A new bank poll published Monday suggests most post-secondary students are rather bullish on their prospects of quickly paying back loans taken out to finance their education.

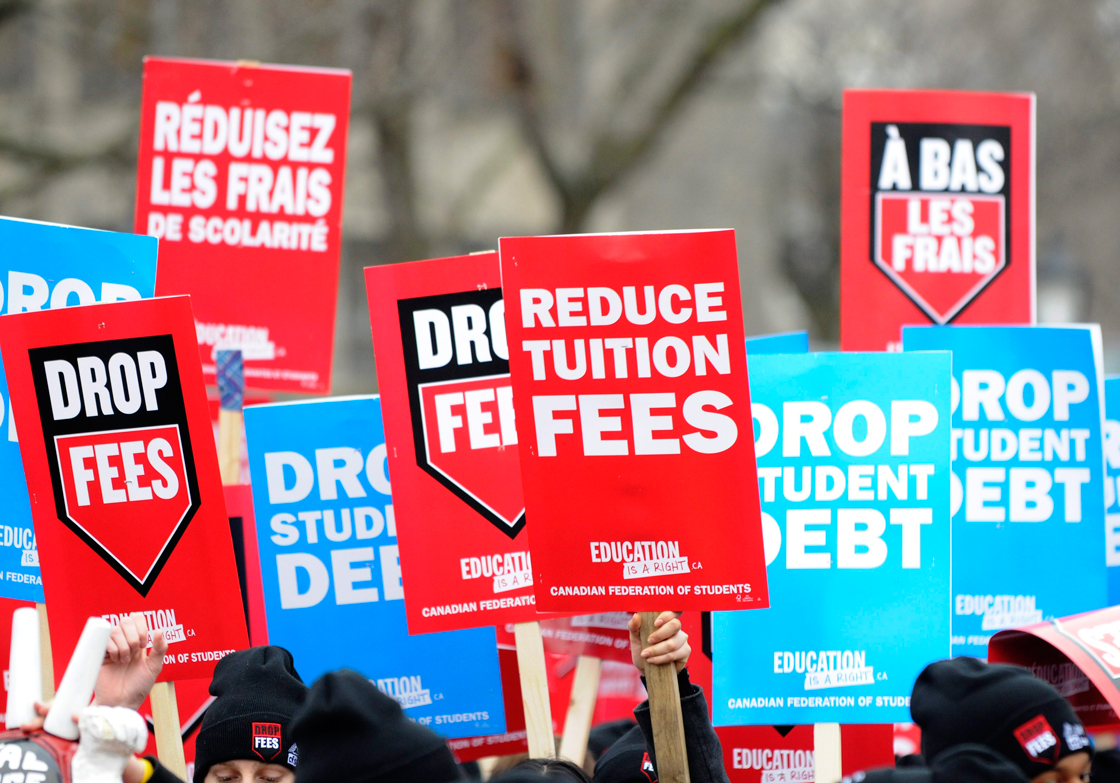

So we decided to take a look at what average tuition costs are these days, as well as the average debt burden students hold.

Not surprisingly, tuition costs and debt loads have jumped in recent years.

MORE: How parents can help save for their child’s education

The average tuition for a four-year bachelor’s degree now tops $5,572, according to the Canadian Federation of Students (who’s stats are based on Statistics Canada data and internal projections).

That’s an increase of more than 67 per cent versus what the average degree or a four-year college program cost in 2000 (it was $3,328 annually).

Over that same time, debt loads have climbed a more tame — but still lofty — 39 per cent.

A poll from CIBC on Monday found that about half, or 51 per cent, of post-secondary students said they would need to borrow money to pay for tuition, living expenses and books.

Of those, 40 per cent said they envision owing more than $25,000 by the time they graduate.

Yet only about a third (34 per cent) said they expect their debt load to stick around for longer than six years.

“While their intentions are admirable they may not be realistic,” Christina Kramer, executive vice-president of retail and business banking at CIBC, said.

Comments