the most expensive cities, this amount can go a long way,” they wrote in a Budgets Are Sexy blog post.

Life of millionaires on the road

To stretch their dollar once they hit one million, they set out for Central America in a 2000 Toyota 4Runner named Bruno.

The retrofitted SUV (which Travis learned to repair himself) is “surprisingly comfy,” they say.

Since taking off last spring, they drove from California to Costa Rica, passing through Mexico, Guatemala, El Salvador, and Nicaragua.

They’re now heading north to Travis’ family’s home in Nova Scotia, visiting countries like Honduras and Belize along the way.

READ MORE: Would you live in a van to travel non-stop? This man’s doing it

“We’ll be scoping out U.S. cities to potentially settle in for longer,” Amanda said. “We’re interested in checking out a few places in Tennessee and North Carolina. If those don’t stick, Bruno will continue carting us around North America!”

Also in the cards: a European leg to their adventure, which might happen with Bruno or by bike.

READ MORE: Edmonton couple spends 10 years cycling the world

They plan to raise at least one child with their current lifestyle, as well, pointing to blogs (Mr. Money Mustache and Root of Good) that have shown them it can be done.

“We know that our lifestyle strays from the status quo,” Amanda admitted.

But they hope their “Freedom With Bruno” blog can inspire others to save and see all that can be gained from living a simpler life.

“Working and saving for our financial independence goal eventually gave us back our personal time to do what we want: travel, raise children, pursue hobbies and interests,” she said.

“We’re excited for the future and all that awaits us.”

Their final tips for achieving financial freedom

- Make it a target to save more than you spend. They weighed every purchase against their future goal.

- As your income grows, don’t let it inflate your lifestyle.

“It really just boils down to this: if you save up enough money, you can live on your nest egg,” Travis said.

“The size of your nest egg depends upon how luxurious of a life you want to live. If you live simply, you don’t need as much.”

READ MORE: Half of Canadians don’t think they’ll be able to retire comfortably: poll

They also realize that this formula won’t work for everyone. Those who struggle with providing just the basics for their family obviously have priorities other than financial independence.

Their advice is mainly for “the middle class who live ‘spendy’ lifestyles and for whom retirement is still a far off goal.”

Comments