The winds shifted on Canadian wireless customers Thursday, and not exactly in their favour.

The parent financial backer of Wind Mobile (European giant VimpelCom) wrote off entirely the value of the fledgling Canadian carrier, a move experts see as the latest sign that its commitment to continue operating here is fading.

That’s bad news for wireless customers everywhere.

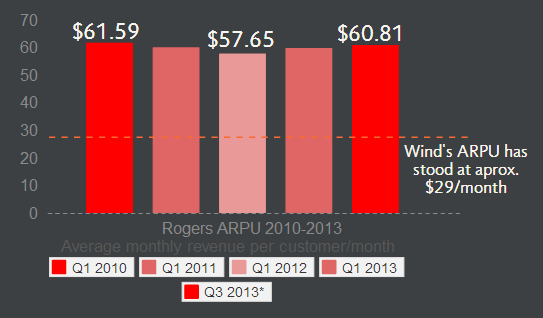

With an average wireless bill that costs about half of what Rogers, Bell and Telus collect per customer — $29.80/month versus $59.40 among the Big Three – Wind continues to be a thorn in the sides of the incumbents.

Rogers, Bell and Telus have had to respond to lower prices offered by Wind by lowering their own prices (see graphic below).

But Wind has struggled to win over customers, in part because it has had to race to put up a brand new network that can deliver comparable service to what the big guys offer, as well as dole out ample amounts of cash for advertising.

Not an easy task, especially when there are three entrenched players spending more to drown you out.

VimpelCom said Thursday Wind had 649,000 customers, well below the 1.5 million Wind initially said it would have back by this time when it launched services in 2009.

It’s been an expensive effort for VimpelCom, which appears now to be cutting back.

The biggest piece of evidence that that’s exactly what is happening was the surprise announcement in January that Wind was backing out of key auction for airwaves badly needed to boost the performance of Wind’s network.

- Trudeau says ‘good luck’ to Saskatchewan premier in carbon price spat

- Canadians more likely to eat food past best-before date. What are the risks?

- Hundreds mourn 16-year-old Halifax homicide victim: ‘The youth are feeling it’

- Vacation death: Cuba apologizes after Canadian family receives wrong remains

READ MORE: With new entrant signals fading, what will happen to wireless prices?

Still, Wind’s Canadian operators continue to say the carrier is around for the long-term – and they may be right.

Looking to boost—or at least maintain—some semblance of competitive pressure on the Big Three, Ottawa is moving to drastically reduce how much smaller players such as Wind must pay the three big network owners to let customers use their systems when outside home coverage areas.

That should save Wind some cash.

Ottawa is also refusing to let Rogers, Bell or Telus gobble up airwave licences owned by Wind, which effectively blocks any sale of the carrier to one of the three.

That leaves few buyers and options for Vimpelcom. But one big one is to simply scale down the amount of money it spends operating Wind.

That’s an outcome Rogers, Bell and Telus would be glad to see – but consumers may not.

Here’s a look at how the average revenue per subscriber has behaved at Rogers, the country’s biggest cellphone provider, from the time Wind launched up to last fall.

Rogers’ average revenue per user dipped at the end of last year (the latest glimpse available), something it chalked up to lower U.S. roaming revenues and voice usage. But analysts expect that number to improve again.

Comments