A growing number of Canadians expect their personal finances to be affected as cases of COVID-19 spread, according to a new Ipsos poll.

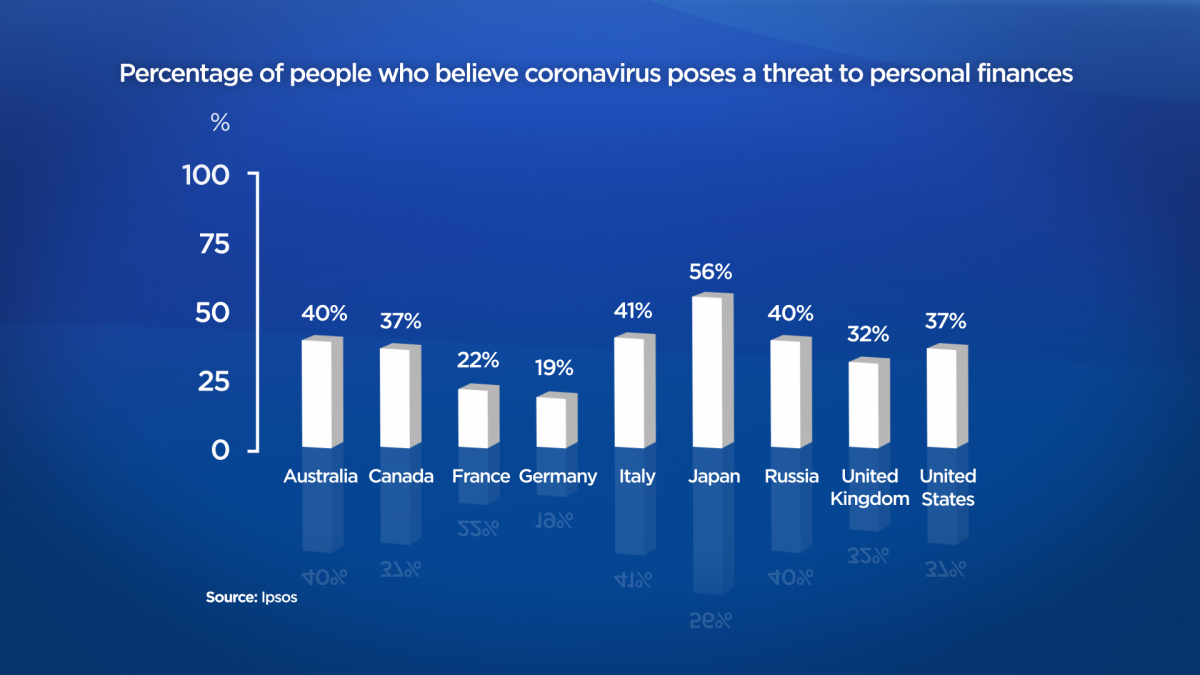

The poll, which was conducted between Feb. 28 and 29, found that 37 per cent of Canadians believe the coronavirus will hit their personal financial situation.

That’s an increase of 20 percentage point from Feb. 14 and 15, when Canadians were asked the same question.

Darrell Bricker, the Global CEO of Ipsos Public Affairs, explained that such a dramatic jump in numbers over roughly two weeks doesn’t happen often.

“This is kind of unprecedented,” Bricker said.

“Sometimes thing get out there and there are more short-term issues and they fade away quickly. This one seems to be more fundamental.”

Bricker noted that Canada’s jump of 20 percentage points is higher than the increase seen in most other countries where the poll was also conducted.

The majority of Canadians, at 67 per cent, also said they believe the virus reached the country because it’s “impossible to forecast.” Another 33 per cent said that the virus reached Canada due to a lack of preventative measures enforced by officials.

That means Canadians aren’t “hammering the government” over its spread, Bricker said.

“What it means is that it’s seen as something that is kind of out of control, which in many ways is even more scary,” he noted.

Get weekly health news

The rise in anxiety over COVID-19’s impact on finances is being noted around the world, the poll noted. The same questions were posed to respondents in 10 other countries dealing with coronavirus cases. individuals in all countries were more fearful of a financial impact than they were earlier in February.

In Japan, 56 per cent of people said they expected a negative effect on their wallet. Japan’s prime minister, who ordered schools closed nationwide last week, has been pressing for legal backing to declare a state of emergency if needed.

Fear over finances was also reported in Italy, where 41 per cent said they were wary of the situation. More than 3,000 people have tested positive in Italy and 107 of them have died — the largest number of deaths outside of China.

Individuals in other countries, such as Australia and Russia, also reported higher levels of financial anxiety over the illness, both at 40 per cent.

Since December 2019, there have been 94,000 cases of the infection and 3,200 deaths. The large majority of them have been in China.

Respondents to the survey aren’t the only ones keeping a close eye on finances amid the spread of coronavirus, though.

The Bank of Canada cut its trend-setting interest rate by half a percentage point to 1.25 per cent down from 1.75 per cent on Wednesday, in an effort to soften the economic impact of the COVID-19 outbreak.

The decision came after the U.S. Federal Reserve implemented a similar cut on Tuesday, acting before its next scheduled policy meeting on March 17-18.

“While Canada’s economy has been operating close to potential with inflation on target, the COVID-19 virus is a material negative shock to the Canadian and global outlooks, and monetary and fiscal authorities are responding,” the central bank said in a statement.

While the traders and analysts had widely anticipated that Canada’s central bank would follow the U.S. lead, it’s unclear to what extent the rate cut will shore up sentiment among investors, markets and consumers.

Global stock markets have also been closely watched in the past weeks over coronavirus outbreak uncertainties. Markets turned higher Wednesday, extending days of volatility, as investors weighed the economic impact of COVID-19.

Rubina Ahmed-Haq, a personal finance expert, explained that Canadians hoping for long-term investment gains shouldn’t change their course of action due to coronavirus outbreak fears.

Ahmed-Haq noted that the stock market fluctuates with different political, social and economic events.

“This is an event just like the financial meltdown in 2008 and 2009, or the SARS outbreak in 2003,” she said.

“If you constantly follow headlines, you’re never going to be able to keep your money invested over the long term.”

She said those looking to invest in the long term — anything more than five years — should not be worried. Ahmed-Haq said those with questions or concerns should speak with a financial advisor.

This Ipsos survey was conducted between Feb. 28 and 29 on the Global Advisor online platform among 10,000 adults aged 18-74 in Canada and the United States and 16-74 in Australia, France, Germany, Italy, Japan, Russia, United Kingdom and Vietnam. The sample consists of approximately 1,000 individuals in each country, which are considered accurate +/- 3.5 percentage points.

— With files from Global News reporter Erica Alini, The Associated Press

Comments

Want to discuss? Please read our Commenting Policy first.