Housing prices are starting to inch down across the Okanagan, though they remain much higher than they were a year ago.

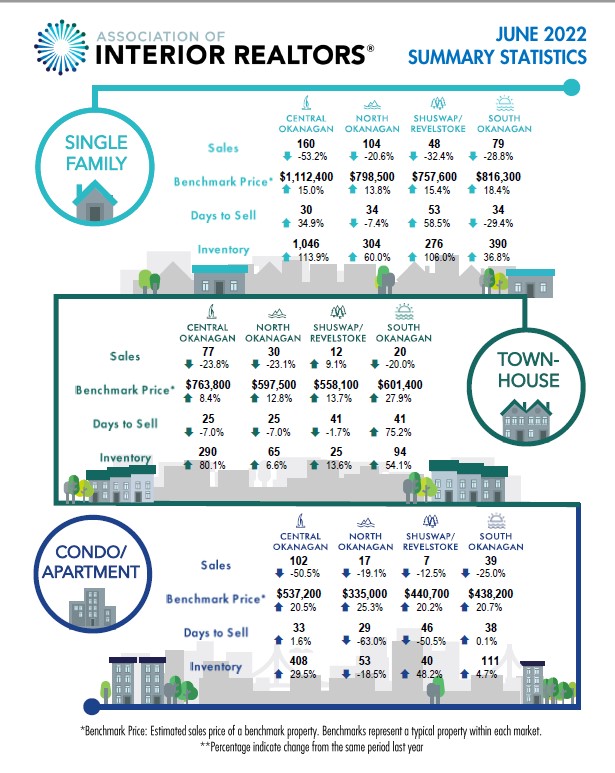

In the June report from the Association of Realtors, the benchmark price for a single-family home is listed at $1,112,400. It’s a 15 per cent hike from the same time last year but when compared to the month earlier, it looks a little less robust.

In May, the benchmark price for a home in the Central Okanagan was $1,130,400, 1.6 per cent higher than June.

Price shifts were similar across the valley. In the North Okanagan, the benchmark price this June was $798,500 which is up 13.8 per cent from last year and down from $807,600 in May.

The South Okanagan saw its benchmark price for a single-family home up 18.4 per cent from the same time last year, coming in at $816,300.

That is down from $826,200 a month earlier.

The metric seeing the biggest shift, however, is the number of sales. In the Central Okanagan, there were 27.5 per cent fewer sales in June this year compared to last year. In the North Okanagan sales were down by 20.2 per cent in that time frame and there was a drop of 22.8 per cent in the South Okanagan.

Get weekly money news

Experts say the changing real estate landscape had been caused by the Bank of Canada raising interest rates, a move made to slow inflation.

READ MORE: Okanagan real estate market leveling out after interest rate hike

“It’s not unusual that mortgage rates are impacting market activity, specifically in the higher-priced markets,” said Lyndi Cruickshank, Association of Interior Realtors president.

“This is what typically happens when interest rates move upward. It makes buying a home more costly, making what a purchaser can afford more limited. We are seeing this effect, particularly in what is typically a higher-priced home type.”

West Kelowna resident Carmen Henderson is one of the many people who found herself navigating an intensely hot real estate market just a few months earlier and can see both the positive and negative sides of the shift.

“We’re in a pretty unique position, where we sold high and bought high so I don’t feel negative about prices changing; we benefitted,” Henderson said.

“Our realtor saw the change in the market coming and pushed us to get our house on the market fast … just a few weeks later we wouldn’t have sold our home for the price we did.”

Had things dragged on, they wouldn’t have qualified to buy their home at the price they got in at, either, she said.

Henderson says she has co-workers who were once ready to dive into the market, but today they’re still sitting on the homeownership sidelines with high house prices lingering and buying power dropping.

“It impacted what they were able to look at and changed their buying power by $100,000 to $200,000,” she said.

Ultimately, she said, simply slowing things down can’t be a bad thing.

“It was out of hand,” Henderson said. “The home we purchased had four offers within a day … and our house sold within 48 hours. A more calm stable market is a good thing.”

The real estate association said there was a 14.2 per cent uptick of listings within the region with 3,265 new listings recorded compared to the same period last year, with a 3.1 per cent increase over last month’s 3,166.

The overall active listings also saw a healthy upswing with 7,154 listings currently on the market, an increase of 45.1 per cent in year-over-year comparisons.

Comments

Want to discuss? Please read our Commenting Policy first.